Understanding Other Comprehensive Income

Post on: 7 Сентябрь, 2015 No Comment

22/02/2013 by GAA Accounting

By Richard Starkey

An explanation of the other comprehensive income concept, illustrating the ‘reclassification’ principle. Other comprehensive income (OCI) is not easy to define, however, the concept behind it is quite simple. This article introduces the concept and illustrates the differences between OCI items that may be reclassified and OCI items that may not be reclassified.

What exactly is this line item called ‘Other Comprehensive Income’? Chartered accountants who qualified more than a couple of years ago may not be entirely confident with this term. The Conceptual Framework for Financial Reporting does not specifically mention it; IAS 1- Presentation of Financial Statements refers to OCI as non-owner changes in equity for a reporting period.

OCI is a financial performance concept (i.e. gains and losses measured over a period) that was created to provide for items that companies traditionally did not want recorded in their net profit and earnings per share (EPS) figures. This is because these items tended to distort EPS figures, for example. Prior to the OCI concept, such gains or losses were taken directly to the Statement of Changes in Equity (think of the Revaluation Surplus that arose from revaluation gains from property, plant and equipment).

At the end of the reporting period the total net profit (the financial performance concept over a period) is closed off to retained earnings. In the same way, individual OCI gains or losses are closed off to their respective equity accounts.

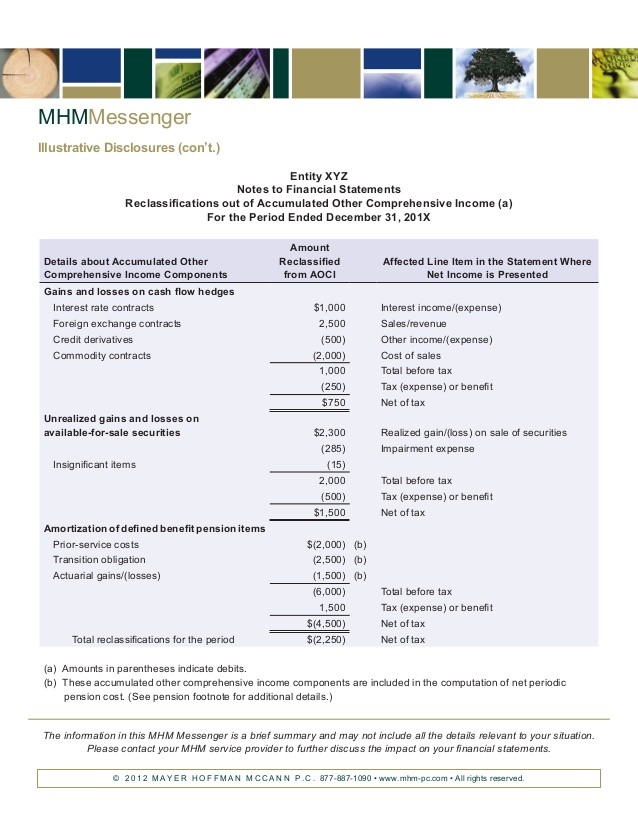

For periods after 2012, two categories of OCI need to be disclosed, namely OCI that may be reclassified versus OCI that may not be reclassified. The following is an example illustrating the accounting for an investment in a private company under IAS 39 versus its replacement standard IFRS 9 Financial Instruments.

Tabaldi (Pty) Ltd purchases 100% of Seltus (Pty) Ltd for R100,000 on 1 January 2011. At reporting date 31 December 2011, Seltus has a value of R180,000. On 31 January 2012 Tabaldi sells Seltus for R200,000. On 31 January the total fair value gains that are closed out to mark to market reserve (equity) is R80,000 (2011) plus R20,000 (2012), being equal to R100,000 (tax ignored for simplicity purposes).

Journal entries relating to OCI and the mark to market reserve (equity) upon de-recognition on 31 January 2012 under the two standards are as follows:

The following is a list of IAS/IFRS standards that may give rise to OCI:

A) Instances where OCI may not be reclassified:

- IAS 16 Property, Plant and Equipment: Gains or losses on PPE revaluations;

- IAS 19 Employee Benefits: Actuarial gains or losses on defined benefit plans;

- IFRS 9 Financial Instruments: Gains or losses due to changes in own credit risk (financial liabilities) designated at fair value;

- IFRS 9: Gains or losses on investments in equity instruments subsequently measured at fair value through OCI.

(B) Instances where OCI may be reclassified:

- IAS 21 The effects of changes in Foreign Exchange Rates: Exchange differences on translation of foreign operations;

- IAS 39: Gains or losses on Available for Sale financial assets;

- IAS 39: Gains or losses due to changes in fair values of cash flow hedging instruments.

OCI’s evolution is an example of how the world of financial accounting is evolving at a furious pace. Being technically proficient will separate you from your peers and ensure that you remain at the cutting edge of global financial reporting.

Richard Starkey CA(SA) is CEO of Tabaldi Accounting Intelligence.

This article was originally published in the December 2012/January 2013 issue of ASA.