Value Investing Example Stock Valuation

Post on: 9 Май, 2015 No Comment

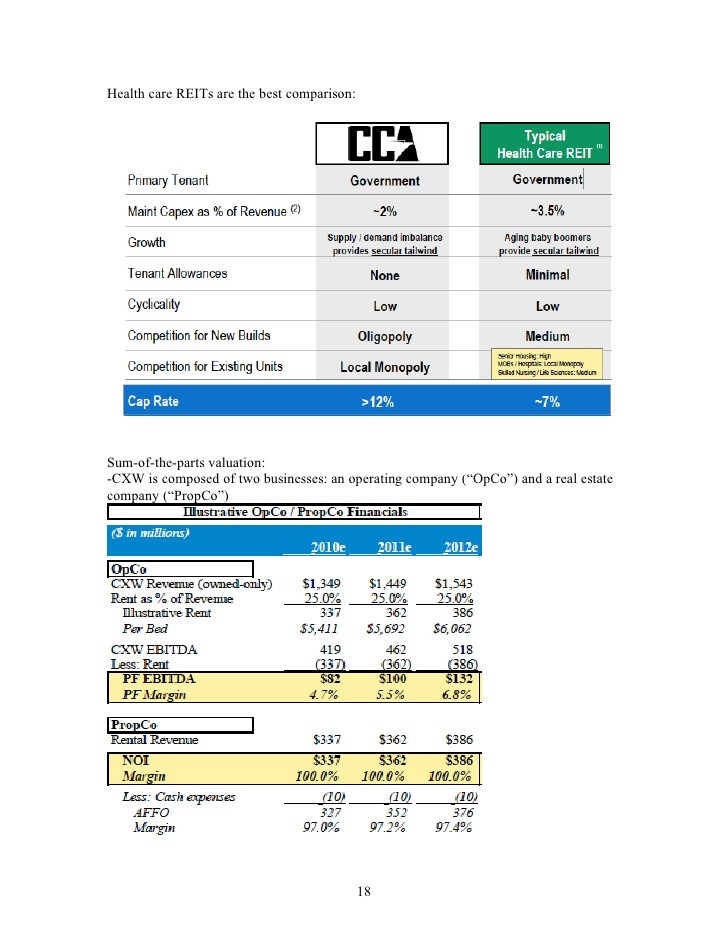

The following example is designed to display the elements of the calculation of the net present value per share (absolute safety margin) and its percentage of the purchase price basis (relative safety margin) for a company with publicly-traded common stock. The DCF Valuator include examples of the estimation of economic intrinsic value and internal rate of return. These valuation models, unlike pricing models, calculate absolute value — not comparative price relative to another company or group or index. A hypothetical company is chosen to avoid limiting the stock selection to one particular circle of competence.

The General Discounted Cash Flow (DCF) model is appropriate for this case. It is the most broadly applicable model and thus requires the most input data. The most general DCF model allows any number of input line items, any desired input line items, any number of input periods, and any unique values of each input line item in each input period. This will work for negative cash flows and for irregular cash flows that can’t be well approximated by a growth pattern. Usually, annual total dividend distributions are estimated for at least five years. If a company is not expected to pay regular dividends, then annual free cash flow to equity would be estimated. For the sake of convenience only, the stock price basis is here assumed to double in five years.

The U.S. federal income tax rate is assumed at the highest marginal rate on ordinary income, in this case portfolio income from dividends. In addition, the investment is assumed to be held for longer than 18 months, and thus the capital gains and losses are classified as long-term for income tax purposes. Generous U.S. trading and other costs are included for the sake of completeness. These assumptions can be modified for other tax and trading regimes.

In addition to using a general DCF model, the example uses a static or deterministic as opposed to a dynamic or stochastic (probabilistic) analysis. The estimate of value per share is a single point estimate rather than a more comprehensive interval estimate of a range of values based on a probability distribution provided by the estimator. The point value in the range of values that is the best single estimate of value is the mean value. In the spreadsheet, pa means per annum, and n/a means not applicable. Graphs of the more important items in the calculation are presented below. Other abbreviations in the spreadsheet and graphs are explained in the questions.