Use Protective Collars to Protect Your Stocks

Post on: 12 Апрель, 2015 No Comment

The stock market is scoring record highs, winning the applause of more and more investors as their portfolios grow ever greener. Times like these are exactly when it can pay very well to protect some of your key holdings.

The world of options offers simple ways to protect or hedge your portfolio — often at little or no cost to you. For example, options let you protect a stock you own from downside, and do so with no or virtually no out-of-pocket cost. This is called a protective collar — and when it’s free to you, it’s called a costless collar .

Protective collars are useful when you’re uncertain about a stock’s valuation risk. They can also be a prudent way to protect your gains on stocks that have recently leaped in price (nearing your estimate of fair value) or become a large part of your portfolio. Courtesy of Motley Fool Options. let’s explain how collars work and how you can use them — including a real-life example.

Insure your positions by buying puts

As a long-term investor who remains committed to your core holdings, you may be reluctant to sell even if you see storm clouds on the economy’s or market’s horizon. After all, life is full of ups and downs, and you can’t simply disengage when the going gets tough. However, when it comes to equities, you can protect your portfolio by purchasing put options.

That’s right. Purchasing options — not selling them. When using options Foolishly, Motley Fool Options generally recommends that you sell (or write) them, which obligates you to either deliver the shares (in the case of a call) or buy shares (in the case of a put) if the stock moves dramatically. Since Options’ inception, more than 90% of our recommendations have closed profitably, in part because we put the odds in our favor as options writers.

But buying options can be a smart move, too. When we buy options, we’re not under any obligation regarding shares of the underlying investment. So, if we buy puts on a stock we own, and the puts gain value for us, we’ll simply sell those puts later for a profit and still keep our shares of the underlying stock (assuming we want to). In other words, buying options means using them as a strategy on their own, with no need to get the underlying stock involved unless we want to.

Now let’s explain buying puts, specifically. A put option goes up in value when the underlying equity declines in price. So when you buy a put, you’re basically buying insurance for your investment. A put gives its owner the right to sell the underlying stock at a minimum set price (the option’s strike price) by a set date (the option’s expiration date), no matter how far it falls. In times of uncertainty, buying puts to protect your key holdings makes plenty of sense. However, it can be expensive — and who wants to shell out piles of cash for insurance policies that may one day expire unused?

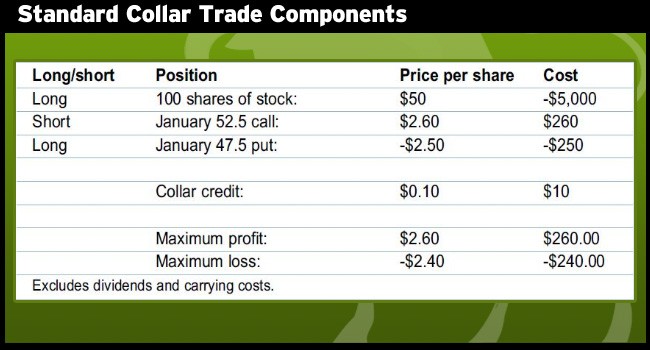

Enter the costless collar. Using this strategy, you buy your puts — your insurance — with funds you receive from the concurrent sale of call options, thus saving yourself the cost of the puts.

The costless collar example: Buy puts, sell calls

Let’s assume that you’re a believer in, and owner of, the House of Mouse. Disney ( NYSE: DIS ) is attracting ever more visitors to its parks, making ever more money from ESPN, and cranking out blockbuster movies like they’re a dime a dozen. Your shares have responded by rising to record highs, making Disney a large position for you. You still believe in Walt’s baby, but you’d like to hedge some or all of your shares in case the market declines substantially between now and October.

The stock lately trades at $67.20 per share. To set up a costless collar, protecting your whole position, you:

- Write (sell to open) October 2013 $70 calls, one for every 100 shares of the stock you own.

- Use the proceeds to pay for the October $65 protective puts you’re buying. You buy to open the puts, one for every 100 shares you’re protecting.

Using real-life quotes on Disney as I write this, the $65 strike price put options expiring in October can be purchased for $2.68 per contract. At the same time, the $70 strike price call options can be sold for $2.38 per contract. The puts will protect you from a decline in Disney’s stock below $65, and the calls you sell pay for almost all of the puts! You only need to pay out $0.30 extra ($30) per contract. That’s cheap insurance for 100 shares!

The real cost of implementing a protective collar is that you limit your upside. If shares of Disney exceed $70 by your call option’s October expiration, you’ll miss any upside above that price, and you’ll need to sell your shares at $70 — or close your calls at a cost to keep your shares. But if Disney’s price declines even a little over the next five months, you’ll be glad you set up the collar. The puts will provide you a profit, canceling out Disney’s decline below $65, and the calls you sold will expire, also at a profit for you. Meanwhile, you can keep holding your shares to await a recovery and more long-term returns.

The Motley Fool Options bottom line

Collars can smooth your returns, help hedge your portfolio during market declines, completely protect a key holding, and allow you to ride out a rough market with confidence. They’re not for everyday use, because they do cap your upside a bit above today’s prices, but they’re useful in stock situations that merit protection.

If you’re interested in hearing more of these types of strategies, Motley Fool Options and Motley Fool PRO are hosting FREE introductory programs this month, called Options Whiz and PRO Academy . Click here for more details and to sign up!

Jeff Fischer has no position in any stocks mentioned. The Motley Fool recommends Walt Disney. The Motley Fool owns shares of Walt Disney. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .