Using ETFs in a 401k

Post on: 8 Апрель, 2015 No Comment

The distinction between mutual funds, the mainstay of retirement plans offered in the workforce and Exchange Traded Funds (ETFs), the mutual fund-like security that trades on the open exchange throughout the day is well known. Yet many of these company sponsored retirement plans have resisted the addition of these low-cost funds. Should they be added to your list of investment options in these tax-deferred plans? Do ETFs belong in your 401(k)?

What is the difference between mutual funds and ETFs?

Essentially, the differences are important to note even as they are often seen as investment cousins.

A mutual fund is a pooled investment of securities managed by a professional manager or management team. The investor becomes a shareholder in the fund owning a small sliver of every investment represented in the fund.

ETFs on the other hand are portfolios of securities, assembled by a professional manager or management team and this investment is offered as a single share on an open exchange.

When you buy or sell your shares in a mutual fund, the underlying basket of securities/assets changes, if only slightly. Buying into a mutual fund increases the number of shares in the fund and/or cash and conversely, selling your shares decreases the amount of shares and/or cash available for investment in additional securities in the fund. When you buy an ETF share, the portfolio stays the same.

Why should ETFs be in retirement plans?

ETFs are currently offered in less than one percent of the 401(k) plans in the United States. The reasons they have met with plan sponsor resistance are numerous.

Shouldn’t these plans offer more than just mutual funds and the company’s stock?

Many would answer this question with a resounding yes. But studies have shown that the vast majority of people do not treat their 401(k) with the same enthusiasm that the proponents of these securities assume they do. The vast majority of people using their company sponsored plan do so from a distance. Many of the plan participants never change funds within the plan once enrolled. Auto-enrollment has created an investor who never seems to add to or exit from the first funds they purchase.

While plan sponsors would like to add this investment to the plan’s offerings, the lackluster use of the current offerings point to an investor that wouldn’t appreciate the effort.

What sort of hurdles do plan sponsors face when considering the addition of ETFs?

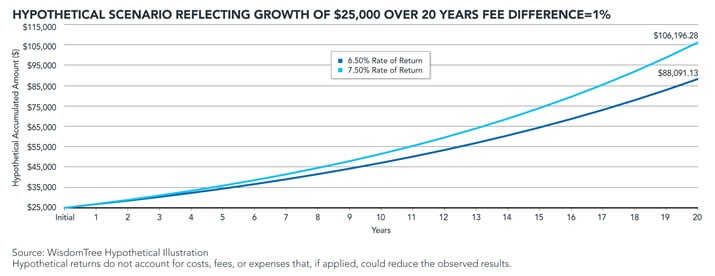

When a plan participant buys mutual fund shares, the cost of doing so is almost non-existent. The same companies offering the mutual funds are the actual plan sponsor. ETFs on the other hand are traded on an exchange and the go-between in this transaction is a broker. While ETFs often offer low-cost funds compared to their mutual fund cohorts, the cost of the trade must be borne by either the plan or by the plan participant.

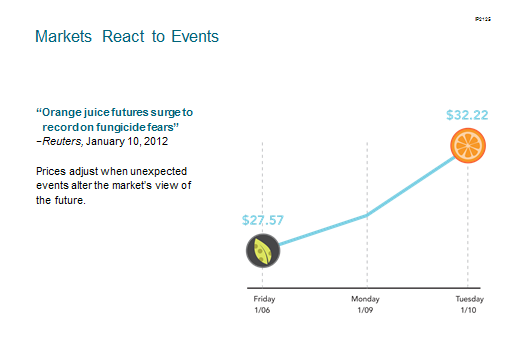

Another hurdle is when an ETF should be purchased. Plans could bundle these purchases in the hope of getting a better price on the transaction at the end of trading but this is how mutual funds trade.

Can these issues be overcome?

There are some brokerages that believe they have the answer. ING, Charles Schwab and TD Ameritrade are testing the waters with an all ETF 401(k). Removing the mutual fund from the equation could be a solution that will be adopted by larger 401(k) providers.