Types of Retirement Plans Differences and Overview

Post on: 29 Апрель, 2015 No Comment

An overview of the essential types of retirement plans.

Learning about how to plan for retirement need not feel like learning another language. The plans are easier to understand than you may think, if you know the basics. Start with these six essential retirement accounts.

A half-dozen retirement account choices. (c) Roger Stowell, Photolibrary, Getty Images

1. Individual Retirement Account (IRA)

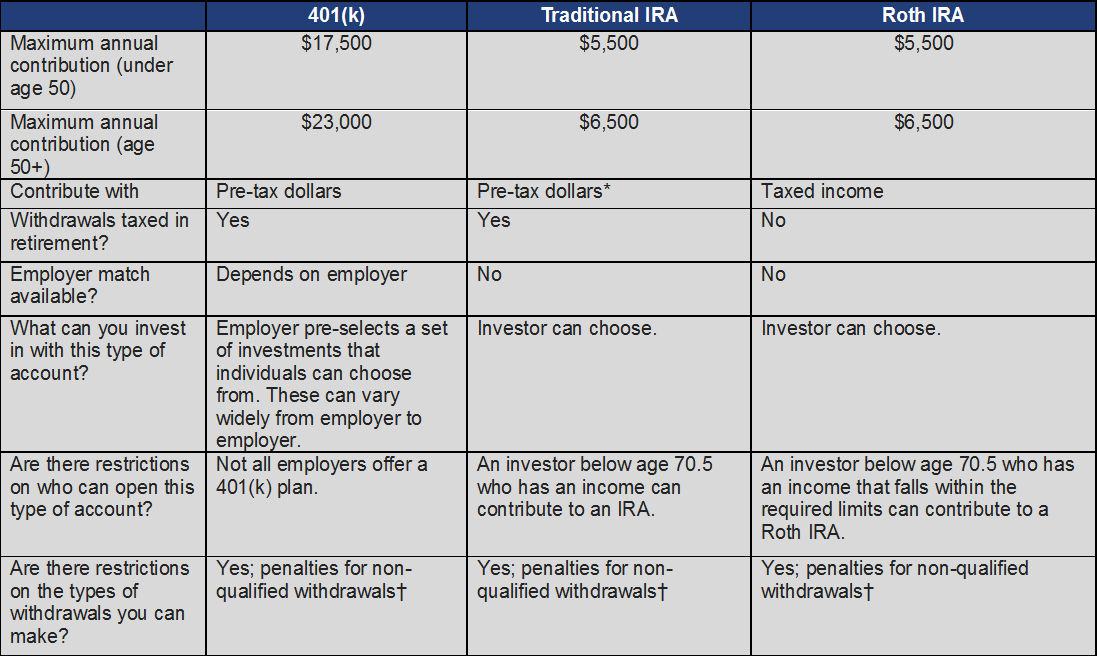

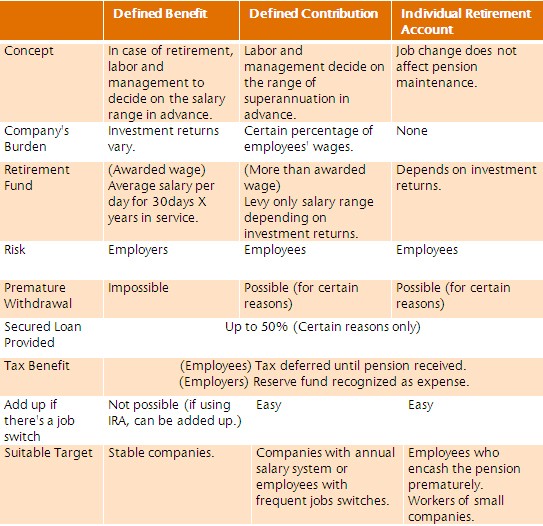

An IRA is a tax-favored retirement account that lets you contribute a certain amount each year and invest your contributions tax deferred. That means you pay no taxes on annual investment gains (which helps them to grow more quickly). With a regular IRA, you pay income taxes on the money when it’s withdrawn at retirement. If you don’t have a 401(k) retirement account at work, you should also be able to deduct IRA contributions on your annual income tax return.

An IRA is an investment account. Once the money is placed within, you can invest in stocks. bonds. mutual funds. ETFs. and other types of investments. You can buy and sell investments within the IRA, but if you try to cash you entirely before retirement age at 59 (known as a premature distribution), you will most likely pay a 10 percent penalty fee and may be subject to federal, state and local income taxes. More

2. Roth IRA

Unlike a regular IRA, Roth IRA contributions are made after tax, but any money generated within the Roth is never taxed again. The best part: you can take withdraw contributions you’ve made to a Roth IRA before retirement age without penalties. If you are just starting out and think your income will grow, putting money in a Roth is a great place to invest extra cashwhile giving your future self an amazing tax break. More

3. 401(k) Account

A 401(k) is a workplace retirement account, offered as an employee benefit. This account allows you to contribute a portion of your pre-tax paycheck in a tax-deferred investment account. One of the benefits of contributing pre-tax money is it lowers the amount of income your taxes are based on (If you earn $75,000 and contribute $10,000, you are taxed on a $65,000 income). Plus, as with an IRA, investment gains grow tax deferred until retirement. If you withdraw funds from the plan before retirement age, you will pay a 10 percent penalty and could be subject to federal, state and local income taxes. However, some employers do offer 401(k) loans.

Many employers will match employee contributions to a 401(k). typically up to 6 percent (though it may vest to the full amount over a period of years). If you are not contributing up to the company match, you may be ignoring a significant employee benefit.

Variations on this type of account include the 403(b), a similar account offered to educators and nonprofit workers; and a 457, offered to government employees. More

4. Roth 401(k)

A Roth 401(k) combines features of the Roth IRA and a 401(k). It is a type of account offered through employers (and because it’s relatively new, not all employers offer them), but the contributions come from your after-tax salary. Funds in a Roth are never taxed again. More

5. SIMPLE IRA

Otherwise known as a Savings Incentive Match for Employees IRA, is a retirement plan small companies can offer to employees. If you have a SIMPLE IRA. you know that it works very much like a 401(k). Contributions are made from pre tax paycheck withdrawals, and the money grows tax deferred until retirement. More

6. SEP IRA

If you are self-employed and have no one working for you, a SEP IRA will allow you to contribute a portion of your income to your own retirement account. and fully deduct them from your income taxes. The maximum annual contribution limits are higher than most other tax-favored retirement accounts.

As you grow in your career, you may accumulate a variety of retirement plans and end up with one or more or each of these plans. For example, a Rollover IRA is a type of account that allows you to consolidate 401(k) accounts from former employers. You can also convert an existing 401(k) or IRA into a Roth IRA. pay the tax today and never pay it again.

When starting to save for retirement, an employer’s 401(k) is the first place to turn for tax-deferred growth, but a Roth IRA is also a great place to put away extra cash that you are saving for retirement or other life events. Remember contributions made to a Roth IRA can be withdrawn without penalty before retirement, and will not be taxed upon withdrawal. This is why a 401(k) and a Roth IRA are a good combination. More