Understanding Bond Prices and Yields

Post on: 16 Март, 2015 No Comment

Bond Prices

Understanding bond pricing can be quite daunting when first learning the bond market. Bond prices are quoted as a percentage of the par value. The simplest way to understand this is by adding a 0 to the price, assuming the par value is $1,000. For example if a bond is quoted at 98.25 in the market, the price would be $982.50 for every $1,000 of par value. In this example the bond is said to be trading at a discount. If however the bond is quoted in the market at 104.5, then the bond would cost $1045 per $1,000 of par value. In this example, the bond is said to be trading at a premium. If a bond is trading at 100, it is said to be trading at par.

In the US, bond prices are quoted slightly different in that they don’t use decimal places, but rather 32nds. When you see a US Bond being quoted you will see the handle and the 32nds. A quote of 98-21, would see 98 as the handle and 21 as the 32nds. To determine how much you would pay for a bond, you need to begin by take the 32nds and dividing it by 32. Thus in this example we take 21 and divided it by 32, giving us 0.65625. We then take 0.65625 and add that to the handle, which for our example will give us 98.65625. Which means we would pay $986.56 per $1,000 par value.

Clean vs Dirty Prices

Bonds are either quoted as a clean price or a dirty price. Predominately around the world, bonds are quoted using a dirty price while in the US they quote their bonds using a clean price.

A dirty price refers to the present value of all future cash flows, including any accrued interest on the next coupon payment. The accrued interest is earned when a coupon bond is in between coupon payment dates.

A clean price represents the present value of all future cash flows, less any accrued interest when the bond is between coupon payments. It’s important to note that even though a bond maybe quoted using a clean price, the bondholder is still entitled to any accrued interest on a coupon payment.

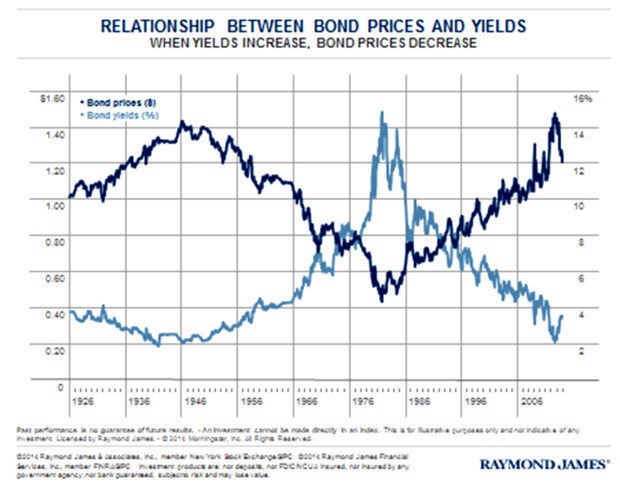

Understanding Yields

Yield relates a bond’s price to its cash flows. A bond’s cash flow consists of future coupon payments plus the return of the principal. In general there are 4 types of yields: nominal yield, current yield, yield to maturity and simple yield. There is also yield to call, though its very similar to yield to maturity, with only the maturity date changing to the call date for calculations.

Nominal Yield

The nomial yield is the simplest to calculate of all the yields. Take the total annual income of the bond and divided it by its par value. Thus a bond that has an annual coupon of 5% would be divided by 100 equals 5%. This yield is only used if you purchased the bond at issue and planned on holding it till maturity.

The current yield is calculated by taking the annual income of the bond divided by the bonds current clean price. For example is bond is paying annual coupon of 6% and the bond’s current clean price is 95, then the current yield is 6.316%. This yield assumes that the price we paid for the bond is what we would receive if we sold it again later, which is obviously unlikely.

Shows the total return of the bond if its held to maturity, however it relies on the assumption that all of the coupon payments can be re-invested at the same yield as when the bond was acquired. This calculation not only takes into account the coupon payments but whether or not there is a gain or loss as the bond matures, based on the purchase price.

Simple Yield

This is used for coupon bonds that are maturing with in one year or less. For example a bond paying 5% and trading at 95, with less than a year to go, would see $5 in coupon payments and a $6 price appreciation, we then take the $11 ($5+$6) and divided it by 94, giving us a return of 11.70%.

Most Appropriate Yield

Nominal Yield: Is best served if you’re buying a bond at issue and plan on holding it until maturity

Current Yield: Is for those looking to make short term gains, as it doesn’t take into account the pull to par effect.

Yield to Maturity: Is best used when you’re buying a bond in the secondary market.