Valuation Approaches And Methodologies Of Acquisitions

Post on: 7 Май, 2015 No Comment

Valuations are performed for a variety of reasons. In addition to acquisitions, they are performed for gift and estate purposes; for marital, partnership, and corporate dissolutions; for bankruptcy reorganizations; and for initial public offerings. Because of the differing objectives for each of these situations, the valuation methodology employed for each can differ, and it is important to match the approach used to the purpose of the valuation. There is general agreement among M&A [Merger and Acquisition ] professionals that the approaches most appropriate for the valuation of a business for acquisition purposes are the income approach, the asset-based approach, and the market approach. Each is briefly discussed in this post .

Advertisement

This overview of the valuation theory and practice is not intended to be an in-depth treatment of what can be a very complex and nuanced topic. It is an overview of the most important and relevant aspects of valuation, as they are applied to acquisitions. There is a vast amount of literature available on virtually every aspect of valuation.

Valuation Approaches

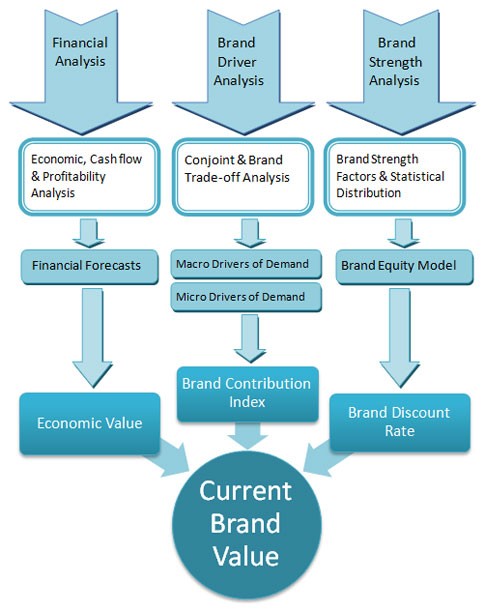

There are three approaches to determining the estimated value of a business: Income approach, Asset -based approach and Market approach. The approach that is most appropriate when valuing tangible and intangible assets directly corresponds to the type of asset being valued. The valuator can use one or a combination of the three approaches to assess value of the acquisition candidate.

Income Approach

The theory behind the income approach is that the value of the acquisition candidate is worth the future benefit of its revenue streams, discounted to present value, after reflecting investment risk and the time value of money. When evaluating the acquisition candidate, both dividends and net cash flow contribute to income inflows.

This measurement is termed “economic income ” and is converted to value with the application of either a discount rate or a capitalization rate. The discount rate represents the total rate of return an investor expects to realize on the amount invested. The total rate of return is measured against similar investments of comparable risk. Although the discount rate applies to a series of expected future income streams discounted back to a present value, the capitalization rate applies to a single-period income stream. The discount rate reflects the compounded expected growth rate while the capitalization rate is not influenced by the expectant growth rate.

The asset-based (cost) theory suggests that the buyer will not pay more for the purchase of the asset than for what a similar asset could be purchased. Computationally. this approach equals the current value of assets less the current value of liabilities. The remainder equals the current value of the company’s equity. This approach applies to both a company that is a viable operating entity (going concern) and to a company that is not considered a viable operating entity (liquidation basis). The asset-based approach usually applies to a control interest valuation. It is also an appropriate approach to use when a target company has material tangible assets.

Note. Assuming the targeted company is a going concern, the asset-based method should not be the primary approach. The income approach would be more appropriate.

Market Approach

The market theory suggests that, in valuing companies, the analyst should search for ones that are comparable or similar to the acquisition candidate. The search criteria that the valuator analyst uses are paramount in locating similar companies.

The market approach provides a minority interest market value. Using the market approach, the valuator must adjust the multiple computations from a minority interest value to a control interest value. The multiplier represents a relationship between the gross purchase price and either book value or a defined revenue stream.

The approaches just described are used in combination by most acquirers. Although methodologies differ based on the facts and circumstances peculiar to an individual transaction, as previously noted, there is a strong bias on the part of acquirers and their advisors toward the use of the DCF method as the primary valuation technique, with reliance on market multiples as a confirmatory tool .

Valuation Methodologies

A number of commonly used valuation methods can be used by the valuator analyst. The chosen methodology is dependent on the valuation approach[es] selected—for example, income, asset-based, or market (as previously discussed). These approaches provide specific methodologies for computing the value of an acquisition candidate. The most commonly used valuation methodologies are discussed hereafter .

Capitalization of earnings (an income approach) is appropriate for valuing a profitable business when the investor’s goal is to provide an annual return on investment in excess of reasonable owner’s compensation. To utilize this method, future estimated earnings is calculated and converted to a value by dividing it by a capitalization rate. This method does not separate tangible and intangible assets and should not be used for businesses that are capital intensive.

