TYWKIWDBI ( TaiWikiWidbee ) Deleveraging debt

Post on: 16 Март, 2015 No Comment

Deleveraging debt

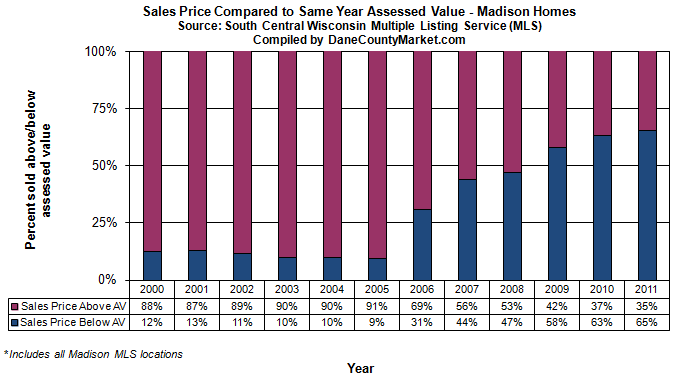

The graph above shows two decades of the trending of debt in ten countries. Some will be surprised to note that the U.S. is not the top blue line — that’s the United Kingdom. And while the U.S. has started to deleverage since the 2008 crisis, for other countries the line is still rising.

I think the sense in which the word deleverage is used here is slightly suspect (but not completely wrong).

Lets start at the beginning. Leverage is used by analogy with the kind of mechanical advantage one might get by using a lever to move a heavy object.

Lets say it is December 1980 and you have 1,000 dollars. You also think that this new Apple company might be on to something. If you invest your 1,000 USD you can buy 363 shares at the IPO price of 2.75 USD/share. Seven years later you will have 5,380 USD as the price has risen to 14.82. A profit of 4,380 USD. No leverage was used.

Instead, if you borrow money you can magnify your gains or losses. This is called leverage. Lets see an example.

It is December 1980 again and you still have 1,000 dollars. You are pretty darn sure this Apple thing is going to be good so you decide to borrow 9,000 dollars from the bank at 5% interest and use that to buy apple shares also. So now you have 10,000 dollars and you can buy 3,636 shares of stock. Seven years later you have 53,885.52 USD worth of Apple stock, but you have had to pay 1,685 in interest to the bank plus the original principal of 9,000. So in total you profited 42,200 USD. That is a LOT more than the case above where you just used the money you had. Leverage multiplied your gains almost 10x.

However the kinfe cuts both ways. If, instead of rising about 540% in seven years, the stock had dropped from 2.75 to 2.50. That is a loss of about 10%.

In the unleveraged case you would have 363 shares worth 2.50 USD each or about 907 USD. The stock lost about 10% and therefore you lost about 10% of your original 1,000 USD.

In the leveraged case you have 3,636 shares each worth 2.50 USD for a total of 9,090 USD. You have to pay the bank back 10,685 (9,000 principal + 1,685 interest). Now your initial 1,000 USD is gone and even after selling all of your stock you still owe the bank 1,568 USD.

So using leverage when there was a 10% drop in share price moved you from 907 USD to -1,568 USD. You did 2,475 USD worse than you would have if you hadnt borrowed any money.

A helpful videos.

www.youtube.com/watch?v=GBsyA0JGFLA

www.youtube.com/watch?v=T-X8LpzCTkM

www.marketplace.org/topics/business/whiteboard/leveraging-and-deleveraging

From this use a slightly sloppy usage of leverage comes into play. It starts to mean simply borrow or go into debt. Which isnt quite right. It really means borrow in order to invest in an asset that you expect to grow in value.

There is a limit to how much they can borrow (like a credit limit). But for them it is expressed as a ratio. For example: for every 1 dollar they have they may be allowed to borrow 5 dollars more. So their leverage limit might be 5:1 (read five to one). If today they are only borrowing 4 USD per dollar they have then they are leveraged at 4:1.

So for an organization to deleverage means to reduce that ratio. They can do that in one of two ways. They can increase the number of dollars they have. Or they can decrease the number of dollars they owe by paying them back.