Understanding ExchangeTraded Funds (ETFs)

Post on: 4 Май, 2015 No Comment

Who Should Invest

Although it is widely understood that one of the key attractions of ETFs is low cost, keep in mind that every time you buy or sell shares of an ETF, you must pay a sales charge, or commission. For investors who trade frequently, these sales charges could easily erase any cost advantage associated with ETFs. Similarly, if you are likely to be dollar cost averaging with periodic payroll deductions, or tend to invest sporadically with small amounts of money, you may be better off with a mutual fund.

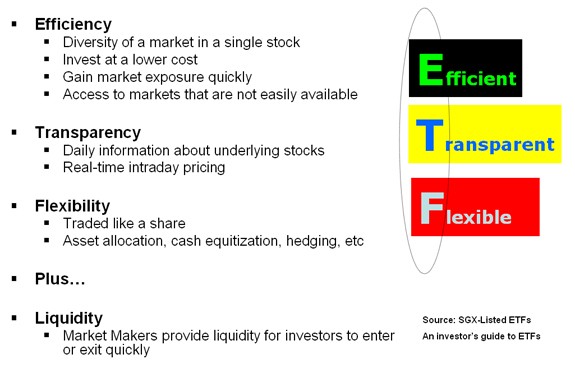

However, if you don’t fit any of these frequent transaction profiles, ETFs can be an effective and flexible choice in a number of situations.

- Investing a substantial lump sum using a buy-and-hold strategy. If you have received an inheritance or some other windfall, or have transferred assets from a former employer’s retirement plan to a rollover IRA, ETFs’ low expense ratios, compared to mutual funds, will help offset the one-time brokerage commission if you follow a long-term strategy.

- Investing outside of a tax-sheltered plan. When investing in a regular taxable account, ETFs could save you money at tax time. Since ETFs sell on an exchange, most trading takes place between shareholders. Individuals cannot redeem their shares for cash directly from the fund company. As such, the fund manager doesn’t have to meet redemptions, so he or she won’t be forced to sell shares to raise cash. This helps ETFs keep their potential capital gains exposure much lower than it would be otherwise.

- For active, knowledgeable investors. If you enjoy focusing on specific industries or on particular regions of the world, ETFs may offer the most cost-efficient way, when compared with single stocks or sector mutual funds, to pursue these segmented market opportunities.

Some investors use ETFs as core holdings, whereas others use them as effective portfolio-hedging tools. ETFs can help many investors achieve a level of diversification that otherwise would be too expensive or time-consuming to attain. Of course, as in all investments, there are risks involved in investing ETFs. Before investing in an ETF, you should consider and understand the specific risks inherent in each fun that you are interested in. Your financial advisor can help you determine whether ETFs are an appropriate strategic fit with your long-term goals.