Value Investing Relative Strength Higher Returns

Post on: 16 Март, 2015 No Comment

One needs to look no farther than Warren Buffett to see that value investing works. Many others have applied these same principles to amass lesser, but still sizable, fortunes. But despite its successes, this strategy is challenging for many investors to follow because it can take a great deal of time for the market to recognize that a particular stock’s valuation is too low.

At other times, stocks that appear cheap keep on declining due to fundamentals that continue to deteriorate. As such, fundamental analysts should consider adding a simple technical tool to their stock selection criteria to help them to avoid these common value traps : relative strength. Read on to find out how to combine this discipline with a value investing strategy for superior results.

Value in the Stock Market

Fundamental analysts use the data available in a company’s financial statements to determine a theoretically fair price for a company’s stock. When the market price is lower than the fair value, these analysts rate the stock a buy. Specific criteria they look at includes common items like the price-to-earnings ratio (PE ratio) or dividend yield, as well as more obscure ratios such as the price-to-cash-flow ratio.

Quite a few studies have been done by the academic community to determine whether value investing works. To complete these studies, researchers usually divide the universe of stocks into different groups based solely on different valuation-based ratios. These studies consistently demonstrate that value investing works well and generally outperforms the market averages over the long term.

Among the first studies was a paper published by Eugene Fama and Kenneth French in 1992 called The Cross-Section of Expected Stock Returns. This study showed that stocks with low price-to-book (PB) ratios have higher average annual returns than growth stocks, which are defined as those with high PE ratios.

To implement a value investing methodology, an investor could buy a group of stocks with the lowest PE ratios from a broad index like the S&P 500. In theory, market-beating results are achievable over longer time horizons because eventually, the market will realize that these stocks are underpriced, and as more investors recognize this fact the stock price will increase.

The Value Trap

While a stock with low valuation may be an undiscovered gem, it may also be a company racing toward bankruptcy. Famed investor Peter Lynch summarized this situation with a single question, If it’s gone down this much already, how much lower can it go? The answer, he noted, is that any stock can fall to zero. Determining the future prospects of a company is one of the core challenges confronted by value investors.

This dilemma is the value trap. Value investing requires a long-term time horizon because the investor is betting that the market will eventually recognize the mispricing.

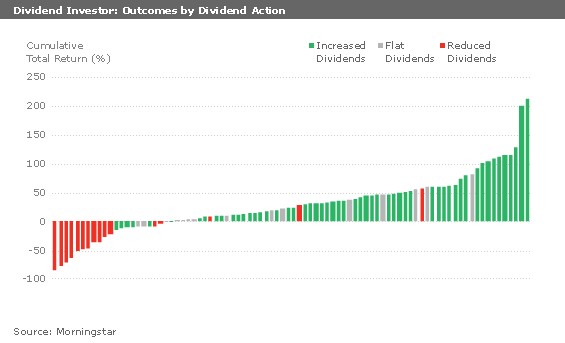

It may take years for the market to find this value and the stock can stay priced at these undervalued levels for extended periods. While dividends provide some measure of comfort to many investors, by tying up their capital in a stock that’s going nowhere, even value investors are missing out on better opportunities to profit. (To learn more, read Value Traps: Bargain Hunters Beware! )