Using the Time Value of Money

Post on: 16 Март, 2015 No Comment

Using the Future Value of One and Future Value of an Annuity Tables

You can opt-out at any time.

In the past you may have heard about the time value of money and wondered why it is so important. Well, as an arts and crafts business owner, you can use this concept to make important business decisions such as whether to lease or purchase equipment. However, understanding the time value of money is also very important for you as an self-employed business person to make sure you are able to realize your spending, purchasing and retirement goals.

I am going to lay out for you the very simple example my father gave to me when I got my first part time job.

Estimating a Rate of Return

Let’s say you get your first job at age 16 and put aside $2000 per year (only $167 per month) for 6 years until you are 21 — then you never save another dollar again. How much money will you have at age 65?

Well one important variable is your expected rate of return. Up until this latest economic upheaval, since the 1920s the average return on investments was about 9% — some years were higher; some lower — but 9% was the average.

I don’t know about you, but I haven’t seen any of my investments coming in at anywhere near 9% for quite few years. The best I am doing is 5% on some bonds, so I’ll use that as my expected rate of return,

Understanding Future Value Tables

You use present and future value table to figure out the time value of money under difference scenarios. To figure how much money will you have at age 65, you use future value tables.

You need access to two different factoring tables for this calculation:

- The future value of an annuity

- The future value of $1

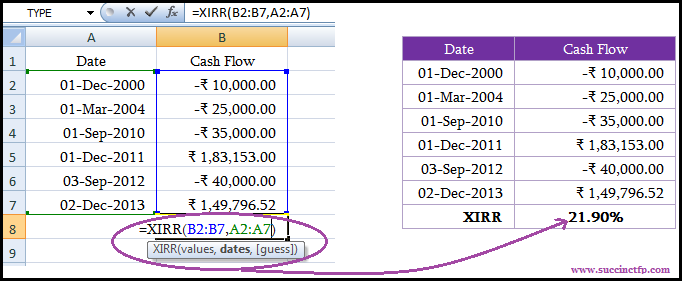

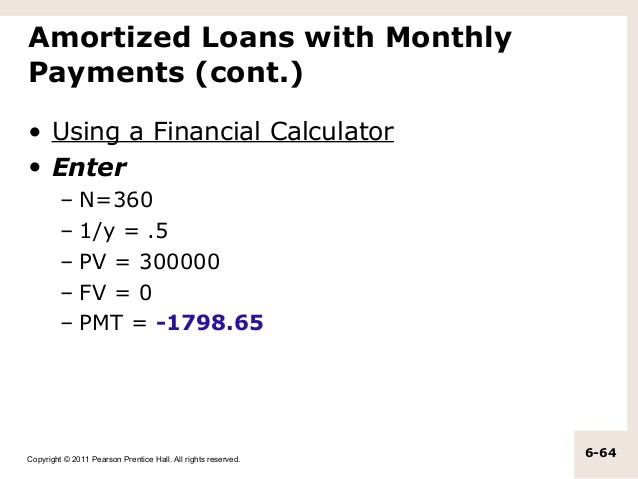

Excel has a function that will perform financial calculations for you. Using an Excel spreadsheet you go to Insert, Function, Financial and pick the proper function name.

If you aren’t a spreadsheet whiz, put the key phrase future value tables in your favorite search engine and I’m sure you’ll be able to access the tables online.

Basic Calculation for the Time Value of Money

The calculation is done by figuring the value at the end of six years of the $2000 per year investment plus any compounded interest ($2,000 x 6 = $12,000). Then, you calculate the value of $12,000 at the end of another 40 years (the remaining years between age 21 and age 61) when you want to retire.

Working Through the Six Year Annuity

The $2,000 invested each year for six years is an annuity: a fix payment over a period of time. We’re using an average rate of return of 5%. Total cash outlay over the six years is $12,000.

Use the factoring table for the future value of an annuity of 1. Using the table, checking out the factor at the intersection of 6 years and 5%, the factor is 6.80191. Multiplying 6.80191 times $2,000 = $13,604. So at age 21 your $2,000/ year investment will be worth $13,604.

Probably doesn’t seem like that big of a deal. After all, you did invest $12,000. However, remember that you didn’t invest that $12,000 all at once — you trickled it into your investment accounts over a period of years.

Working Through the Future Value of a Single Sum

What really brings home the whole time value of money equation is seeing what your $13,604 grows into over a period of years. Remember, you aren’t going to save any more money, so you now want to see what this single sum of $13,604 will grow into if you don’t add to or withdraw from it over the years until you are 61 and ready to retire.

For this one, use the factoring table for the future value of 1, Checking out the factor at the intersection of 40 years and 5% gives you 7.03999. Multiple $13,604 times 7.03999. At age 61 your $2000 per year savings from age 16 to age 21 will now be worth $95,772.

Please note: Sigh, back in the day when the average rate of return was at 9%, that $12,000 investment would have been worth nearly half a million dollars at retirement age.

The next article in this series about the time value of money, shows you how to use it to make business decisions for your arts and crafts business.