Unconstrained Bond Funds What Investors Need to Know

Post on: 16 Март, 2015 No Comment

The Risky Allure of Go-Anywhere Bond Funds

It’s okay to let your bond managers roam, just don’t let them run completely wild.

This is the fifth in a series of five articles looking at the most popular bond alternatives and the safest ways to use them to improve your income prospects when rates are low. Adapted from Reaching for Yield in the January/February issue of MONEY magazine.

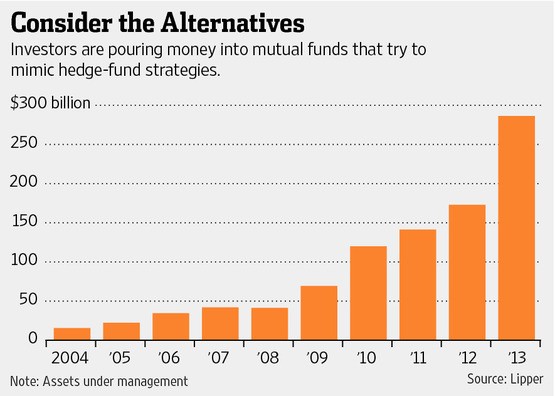

At a time when traditional routes to investment income arent paying off, its only natural to seek out pros who are willing to go off the beaten path. Enter unconstrained bond funds.

The appeal of these actively managed portfolios is that theyre not bound to invest only in the low-yielding government and corporate debt. Instead, they buy anythingforeign debt, asset-backed securities, stocks, preferreds, and even derivativesto boost yields and hedge against price drops if interest rates rise.

Sounds good in theory. Alas, theres no proof that derivatives and other exotica lead to better results. Pimco Unconstrained Bond, one of the biggest funds in the group, is up 2.8% annually over the past three yearsthats less than the plain-vanilla Vanguard Total Bond Market Index Fund. Plus, unconstrained bond funds are expensive, with average fees of 1.3% of assets, vs. 1% for the average bond fund and 0.28% for bond index funds.

Your best strategy: Let your managers roamjust dont let them run completely wild. Before unconstrained bond funds came along, investors who wanted to give their managers a longer leash turned to multisector bond funds. These fixed-income portfolios also allow managers to invest in a wide variety of assets, such as junk and foreign debt, in addition to high-quality bonds. However, these funds typically set boundaries over what those areas areand how much of the fund can wander there. This reduces risk, which should help to limit losses in bad markets. The approach also results in lower costs; the typical multisector bond fund has annual fees of 0.8% of assets.

T. Rowe Price Spectrum Income T. ROWE PRICE SPECTRUM INCOME RPSIX 0.16%. for instance, can stray into emerging-market bonds and floating-rate bank loans, but only up to 10% of assets for each. This has been enough freedom for Spectrum Income to beat the Barclays Aggregate U.S. Bond index over the past three, five, 10, and 15 years. The same goes for Loomis Sayles Bond LOOMIS SAYLES BOND FUND RET LSBRX 0.14%. a MONEY 50 fund that has also beaten at least 80% of its peers over the past three, five, 10, and 15 years.

Recognize, though, that while boosting your investment in multisector bond funds and other alternative assets can help boost your yield, the strategy isnt a cure-all. Shifting 20% of a portfolio split fifty-fifty between stocks and traditional bonds into a mix of higher-paying alternatives might raise your yield from about 2% to 2.6% with little additional risk, says Geoff Considine, who runs the portfolio modeling firm Quantex. If youre retired, that means youll still probably have to rely on principal and capital gains to fund at least some of your living expenses.

You might prefer to just cash dividend checks to pay the bills and leave the rest of your savings intactbut in reality, where you pull the money from isnt that important, says Chris Philips, a senior investment analyst at Vanguard. Says Philips: What really matters is maximizing the total return of your whole portfolio.

More in this series: