Verizon My Top Dividend Pick For 2015 Verizon Communications (NYSE VZ)

Post on: 5 Июнь, 2015 No Comment

Summary

- Most high yield stocks are not projected to grow their earnings per share quickly enough to appear undervalued based on my DRAG framework.

- However, thanks to an improving return on invested capital, its lack of economic sensitivity and a compelling dividend yield, Verizon scores well in this analysis.

- Its balance sheet is highly leveraged due to its acquisition of the remainder of Verizon Wireless, which is one negative for conservative investors and something worth monitoring.

- Nevertheless, the DRAG model suggests shares in Verizon could return more than 30% in 2015 thanks to a combination of earnings growth and multiple expansion.

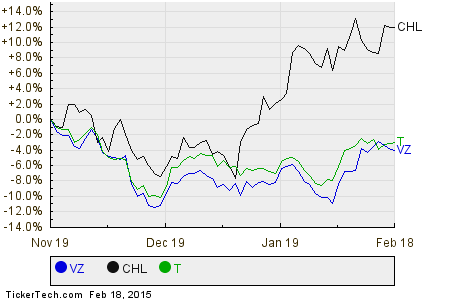

With a track record of consistent dividend growth and a current yield of more than 4.5%, Verizon (NYSE:VZ ) is a popular choice for income investors. However, the stock has underperformed over the last 18 months, trading in a narrow range during this time while the S&P 500 continues to march higher. Earlier this year, Verizon finalized a transaction with Vodafone (NASDAQ:VOD ) to acquire the remaining 45% of Verizon Wireless it did not already own. The result of this acquisition is a highly levered balance sheet but a significant increase in free cash flow moving forward. This article examines Verizon’s fundamental attributes and then utilizes the DRAG framework to determine whether this company should be a core holding in all income portfolios.

Please click here to read my article which outlines the DRAG analysis framework in more detail.

To summarize, the four variables used in a DRAG (dividend and risk adjusted growth) analysis are as follows (each company is ranked from 0 to 3 in each category):

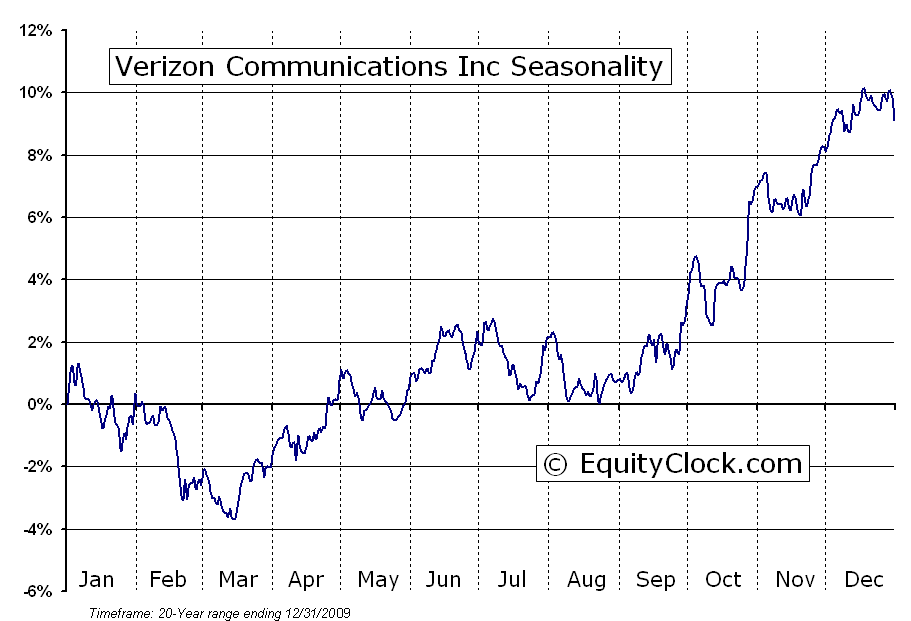

1) How cyclical is the industry in which Verizon operates?

2) How strong is Verizon’s competitive position within this industry?

3) How risky is Verizon’s balance sheet?

4) What is Verizon’s dividend yield and dividend growth history?

The premise is that a company that operates in a non-cyclical industry, with a strong competitive position and a clean balance sheet that pays an attractive dividend should trade at a higher earnings multiple than a company without these attributes, even if the lower quality company has higher projected future earnings growth. After adjusting for these variables, it becomes easier to compare companies in different sectors with different levels of future growth potential.