Understanding the time value of money_1

Post on: 16 Март, 2015 No Comment

Contents

Most of us have heard it a lot, when people say that a dollar today is worth more than a dollar tomorrow. At first glance, it seems quite natural and instinctive. However, giving more thought to it, it is a bit cumbersome to realize, how the bill with the exactly same face value can be worth more in any given spot in time.

Time value of money

Those, who have more interaction with the world of economics and finance, might think it has something to do with the inflation and the buying power of the money. While it might be true, that the same dollar today might have more buying power, therefore have greater value as compared to the dollar a year from now due to the possible inflation in the economy, the concept outlined above has nothing to do with it. The real reason for this lies in one of the most fundamental clauses in corporate finance, namingly the time value of money .

A dollar today is worth more than a dollar tomorrow.

Then, how to understand this phrase? Quite simple. Let’s consider two cases.

- We receive $1,000 today.

- We receive $1,000 a year from now.

The reason, why $1,000 should have a greater value, can be written with the following expression: $1,000 a year from now = $1,000 today + the opportunity cost of using that money now. Having the $1,000 today, gives us the opportunity to make some use of that money during the 1-year period and thus, earn some additional profit. When we get that same amount of money in a year, then we forgo this opportunity. The opportunity cost is the amount of money that we can earn on our $1,000 putting it in the best investing opportunity that is available in the financial markets.

To give a clearer example, let’s assume that a local bank borrows money at 5% annual rate on the deposits and it is the best alternative that is available for us. When we have $1,000 today, we can deposit our money in this bank and get $1,050 ($1,000 initial amount + $50 in interest) a year from now. That is clearly more, by the amount of the interest earned, than the option of getting $1,000 a year from now. And this is the whole idea of time value of money.

Calculating Future Value

So, having made it clear, that having the money today is always much better then getting it in the future, let’s go on with the calculation of future value. In the example with the bank deposit we stated, that if invest today $1,000 at an interest rate of 5%, then our future value would equal to $1,050. This converses to the following formula:

(1000 x 0,05) + 1000 = 1050

1000 x [(1 x 0.05 + 1)] = 1050

1000 x (0.05 + 1) = 1050

Obviously, we can leave the deposit not only for one year. At the end of the second year, our deposit would have the following future value:

1050 x (1 + 0.05) = 1102.5

Or, we can write the same in the following way:

1000 x (1 + 0.05) x (1 + 0.05) = 1102.5

It is clear, that we can extend our calculation to any time period. The general equation for calculating the future values looks like this.

20value.jpg /%

where, P = original amount or the present value

r = interest rate per period

n = number of periods

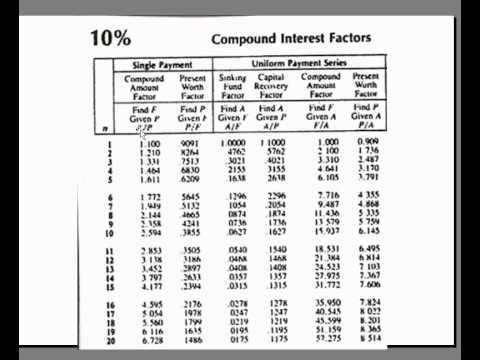

So, for example, if we put our deposit for 10 years at 8% interest rate, at the end of the eighth year the deposit would have the following future value:

20value_example.png /%

Note: Using the formula, always remember, that the interest rate per period should be written in decimals. So, when you have a 10% rate, you should write it as 0,1.

Calculating Present Value

Now let’s assume, that we are going to get $1,000 in one year. We know, in this case, the future value. But how much is that amount worth today? For this we need to calculate the present value of $1,000 to be received in a year. As $1 today is worth more than $1 in a year, it should be more than just obvious, that the present value of $1,000 to be received in a year would be less than $1,000.

To find the present value, we can just reverse the formula that we used for calculating the future value. If we assume a 5% interest rate, then the present value would be equal to:

PV = 1000 x [1 / (1 + 0.05) ] = 952.38

As we can see, to get the present value, we must multiply 1000 by [1 / (1 + 0.05)]. This multiplier is known as the discount factor.

