Value Investing How to Calculate a DCF Growth Rate

Post on: 29 Апрель, 2015 No Comment

A DCF can be easy or as difficult as you make it.

The easiest way is to simply start off with the latest Free Cash Flow and then apply a single stage with a DCF growth rate.

DCF isn’t a 100% sure thing.

The easiest problem to fall into is to try and use a DCF for every single stock you look at without really thinking about the inputs.

You don’t want to fall into the hammer and nail problem.

It’s very tempting though because when you just get into valuing companies, you get excited and want to test it out on every stock you come across.

Bruce Greenwald is clear that he doesn’t like DCF’s.

That’s why he came up with his Earnings Power Value method to value stocks.

However I like using DCF’s because I try to keep all my inputs realistic and make sure I have a big picture in my mind of what I’m trying to model.

And DCF growth rates is an important part of that.

Stock Valuation Preparation is Important

My wife is into ceramics and I was looking at a youtube video on how to make a pot.

Throwing a Pot

Looked like a fun hobby so I began researching how to start.

Turns out, there is a lot to do before you even get a chance to have fun on the throwing wheel.

The right clay has to be chosen.

It has to be mixed and formed properly.

Only after several hours or days when the clay is ready, can you play on the throwing wheel and try to make something.

Getting the growth rates, normalizing data and understanding the inputs is a lot like getting the clay ready.

There’s a lot to think about before you can get to a real valuation.

Calculating DCF Growth Rates

Since I show a lot of valuations and intrinsic value numbers when I write about stocks, you should know how I get my numbers.

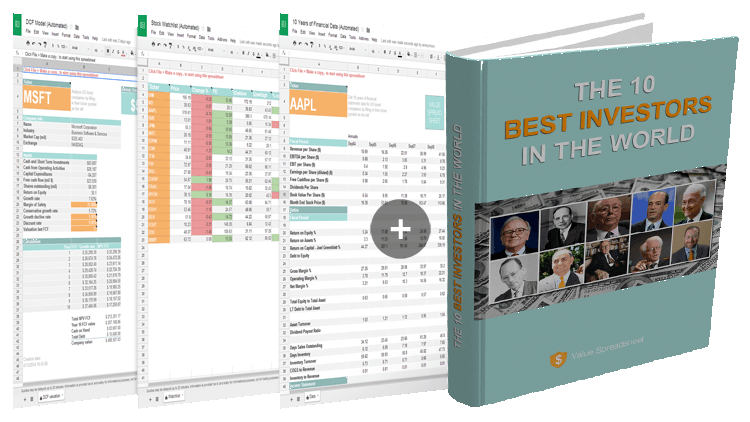

The DCF valuation method I use in the Old School Value Stock Analyzer is similar to a 3 stage DCF .

Instead of just taking one growth rate and extrapolating it linearly, I’ve applied a decay rate to simulate a business cycle.

DCF to Simulate a Business Cycle

And instead of just using an analyst growth rate estimate I normalize FCF growth to remove one time good/bad years to come up with something more usable.

This isn’t a precise method.

There is no precise way of doing things when you try to project, calculate or regress growth.

Valuation = art + science.

The easiest way to calculate growth is to subtract the beginning value from its ending value, and then divide that result by the beginning value.

Growth rate = (End value – Start value)/(Start value)