Using The Pricetobook Ratio To Evaluate Companies 2015

Post on: 16 Март, 2015 No Comment

3A%2F%2Fwww.slideshare.net%2F?w=250 /% Transcript. 1. Management And Financial Accounting In Oil and GasUpstream Industry.Net Present Value in evaluating Oil and Gas Company

3A%2F%2Fen.wikipedia.org%2F?w=250 /% Sources of data for financial ratios. Values used in calculating financial ratios are taken from the balance sheet, income statement, statement of cash flows or

3A%2F%2Fen.wikipedia.org%2F?w=250 /% The price-to-book ratio, or P/B ratio, is a financial ratio used to compare a company’s current market price to its book value. It is also sometimes known

3A%2F%2Fstocks.about.com%2F?w=250 /% The Price to Book ratio is a way to determine how the market values the book value of a company based on the current market price.

3A%2F%2Fwww.investopedia.com%2F?w=250 /% DEFINITION of ‘Price-Earnings Ratio — P/E Ratio’ A valuation ratio of a company’s current share price compared to its per-share earnings. Calculated as:

3A%2F%2Fwww.ehow.com%2F?w=250 /% How to Evaluate Financial Performance. Financial statement analysis is the most objective way to evaluate the financial performance of a company. Financial

3A%2F%2Fwww.bls.gov%2F?w=250 /% How To Compute a Firm’s Incidence Rate for Safety Management. Incidence rates can be used to show the relative level of injuries and illnesses among different

3A%2F%2Fwww.investopedia.com%2F?w=250 /% For stock investors, the balance sheet is an important consideration for investing in a company because it is a reflection of what the company owns and owes.

3A%2F%2Fwww.investopedia.com%2F?w=250 /% What price should you pay for a company’s shares? If the goal is to unearth high-growth companies selling at low-growth prices, the price-to-book ratio (P/B) offers investors a handy, albeit fairly crude, approach to finding undervalued companies.

3A%2F%2Fwww.moneycontrol.com%2F?w=250 /% India’s largest listed sanitaryware company will be using the entire QIP The stock’s price-to-earnings (P/E) ratio was 29.58. The latest book value of the company is Rs 169.80 per share. At current value, the price-to-book value of the company

3A%2F%2Fseekingalpha.com%2F?w=250 /% the payout ratio is one of the most important metrics to evaluate. The payout ratio takes the dividends paid and divides them into the earnings (or Funds From Operations) of the company. The simplest way to view the payout ratio is, it expresses your

3A%2F%2Fwww.forbes.com%2F?w=250 /% For example, the recent MRK share price of $56.17 represents a price-to-book ratio of 3.3 and strongest most profitable companies, that also happen to be trading at an attractive valuation. That’s what we aim to find using our proprietary

3A%2F%2Fwww.valuewalk.com%2F?w=250 /% You can use the Piotroski F-Score to improve most investment strategies, not just a low price to book ratio Best strategy with Piotroski F-Score = Free cash flow yield (FCF Yield) +680.4% The strategy combined with the best Piotroski F-Score companies

3A%2F%2Fwww.ftadviser.com%2F?w=250 /% An investor valuing the telco using only the P/E ratio might have concluded Vodafone was worthless, however the company today is worth more than £60bn. Turning to the price-to-book ratio, the book value of a company is everything that it owns (its assets

3A%2F%2Fexperts.allbusiness.com%2F?w=250 /% Your goal in using five ratios can be useful to develop trends and evaluate the relative financial strength of your business in certain areas: 1. Current ratio – Divides current assets by current liabilities. This is one measure of your company

3A%2F%2Fwww.livemint.com%2F?w=250 /% Using a debt-to-equity ratio of 30% will Therefore, a price-to-book value of 2 may be more appropriate. However, we have used very stringent criteria as far as leverage and capital efficiency is concerned. For companies with highly profitable business

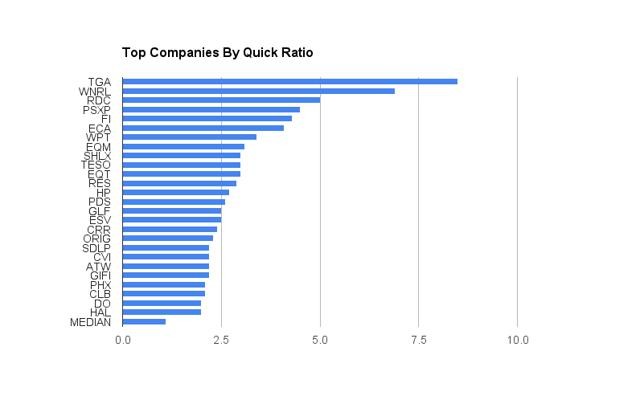

3A%2F%2Fwww.doughroller.net%2F?w=250 /% Most large publicly traded companies have billions in assets and liabilities, which can make it difficult to draw any actionable conclusions. And that’s where the current ratio and quick that will allow you to evaluate a company’s financial

3A%2F%2Fwww.foxbusiness.com%2F?w=250 /% Yes, “operating earnings” stripping out all the bad stuff, was in fashion back then, still in use companies back then had not built out their infrastructure or operations and had no real assets. As a result, “the price-to-book value ratio