Unit Trust Investing

Post on: 14 Июнь, 2015 No Comment

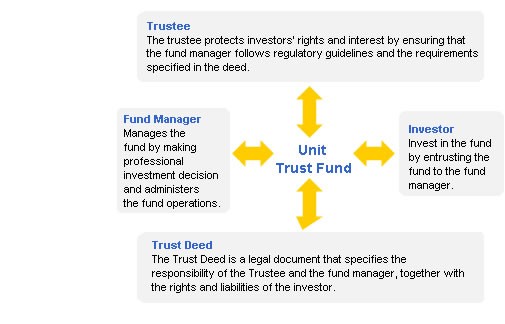

Collective investments (or unit trusts) are investments in which investors’ funds are pooled and managed by professional managers. Investing in shares has traditionally yielded unrivalled returns, offering investors the opportunity to build real wealth.

Yet, the large amounts of money required to purchase these shares are often out of reach of smaller investors. By pooling everyone’s funds in a collective investment, a portfolio of securities or shares can be put together, providing cost effective access to the world’s stock and securities markets.

Some factors to consider when investing:

- Do you want to grow your investment or capital, or are you looking for income?

- Will my investment be able to beat inflation?

- Can you access your money when it is needed?

- What are the costs involved in making the investment?

How does a collective investment work?

What can be included in a fund?

Investor Protection

The Collective Investment Schemes Control Act (CISCA) provides the legislative framework for collective investments and offers investors well thought through consumer protection.

Disclosure guidelines are clearly laid out and add an extra layer of protection to the self imposed industry laid down guidelines. For example, before concluding a transaction with an investor, the manager must disclose details such as investment objectives, calculation of the net asset value, dealing prices, charges, risk factors, distribution of income accruals, and all other information necessary to make an informed decision.

CISCA also facilitates clearly laid out and flexible investment limits and structures for investment managers, which can enhance performance of investments in line with investment manager mandates.

Investors in unit trusts have always enjoyed great protection as assets are held in a trust, which is closely administered on the investor’s behalf by an independent trustee. This means that the investors’ money is held separately from STANLIB’s assets. STANLIB’s trustee is Standard Chartered.

Fund protection

Return on investment

The return from a collective investment portfolio may be comprised of two elements: capital growth and/or income. Income can be split into three classes: Dividend, Interest and Rental Income.

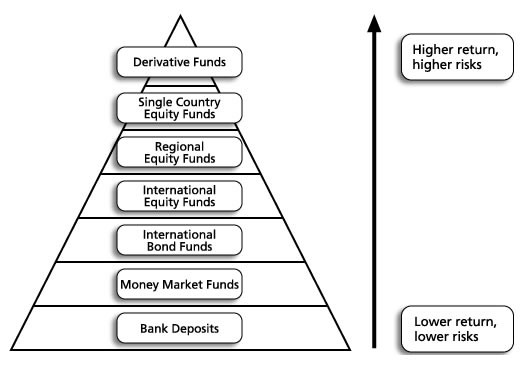

All collective investments have a certain degree of risk. The capital invested is never guaranteed as the fund value is always dependent on the movement of the underlying securities prices. Generally however, cash or money market type investments are less volatile while investments in the equity markets are more volatile. Offshore investments carry the additional risk of currency fluctuations. Depending on the investor’s risk preference, there are portfolios that can satisfy the investor’s needs.