Valuation Of A Preferred Stock

Post on: 16 Март, 2015 No Comment

Preferred shares have the qualities of a stock and a bond, which makes valuation a little different than a common share. The owner of the preferred share is part owner of the company, just like a common shareholder. The stake in the company is in proportion to the held stocks. Also, there is a fixed payment which is similar to a bond issued by the company. The fixed payment is in the form of a dividend and will be the basis of the valuation method for a preferred share. These payments could come quarterly, monthly or yearly, depending on the policy stated by the company.

Unique Features of Preferred Stock

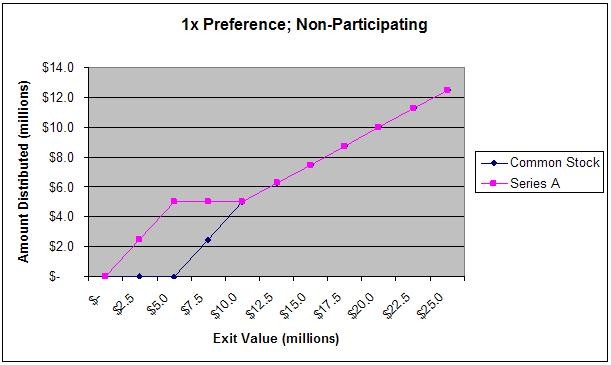

Preferred shares also differ from common shares, in that they have preferential claim on the assets of the company. In the event of a bankruptcy, the preferred shareholders get paid first, over the common shareholders.

The creditors, or bond holders, trump both the common and the preferred shares in an instance like this. This also goes for dividend payments; in the event that the management of the company has determined that the earnings cannot support a full dividend payment, the common shares get cut first. (For a deeper look into preferred stocks, read A Primer on Preferred Stocks .)

Generally, the dividend is predictable and fixed as a percentage of the share price, or as a dollar amount. This is usually a steady predictable stream of income. When an investment pays a steady stream of payments, like some bonds or annuities, the valuation can be completed by discounting each cash flow back to today.

Valuation

Preferred stocks have a fixed dividend, which means we can calculate the value by discounting each of these payments to the present day. This fixed dividend is not guaranteed in common shares. If you take these payments and calculate the sum of the present values into perpetuity. you will find the value of the stock.

For example, if ABC Company pays a 25 cent dividend every month and the required rate of return is 6% per year, then the expected value of the stock, using the dividend discount approach. would be $0.25/0.005 = $50. The discount rate was divided by 12 to get 0.005, but you could also use the yearly dividend of (0.25*12) $3 and divided it by the yearly discount rate of 0.06 to get $50. The point is that each issued dividend payment in the future needs to be discounted back to the present and each value is then added together.