Understanding Time Value of Money in Investment appraisals

Post on: 16 Март, 2015 No Comment

The nature venture businesses always lean on finding ways to expand and grow. In the mind of a senior executive in large companies or perhaps a single freelance designer looking for more business, there are different investment decisions available. For all of us, imagination is unlimited. The money? Not so much. That is why efficient financial practices such as investment appraisals or capital budgeting will help choose what business or investment decision to pursue.

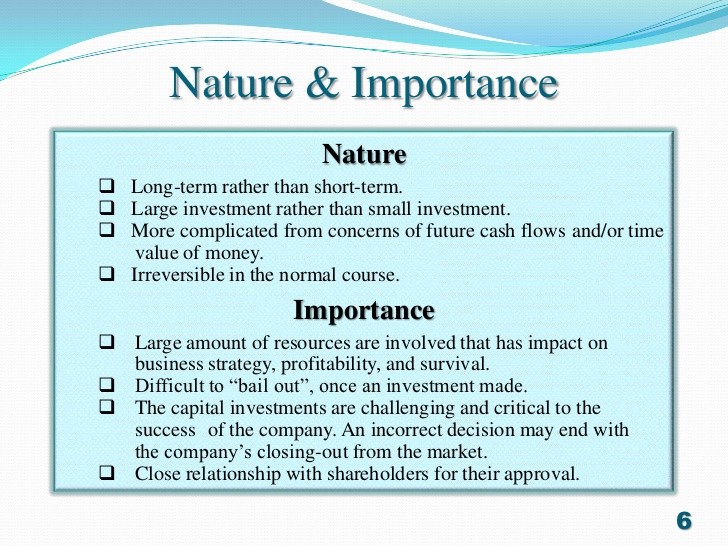

In capital budgeting and management, there are mainly three factors that must be taken in to consideration. These are (i) the extent to which the proposals are consistent with the long term plan; (ii) the risk attached to the proposals; and (iii) the availability of the necessary resources even if the money is available (British Computer Society nd). However, the more important question in capital budgeting is which investment decision can give the best return of investments? The tools to acquire a value for a capital proposal are important for the outlook of a company in any scale or business model.

Investment appraisals on any financial decision follow the idea of the time value of money. The time value of money is a concept that addresses the way the value of money changes over time (answers4funding 2007 [online]). In capital budgeting, it is a mechanism for investors to find the current value of a capital good against its value in the future. This idea is central to investment appraisals and capital budgeting as it lays out the different factors that are important in investing in a capital good. The concept of time value of money is closely related to interest rate which leads to the discount factor. Eventually the discount factor is integrated into investment appraisal equation such as net present value and internal rate of return (Wikipedia 2007 [online]). The time value of money is essentially part of the opportunity cost that will either give the decision maker the incentive or disincentive to buy a capital good.

Investment appraisals are also governed by the cost of capital (British Computer Society nd). In economic terms, cost does not only pertain to the monetary value of the capital good but also to the opportunity cost associated with the good. As an example, Joe tries to buy a motorcycle for his delivery service. Joe has to evaluate the cost of the motorcycle and the expected cash inflow that he would be getting as opposed to the opportunity to invest the money somewhere else where it might yield a higher return. As we can see, investment appraisals are an academic term for wise consumption decisions. Together, the cost of capital and the time value of money are the two main pillars in influencing capital budgeting for individuals and companies.

Capital budgeting or investment appraisals are methods to full understand the economic cost and benefits of a business decision. Tools such as NPV and IRR are important to help define a companys priorities. The economic relationships that exist in capital budgeting falls on the value of the discount factor (time value of money) and the (opportunity) cost of capital.

References

answers4funding.com/index.php?sec=11. Last accessed 18 October 2007.

www.bcs.org/upload/pdf/ profissuessamplechapter.pdf. Last accessed 18 October 2007.

www.netmba.com/finance/ capital/budgeting/.htm. Last accessed 18 October 2007.

www.odellion.com/pages/online%20community/IRR/financialmodels_irr_definition.htm. Last accessed 18 October 2007.

en.wikipedia.org/wiki/Capital_budgeting. Last accessed 18 October 2007.

en.wikipedia.org/wiki/Internal_rate_of_return. Last accessed 18 October 2007.

en.wikipedia.org/wiki/Net_Present_Value. Last accessed 18 October 2007.