Variable Annuities and Retirement Income

Post on: 21 Май, 2015 No Comment

Key Points

- When you start to think about retirement, you should have a strategy to manage market risk and generate predictable income for life. A variable annuity can support that strategy, and can be further enhanced with the addition of an optional guaranteed lifetime withdrawal benefit. If you are 5–10 years away from retirement, want to stay invested in the market but want guaranteed income for life, and are likely to be retired for at least 20 years, a variable annuity with an optional guaranteed lifetime withdrawal benefit rider may be a good choice.

How can I protect the money I’ve saved and make sure I have income for life? Could a variable annuity help? And if so, what kind?

The answer depends on who you are—how soon you’re planning to retire, your life expectancy, and your relative risk tolerance. At the Schwab Center for Financial Research, we took a close look at variable annuities with an optional rider, called a guaranteed lifetime withdrawal benefit (or GLWB). We determined that they may be a good match for people who:

- Are nearing retirement and would like to stay invested in the market, but would value some protections as they prepare for retirement

- Want guaranteed income that they can’t outlive once they begin retirement Are likely to live 20 years or more once they begin taking income from their annuity

If that sounds like you, read on.

What is a variable annuity?

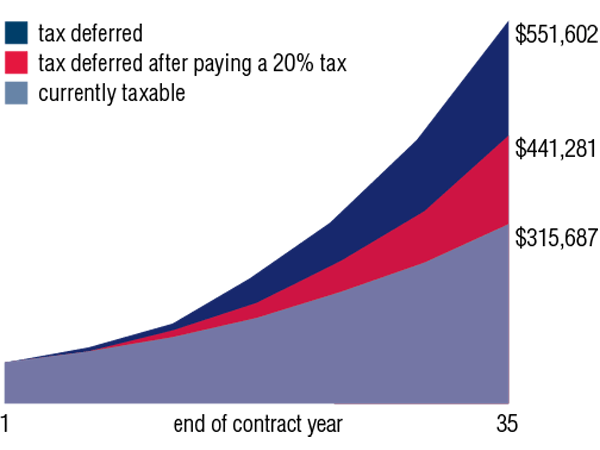

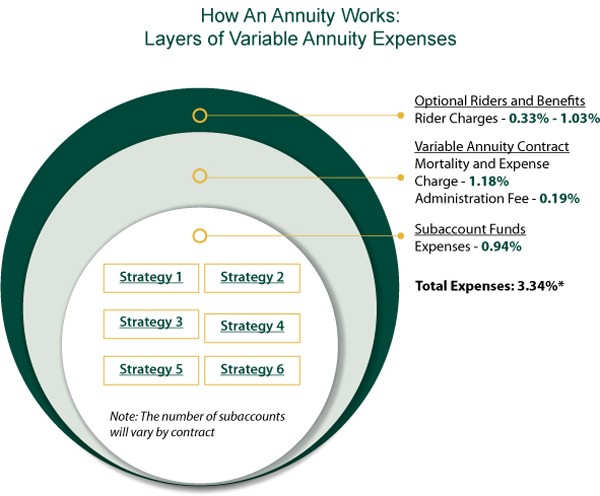

A variable annuity is a contract between an individual and a life insurance company. You purchase the contract either in one lump sum or in a series of payments, and in return the insurance company provides you with periodic payments based on a portfolio of underlying investments. When you purchase the annuity, you choose from a variety of investment choices, called subaccounts, that provide exposure to the market, much like a traditional portfolio. No investment earnings are taxed until you begin withdrawals, and there’s generally no IRS limits on the amount you can invest (assuming the annuity is not held within a qualified plan or IRA).

The guaranteed lifetime withdrawal benefit

In many cases, you have the option to add riders to your annuity for an additional cost. These riders are generally designed to help minimize the risk to your retirement income.

For example, a GLWB rider generally guarantees a minimum amount of income for life, regardless of how the subaccounts perform. The amount of annual income can rise if the value of the investments increases, but the rider ensures that your income will never fall or stop, even if the value of your investments dwindles to zero.

