Value Averaging vs Dollar Cost Averaging Financial Web

Post on: 16 Март, 2015 No Comment

Many investors use value averaging or dollar cost averaging as a way to minimize the impact of market timing on their portfolios. Both methods have proven that they have some merit for long-term investors. However, they do have some distinct differences that you need to be aware of. Here are the basics of value averaging and dollar cost averaging.

Dollar Cost Averaging

Dollar cost averaging is a very popular method of investment that allows you to level out the movement of a particular security overtime. With this strategy, you are going to be investing a set amount of money on a regular interval. For example, you might decide to invest $100 every month into a particular mutual fund. By doing this, you are limiting the risk of purchasing at the wrong time in the market. For example, if you took $1200 and purchased as many shares as you could at the beginning of the year, you will be subject to the price risk at that particular time. If the price of the mutual fund went down over the course of the year, you would lose money on your investment. However, if you invested $100 each month for year in the same mutual fund, your risk would be minimized. You would buy some shares when the price was high and some when the price was low.

This strategy can help you stick to investing over the long-term and cut down on risk. However, if the price of the security continues to rise, you will be missing out on the potential growth that you could of had by purchasing all of your shares at the beginning.

Value Averaging

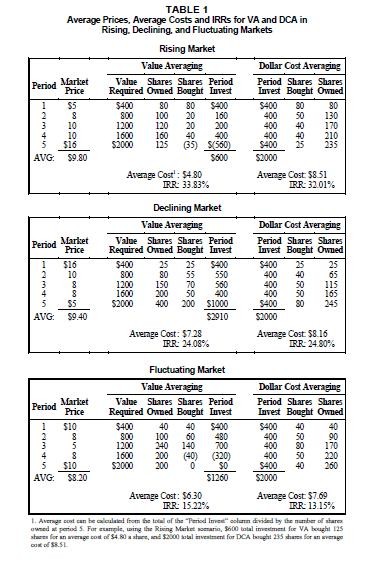

Another popular method of investment is known as value averaging. With this strategy, you will not always invest the same amount of money at a regular interval. With value averaging, you will try to invest more money when the price of a security falls. Then, when the price of the security goes up, you will invest less money.

This is accomplished by setting an investment goal for each interval. For example, you decide that you want your investment to go up by $1000 every quarter. Therefore, the first time you invest $1000 into a particular security. At the end of the quarter, the value of your shares equals $1250. This means that for the upcoming quarter, you will only have to invest $750 in order to get the total value of your portfolio up to $2000. Then, the next quarter comes and the value of your investment is $1900. At that time, you will have to invest $1100 in order to get up to the $3000 threshold. While you are investing more money, you are also purchasing more shares when the price is low. Therefore, this has the ability to help you take advantage of timing and still invest in regular intervals.

Choosing a Method

Dollar cost averaging is for those that take a long-term approach to investing and have a low risk tolerance. If you want to try and take advantage of market timing without having to analyze the market, value averaging could be the way to go for you.

$7 Online Trading. Fast executions. Only at Scottrade