Use neutral to bullish strategies

Post on: 23 Июль, 2015 No Comment

Use neutral to bullish strategies

Mar 01 2015

as the possibility a strong and sustained directional move in Nifty due to event risk is over, option prices that were very high till last Friday are now likely to see faster decline in time value.

This will happen largely in out-of-money call and put options, which have huge open interest positions. The decline will gain pace mid-week as Nifty is likely to remain volatile in the first two sessions, forcing traders to stick to their options.

So, what should be the strategy for the week?

Option traders, who are sitting on high cash levels, should remain in that state for the next two sessions and go for positional trade only through mid-week. As for the direction of that trade, we feel Nifty may continue to witness small corrections, but the broader market trend is going to remain positive.

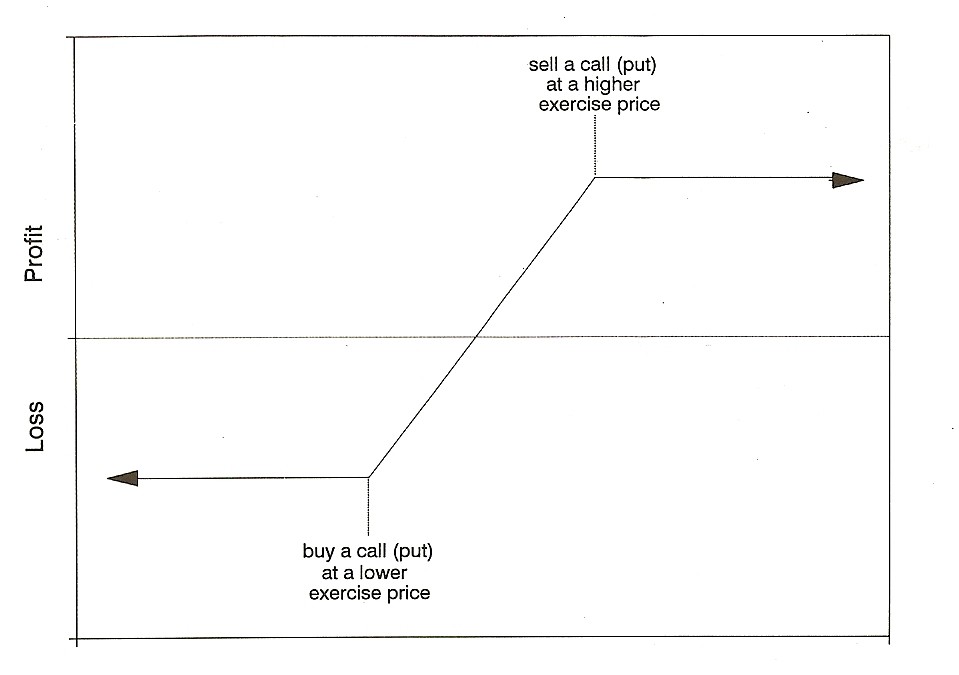

So, the basic idea would be have neutral to bullish strategies at this point of time. We would suggest traders to go long on Nifty futures from March series and buy put options from the same series to create a hedge.

If Nifty were to start a new rally, it would be very sharp and Nifty futures can help traders take full advantage of such a run. We recommend buying of put options, as they can protect traders from heavy losses in case of a sharp fall in Nifty in the short term due to any reason. In such a case, one should stay long on futures and wait for a turnaround, which can be done by employing a very small portion of the trading capital.

One can also go for a similar trade in bank Nifty. It is very likely that this index will see a strong directional move over the next few sessions.

Having a put option and a long position in bank Nifty futures would be ideal to take care of any volatility that is likely to emerge.

It is very likely that some of the private banks may see a strong directional move, most likely in the upward direction. Traders can buy call options in private banks for the extreme short-term.

Another trading possibility over the next few sessions would be in pharma and FMCG stocks.

If Nifty witnesses any decline, stocks from these two sectors may gain weight. If Nifty witnesses a sharp decline, traders can buy call options in these stocks. Stock futures from these two sectors can act as an imperfect hedge. zz

rajivnagpal

@mydigitalfc.com

© 2011 Financial Chronicle, All rights reserved