Vertical Spreads_1

Post on: 12 Апрель, 2015 No Comment

A Recap with Special Insights

Vertical spreads can have various names. The same vertical spread could be called several different things by several different people. We have used two terms only: vertical call spread and vertical put spread. Each of these two spreads allows for two positions, long and short.

The long vertical call spread is constructed by buying one call option with a lower strike price while simultaneously selling another call option in the same month with a higher strike price. In a one to one ratio this trade, the long vertical call spread, is labeled a bullish trade. This means that when engaging into a long vertical call spread, the investor expects the stock to increase in value. An investor who engages in a trade with the expectation of the stock going up is said to be bullish. Thus, a long vertical call spread is a bullish trade.

For example, you are long a vertical call spread if you buy 10 August 35 calls and sell 10 August 40 calls. The proper way to describe this would be long the August 35 – 40 call spread. Using our previous example of the August 35 – 40 call spread, we assume that you bought the spread for $2.80. At expiration, you know that you can lose a maximum of $2.80 if the stock closes at $35.00 or below. At expiration, you will gain your maximum profit if the stock is $40.00 or over. Your maximum profit is defined as the difference between the two strikes minus the amount you paid for the spread.

Vertical spread’s maximum profit = (difference between the two strikes) – (amount paid for spread).

In this case, the difference between the two strikes equals $5.00. That $5.00 minus the $2.80 you spent on the spread leaves you with a maximum potential gain of $2.20, and represents a 78.5% return. The potential maximum loss is $2.80 or the full value of the investment.

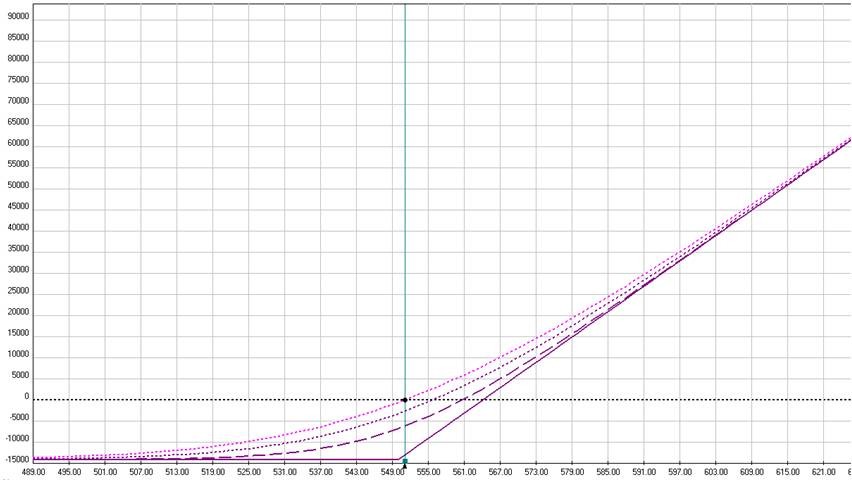

The chart below shows what this spread will do over the course of a range of stock values.

A short vertical call spread is constructed by selling a call with a lower strike price, while simultaneously buying a call in the same month with a higher strike price. Since owning a vertical call spread created a long position for the owner, then the seller of the vertical call spread must be short. An investor who takes a short position anticipates a decrease in the price of a stock and is considered to be bearish on the stock. Thus, a short vertical call spread is considered a bearish position.

Using our example, say you are short 10 August 35 calls and long 10 August 40 calls. The short vertical spread is set up in the proper ratio and in the same month. For the sale of the spread you received $2.80. Your maximum potential gain is the $2.80 that you received from the sale and would be obtained if the stock closed $35 or below.

The maximum loss is calculated by taking the difference between the two strikes and subtracting the sales price of the spread from it. The difference between the two strikes is $5.00 (40-35). From that we subtract the price of the spread which is $2.80 and we are left with $2.20. This $2.20 is the maximum potential loss for a seller of this spread. The formula is given as: The difference between the two strikes – the price of the spread = total potential maximum loss.

The maximum profit for the seller of a vertical call spread is attained when the price of the stock closes at or below the lower priced strike. And the maximum loss is attained when the stock closes at the higher strike.

The vertical put spread functions in much the same way as the vertical call spread just in the opposite direction. Like the vertical call spread, the construction of the vertical put is done in a one to one ratio. The vertical put spread is constructed by purchasing one put and simultaneously selling another put in the same month but in a different strike.

A long vertical put spread is considered to be a bearish trade. This means that the purchaser of a vertical put spread is expecting the stock to go down. Further, a long vertical put spread is considered a debit spread which simply means that the purchaser had to put out money to buy the spread. Now, if the stock proceeds down, the spread’s value will expand. As stated before, a spreads maximum value is equivalent to the difference between the strikes. On the other hand a spreads minimum value is $0.

In the case of a put spread, maximum value is attained when the stock trades at or below the lower strike. Conversely, a put spread’s minimum value is attained when the stock trades to the higher strike.

For example, suppose we purchase the August 50-55 put spread for $3.00. To set up this trade, we would have bought the August 55 put and sold the August 50 put. If the stock trades down to 50 or below at expiration, the spread will be worth its maximum value of $5.00 (difference between the two strikes: 55-50).

Since you bought the spread for $3.00 and it is now worth $5.00, you have a $2.00 profit which represents a 66.6% profit on your $3.00 investment.

On the downside, the most you can lose is the $3.00 you spent for the spread and this will happen if the stock closes $55 or above. If the stock was to close at $55, the August 55 put would be worthless because it would be equal to the stock price thus valueless. The August 50 put would also be worthless being that it is $5.00 out-of-the-money. The difference between these two values would obviously be $0. Below, the chart shows the value of the spread at different stock prices.

A short vertical put spread is constructed by purchasing a put with a lower strike price while simultaneously selling a put with a higher strike in the same stock in the same month and in a one to one ration. For example buying one Feb 65 put while selling one Feb 70 put or buying 10 May 20 put while selling 10 May 30 put. It is considered to be a bullish trade because the seller expects the stock to go up or increase in value. Further, it is considered a credit spread meaning that you receive cash into your account upon execution of the trade.

Say you were to sell the June 50 — 60 put spread for $5.50. As the seller, your maximum profit will be the $5.50 you received for the sale of the spread. The maximum profit will be attained if the stock closes at $60.00 or above. At that level, both the June 50 and 60 puts will be worthless because both will be out-of-the-money. Thus, the spread will have no value.

The maximum loss of the trade will be defined by the difference between the two strikes minus the amount you received from the sale of the spread. In this case, the difference between the strikes is $10.00 (60 strike – 50 strike). The spread was sold for $5.50 so $4.50 is the maximum loss of the position to the seller.

In conclusion, vertical spreads provide the buyer and the seller an excellent percentage return while, at the same time, provide limited loss scenarios. Vertical spreads allow for two types of bullish trades, the purchase of a vertical call spread or the sale of a vertical put spread. On the other hand, vertical spreads offer two bearish trades; the purchase of a vertical put spread and the sale of a vertical call spread.

So, if you want to take advantage of a directional stock movement (either up or down) but you are not interested in taking a longer term, possibly capital intensive position, then look to using the vertical spread due to its favorable risk reward scenario.

For more Information about option trading, please click here: Options University

-=-=-=-=-=-=-=-=-=-=-=-= Advertisement -=-=-=-=-=-=-=-=-=-=-=-=-=-==-=-=-=-=-Amazing Options Trading Strategies For Safer Investing and Explosive Profits! Discover How to Protect Your Investments With the Leveraged Power of Options & Learn How to Trade Options Like the Pros. **TIME SENSITIVE** We are offering our Options 101 Home Study Course at a special ‘Pre-release’ price for a limited time. Click below to save up to 50% and before the price doubles in the coming weeks. Click Here: Options Trading Strategies