Discounted Earnings Method (DEM)

The discounted earnings method (DEM), another income approach, is also referred to as the discounted cash flow method. With this method, it is important to define the earnings that will be used to compute the company’s value. Examples of earnings used in this method are cash flow from operations and after-tax cash flow. Using a discount rate instead of a capitalization rate, the theoretical assumption is that the total value of the business is determined by computing the present value of the projected future earnings plus the present value of the terminal value. When acquiring a company, the valuation analyst should be confident that the projected earnings are based on management’s assumptions and represent reasonable future earnings.

Theoretically similar to the capitalization of earnings method, the price/earnings ratio method (an income and market approach) uses market comparisons to determine the multiple to be applied against after-tax earnings. The future estimated net income (after tax) is capitalized by a weighted average price/earnings ratio of comparable publicly traded companies. In using market comparisons, the difficulty is in finding publicly traded comparables that are similar to the targeted company. Usually this method is more appropriate when valuing larger and more diverse companies.

Dividend-Paying Capacity Method

The dividend-paying capacity method, another income and market approach, is appropriate for valuing large companies that pay dividends. Also an income approach because of its capitalization focus, it uses market comparisons in its methodology. The future estimated dividends to be paid, or that have the capacity to be paid, are capitalized by a five-year weighted average of dividend yields of five comparable companies. Usually this method is more appropriate when valuing larger and more diverse companies.

Net Asset Method

The net asset method (an asset-based [cost] approach) addresses the fair market value of each asset and liability at the date of valuation. The value of the equity equals the adjusted assets minus the adjusted liabilities. Typically, an acquiring company would use this method to purchase underperforming assets.

Excess Earnings (Return on Assets) Treasury Method

The treasury method (an income and asset-based [cost] approach) distinguishes between adjusted net tangible assets and intangible assets. The intangible value component is computed by capitalizing the earnings of a business that are in excess of those earnings related to a reasonable return on the fair market value of the company’s net assets. The total value of the business is then determined by adding the tangible net adjusted assets, at fair market value, to the intangible value as computed above. This methodology utilizes industry averages or average returns on equity from comparable companies to determine a reasonable return when computing an appropriate capitalization rate.

Excess Earnings (Return on Assets) Reasonable Rate Method

Instead of using an industry rate of return as in the treasury method, a reasonable rate of return (another income and asset-based [cost] approach) is applied to the adjusted net assets, such as the cost of debt. The intangible value component is computed by capitalizing the earnings of a business that are in excess of those earnings related to a reasonable return on the fair market value of the company’s net assets. The intangible value is then added to the fair market value of the adjusted net assets to determine the total value of the business.

Guideline Method

The guideline method (a market approach) compares the targeted company with public companies that are similar in nature. It is necessary, however, for the valuator to be confident that the public companies (otherwise known as the guideline companies) and the targeted company are similar in operations, product and service lines, and geographic location.

It is important for the valuator to use professional judgment when analyzing both qualitative and quantitative data. To properly compare the research data to the targeted company, the valuator should make adjustments to the financial statements of the public entities being used for comparison. The valuator must also refine the search criteria to make consistent and reliable comparisons, to select the appropriate ratio measurement, and to determine if further adjustments should be made for the premiums and discounts.

Examples of ratio measurements include :

- Price/earnings

- Price/pretax earnings

- Price/earnings before interest and taxes (EBIT)

- Price/earnings before interest, taxes, depreciation, and amortization (EBITDA)

- Price/book value

Direct Market Data Method

The direct market data method (a market approach) involves the use of actual industry sales transactions as a comparison with the acquisition candidate. It is sometimes difficult to validate comparable sales data because the comparative studies do not disclose the underlying reasons for the acquisition. Since transactions are often consummated because of acquired synergies, favorable purchase terms, and to achieve a greater market share, certain multiples, such as gross selling price to sales revenue, may not be appropriate measures of value. The valuator may need to adjust the direct market data used for a discount or premium.

Rule of Thumb and Formula Method

The rule of thumb and formula method (another market approach) is a derivative of the direct market data method. A multiplier or formula is developed from industry-wide experiences in the marketplace. The multiplier or formula addresses the relationships between the sales price and an industry-specific operational unit of measurement. The rule of thumb and formula method does not factor in risks that can materially impact value. These risk factors may include capital structure, stability of earnings, variances in market share, and management depth. This method does act, however, as a sanity check when comparing value estimates computed from other more sophisticated methodologies.

As noted, while this simple conceptual valuation approaches and methodologies are absolutely valid and quite useful, its practical application is considerably more complex. This complexity stems from the fact that valuation is not a precise discipline and, in fact, consists of as much art as science . Even though historical information forms the bedrock for valuation analysis, the calculation of acquisition values is ultimately based on estimates, forecasts, and assumptions about future performance. Because valuations are rigorously modeled and neatly quantified, they tend to imply a degree of precision that may be misleading to those who are not familiar with the nature of the underlying analysis. The reality is that the practical application of valuation theory and methodology is a complex process that is as reliant on professional judgment as it is on financial and analytical skills. The previous discussion is meant to illustrate the challenges and complexities associated with the valuation process.