Understanding and applying value investing principles Valuation reverse engineering the stock

Post on: 9 Май, 2015 No Comment

January 23, 2008

Valuation — reverse engineering the stock price

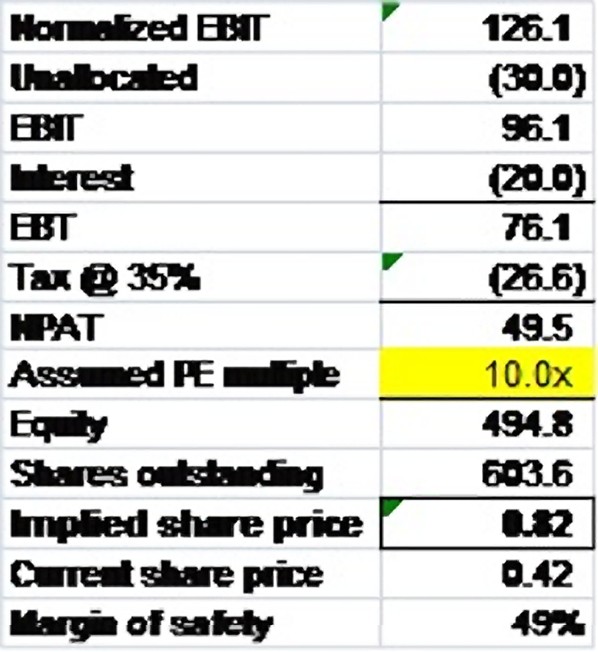

I discussed my approach on evaluating PE ratios (see here ). In addition based on the table shown in the previous post, we can work out the assumptions built into the stock price in terms of the ROC, CAP and growth rates. These variables can be compared with the actual and expected results of the company to decide if the stock is undervalued or not. Sounds easy in concept, and it is if you understand the company and the industry well. This approach is also called as expectations investing and I learnt about it in the book -. expectationsinvesting. I would recommend reading this book to understand DCF and the previous post better.

The above approach is a very useful tool in analysing a company. Let me give two examples.

Example A CRISIL. This company sells for a PE of almost 60+. The embedded expectations are

ROC 25% (current value)

Profit growth ( Net profit = Free cash flow) 18% p.a for last 6 years

CAP 20 years

Basically the company needs to grow at 18% per annum for the next 20 years and maintain the ROC. The company would be earning a net profit of almost 1000 odd crores by then. To make money on the stock in long run, one has to believe that the company will do better than what is implied by the stock price. Will the company do as good or better than implied above? I dont know and certainly not comfortable or confident of a company to do this well for such a long period of time.

Example B Novartis. The company sells for an adjusted PE (take cash out from mcap) of around 7.

ROC 50% +

Profit growth around 10% per annum for last 6 years

CAP (implied) 0 years (if you assume terminal value at 10-12 times cash flow).

Basically the company sells for 7 times earnings. Current earnings are around 90 crores on a very low capital base. In addition the company has strong competitive advantage. So with a mcap of around 600 odd crores, the company will earn the current investment back in 5 years. The market is current pricing novartis with an assumption that the company will be out of business in 4-5 years.

I have given the two examples for illustrative purposes only. It does not mean that the stock will do well for novartis in the next few months or do badly for Crisil. But the above analysis is useful in making investment decisions.