Vanguard Investors How To Build A Better Target Retirement Income Fund

Post on: 16 Март, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

The following article by Dan Wiener chief executive of Boston’s Adviser Investments was taken from the most recent edition of his newsletter The Independent Adviser For Vanguard Investors. As I have mentioned in previous posts Dan is the foremost authority on Vanguard funds.

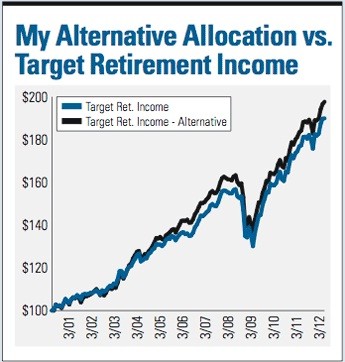

His article explores how you can create a better life-cycle fund than Vanguard’s Target Retirement Income Fund. Vanguard’s fund is designed for people currently in retirement who need to draw income. It is a fund consisting of other funds. Dan provides an alternative selection that produces higher returns with less risk.

By Dan Wiener

When I’ve looked at life-cycle funds in the past, I’ve pointed out that an income-oriented portfolio is one place where I think investors really can do better without much work or the confusion of sorting out the different choices Vanguard throws at us.

If I were to wipe the slate clean and start today, I might make some slightly different decisions, but so that I’m not accused of moving the target, here is a quick review of what I originally proposed.

The table below shows the funds I suggested years ago, with no changes. Remember, the exercise then, as now, was to build a portfolio with an allocation that looked just like Vanguard Target Retirement Income (VTNIX), but using better funds.

I’m earning a higher yield with Vanguard GNMA, which has outperformed Vanguard Total Bond Market (BND ) over time. I also replaced the money market with a bond fund, a strategy I have consistently recommended and practiced throughout the years.

And for stock exposure, I selected a large-cap fund, Vanguard Growth & Income (VQNPX) and added a high-yield, smaller-stock fund, Convertible Securities (VCVSX). That’s not a tough portfolio to build, and the returns have been higher. In lieu of indexing the foreign markets, I put 10% of my alternative’s assets into Vanguard Global Equity (VHGEX).

In the chart below, I show you how this allocation would have done versus Target Retirement Income. With a little effort, I was able to produce a portfolio that generates a higher yield with lower risk and higher returns.

If I were to make the allocations today, I’d substitute Vanguard Dividend Growth (VDIGX) for Vanguard Growth & Income and probably use Vanguard Total World Stock Index (VTWSX) instead of Vanguard Global Equity given the active fund’s lagging performance and constantly growing team of managers.