From our perspective, this is the most useful feature variable annuities offer, since it protects your future income from market risk while providing guaranteed income for life, subject to the financial strength and claims-paying ability of the issuing insurance company. You can’t get that from a traditional portfolio.

It should be noted that, while the GLWB rider protects your retirement income, it does not preserve your contract value, which will deplete with each withdrawal.

The protections offered by a variable annuity with a GLWB are most useful during two phases of your investment lifecycle:

- Transition: The years just prior to a shift from saving to withdrawing from your portfolio

- Distribution: The years during which you withdraw from your portfolio

Transition

To maximize the chances of growing your assets, you’ll generally need to stay invested in the market. Yet your portfolio’s performance during the years just prior to and early in retirement can significantly impact the success of your retirement plan. And with more savings invested than ever before, and less time to recover if markets fall, you may be more cautious.

Several strategies can help tackle this problem.

Save a lot. If you’ve saved a lot relative to your needs, you may be able to limit your exposure to a bad market by decreasing the risk in your portfolio and still generate enough investment income to support yourself. However, you’d need a large portfolio to generate sufficient income, and you’d still need to hold investments that can keep up with inflation.

Use buckets. Another sensible way to manage the transition to retirement is what’s called a bucket approach. The Schwab Center for Financial Research’s version of this strategy is to create a cushion of more predictable investments, such as cash and short-term bonds, to support your short-term needs in case markets fall. Then you invest the rest in more aggressive investments that you can afford to hold onto and allow to recover. This isn’t a cure-all. But it can help limit your need to sell investments in a prolonged bear market.

Invest in a variable annuity with GLWB rider. A third approach is to purchase a variable annuity with a GLWB option. A variable annuity allows you to keep a portion of your portfolio that you’ll need for future income invested. Adding an optional GLWB rider protects a portion of your future income against a market downturn. You’ll pay a fee for a GLWB rider and a fee to invest in a variable annuity. But the added protections can be very useful as part of a comprehensive income plan.

Why might a variable annuity with GLWB fit the bill?

When saving for retirement, most investors focus on average annual returns in the market over time. If you invest with discipline—using dollar-cost averaging, 1 for example—the averages can make up for the down years. In fact, a down market could work to your advantage. The amount you invest in the down years buys more shares than the same amount of money when markets rise. So if you have time to hold those shares, volatile markets can work to your advantage.

The opposite is true. however, when spending in retirement. The transition to and early years of retirement is the period where market risk can put the most significant dent in your plans.

In 2008, for example, even some of the most iron-willed investors pulled out of the market when they saw a sharp drop in their retirement portfolios. But the worst thing you can do is sell investments at market bottom to fund spending, or in response to a down market.

In such a market, a variable annuity with GLWB can help you stay the course. With the security of a guaranteed minimum level of income from a portion of your portfolio, even if markets fall, you’ll increase the probability of success by sticking to your plan.

The risk of a market shock early in retirement

These charts illustrate the potential negative impact of a market downturn early in retirement and the risk of basing your retirement strategy on average return expectations. Each chart shows expected returns for a hypothetical balanced portfolio of stocks and bonds during the accumulation phase and hypothetical average returns thereafter coupled with a 5% annual withdrawal.

Average return illustration

In this chart, returns after retirement reflect our average return expectations for a hypothetical portfolio of stocks and bonds, based on the Schwab Center for Financial Research’s current capital market expectations. 2 If the markets deliver the average return each year, a 5% annual withdrawal rate from the portfolio would be sustainable.

For illustrative purposes only. Actual results will vary. Not intended to predict or project the return of any specific variable annuity investment option. Source: Schwab Center for Financial Research.

In real life, markets don’t deliver average returns every year. This chart shows what could happen if you retire just as the market delivers two years of –10% returns in a row, followed by average returns based on our long-term expectations. 3 The timing of returns, and when you experience a market shock, can significantly impact retirement income.

Distribution

The next task is to create a paycheck that will last through retirement. And your retirement may last longer than you plan for. A 65-year-old man in good health in the U.S. has a 20% chance of living 25 more years, and the odds for a 65-year old woman are higher—31%, based on current estimates from the Social Security Administration. And the life expectancy for active retirees is getting longer and longer.