Understanding Financial Statements How to Analyze Financial Statements

Post on: 11 Апрель, 2015 No Comment

Understanding Financial Statements — Your Key to Making Winning Investment Decisions

Learning how to analyze financial statements to gauge the health of a business is the most critical step in your investment journey.

We’re going to spend a lot of time digging into financial statements. Yes, you’re probably bracing yourself for some dry, financial speak.

But we’re going to take a different approach to understanding financial statements. We’ll keep it simple, direct and easy. We’ve sprinkled in several examples along the way to make your learning more practical.

So let’s get started.

What are Financial Statements?

Financial Statements, or financials as they’re sometimes called, are a set of accounting reports—

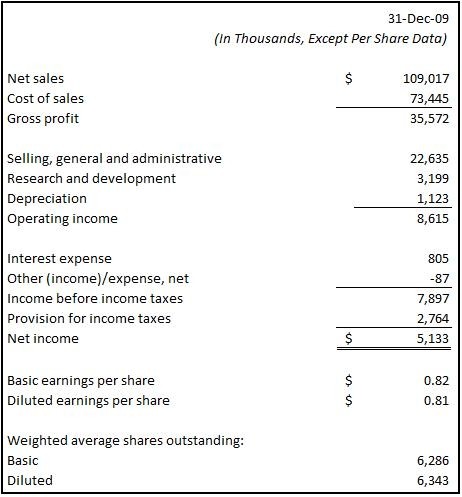

Sample Financial Statements

We’ve pulled together some sample financial statements here so you can get a better idea of what they look like together.

Financial Ratios

Financial Ratios are pillars of Financial Statement analysis. We’ll look at some important financial ratios here that are derived from our financial statements. These ratios help get a better handle on the business we’re studying.

We’ve covered this section extensively. To make it easier to absorb, we have divided it into three parts:

Part 1 focusses on defining Financial Ratios and covers the first two categories — Liquidity and Asset Turnover ratios.

Part 2 covers Leverage and Operating Peformance/Profitability ratios.

Part 3 concludes the series with a detailed discussion on Valuation ratios.

Pro forma Financial Statements

These financial statements are different from the ones we talked about earlier. They’re usually prepared before a major event like a merger, significant capital investment, new product line, etc. They focus on the future instead of the past and are based upon forecasts instead of hard facts.

Limitations of Financial Statements

Even though financial statements occupy an important place in our stock selection process, it’s important to be aware of some of their main limitations.

If you’ve diligently absorbed all the information here, you’re well on your way to understanding financial statements. Practice reading financial statements of some of your favorite companies and you will have a major edge.

You can now differentiate between good, profitable businesses with strong fundamentals and poor performers with shaky fundamentals. You have used hard data to determine this. you’re already ahead of most individual investors in the stock market.

Return from Understanding Financial Statements page to the Fundamental Analysis page

Return from Understanding Financial Statements page to the Independent-Stock-Investing home page