The discount factor is the present value of $1 received in the future. (FV = $1; PV = discount factor)

20factor.jpg /%

where, r = the discount rate.

This is the rate of return that investors demand for accepting delayed payments. It is the return that is offered in the capital markets by investment alternatives of the same duration and risk. This rate of return is also known as the hurdle rate or the opportunity cost of capital. It is called the opportunity cost of capital, as it is the return foregone by investing in the deposit rather then in other securities. Alternatively, we could invest in the stock market or buy government T-Bills. So the opportunity cost of capital is the highest return of other investment opportunities, that are available for us.

We calculated the present value of a cash inflow to be received in one year. Now, if we assume, that we are going to get $1,000 in two, rather than one year, then our calculations would look like:

PV = 1000 x [1 / [(1 + 0.05) x (1 + 0.05)] ] = 907.03

To generalise this formula for any number of periods and any interest rate, we get the following:

20value.jpg /%

where, F = the amount we are going to get in the future or simply the future value

r = the discount rate

n = number of periods.

Considering an investment opportunity

Now, let’s sum up what we have discussed above and understand how it relates to investment decision-making. Corporate financial managers do use the idea of present value quite often in their day-to-day operations. Consider that we have an opportunity to invest in a project $500,000. The expected return from this project a year from now is believed to be $560,000. So, in this one-year time interval our profit from the project would equal to $60,000, which would give us a 12% rate of return.

Return = Profit / Investment = [560000 — 500000] / 500000 = 0.12

This seems great, doesn’t it? Many people would think so, as in the end we get positive return. So the big question is, whether we should go on and undertake this project. To make the right decision, we need to calculate the present value of the future cash flows and substract from them the initial investment at Period 0. In other words, we need to calculate the Net Present Value (NPV).

where, C is the cash flow from the corresponding year.

From the equation above, we can see that the net present value is the sum of the present values of all the cash flows during the lifetime of the project. The cash flow at Period 0 is usually our investment and therefore, a negative figure or a cash outflow.

The only thing that we miss now is the opportunity cost of capital. Which discount rate should we use? If we assume, that our project is risk-free and our return of $560,000 at the end of the year is a sure thing, then the correct rate would equal to the government T-bills, as there is generally no risk associated with this type of securities. However, such projects are rarely risk-free. There are many factors that might ruin our projected future cash flows, resulting in lower outcomes. To integrate this risk to our calculations, we need to look at the capital market and find a stock which has the same amount of risk. Say, we found some common stock X, that is a perfect match for our investment project. It is currently trading at $57 and it’s expected price a year from now is calculated to be $63. The expected return of this stock is equal to:

Stock’s expected return = (63 — 57) / 57 = 10.5%

This means, our opportunity cost of capital is 10.5%. This is the rate that we forgo by investing in our project. And this is the rate at which we should discount our future cash flows to get the present values. For our project it would result in the following:

20example.jpg /%

We can see, that the NPV of this project is positive. It means that it is worth more than it costs or to say it differently, it makes a net contribution and increases the wealth. We can also see, that the return of our project (12%) is higher than the return of an equivalent investment in the stock market.

If the price of stock X was considered to be $69 next year and not $63, then our calculations would yield a different result.

Stock’s expected return = (69 — 57) / 57 = 21%

20example%202.jpg /%

In this example, our opportunity cost of capital is equal to 21% and our NPV calculations result in a negative value, meaning this investment project ruins wealth and is not worth undertaking. To achieve the same future value of $560,000, we could simply invest $462,609 in stock X, while our investment project cost us more ($500,000). We can also see that the opportunity cost of capital of 21% is higher than our 12% rate of return on the project.

To sum up, we can write the following two rules for capital investments:

- Net present value rule: Accept investments that have positive net present values

- Rate of return rule: Accept investments that offer rates of return in excess of their opportunity cost of capital.