Two Types of Annuities for Retirement Income

Post on: 14 Апрель, 2015 No Comment

Key Points

- Turning your retirement savings into income that will last can be a major challenge when you’re preparing for and then living in retirement. Immediate fixed life annuities and variable annuities guarantee income that can’t be outlived in retirement. Adding an optional guaranteed lifetime withdrawal benefit to a variable annuity guarantees a minimum level of income, regardless of market fluctuations. Understanding the unique attributes of each can help you decide if they’ll support your income plan.

After all your hard work saving for retirement, you’ll need to manage market risk and generate income that lasts. Annuities are one tool that can help—particularly if you’re seeking a stream of income that you know will be around as long as you are.

There are two types of annuities we believe may be worth considering to generate income: immediate fixed annuities and variable annuities. Many variable annuities offer an optional rider (often called guaranteed lifetime withdrawal benefits, or GLWBs) that can provide additional protection for your income.

Immediate fixed annuities provide pension-like income, while variable annuities provide a guaranteed stream of lifetime income at retirement, either through annuitization or the purchase of an optional GLWB rider.

Under the standard annuitization option, an investor’s retirement income is based on the performance of the underlying investment options he/she selected. Adding a GLWB rider locks-in a minimum level of income that can rise with the performance of the investment options but can never fall.

Annuities add protections to your retirement

First off, why consider an annuity? One reason beats all the others, in our view: Unlike a portfolio of stocks and bonds, annuities combine characteristics of standard investments with insurance features. Most life annuities provide a reliable stream of income that you can’t outlive, and some can help you reduce or transfer the risk of investing in the market for part of your portfolio to an insurer.

Annuities are also a way to systematically turn savings into income. This may seem complicated, but it’s one of the most important steps to consider when managing your retirement portfolio—how, exactly, will you create regular withdrawals from your portfolio that will last?

Immediate fixed annuities provide pension-like income for life

Immediate fixed annuities are the oldest, most common type of annuity: you pay an insurance company a lump sum up front, and in return, you receive a fixed monthly payment for life (or some other specific time period)—a reliable stream of income you can’t outlive.

Immediate fixed life annuities may make sense, in our view, if you’re seeking income now and don’t want to worry about market fluctuations—at least for a portion of your savings. The insurance company manages those details and makes sure you receive a fixed payment that lasts for life. As long as the insurance company is solvent, you’ll receive a payment for the same amount every month.

If you live longer than average, you’ll benefit from owning an immediate fixed life annuity. The rate of return depends on your initial investment and how long you live. Annuity experts call this a mortality credit. If you live longer than other investors, you’ll benefit. In fact, it may be most useful to think about an immediate fixed annuity not purely as compared to other investments, but more for its insurance features.

What about the current low-interest-rate environment—can that impact payments from an annuity? It may not make the most sense to load up on immediate fixed annuities when interest rates are low, as the payments depend, to a degree, on the market. But if you need guaranteed income, it probably won’t pay to wait too long either. One strategy is to stagger your purchase of immediate fixed annuities over time, much like a bond ladder but using annuities, as your guaranteed income needs grow.

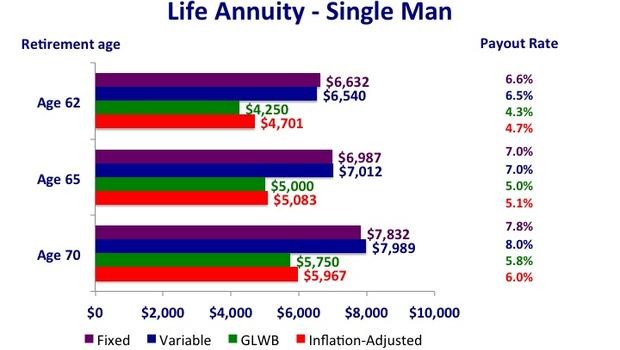

It’s worth noting that monthly payments from immediate fixed life annuities are generally higher the older you are at the time of purchase. The insurer anticipates that it will be making payments for a shorter period of time, so it can pay a higher proportion of the lump sum on a monthly basis. This feature isn’t shared by variable annuities with GLWBs.

Variable annuities with GLWBs: income protection, flexibility and growth potential

In contrast to immediate fixed annuities, variable annuities with an optional GLWB rider don’t require that you to turn cash over irrevocably to an insurance company. Rather, the investor retains control of the money and makes withdrawals from a portfolio of investments that is held within the variable annuity.

When purchased with a GLWB feature (at an additional cost), the rider may protect against market downturns by guaranteeing your ability to take withdrawals for life at a certain minimum level, no matter how the market performs, without annuitizing the contract. In other words, you can stay invested in the market and benefit from flexibility and potential for growth.

You should be aware, however, that the GLWB is not a contract value and is not available for withdrawal like a cash value. Your actual contract value will deplete with each withdrawal, though you’ll continue to take income for life even if withdrawals and market losses deplete your annuity’s value to zero. There’s also an annual cost associated with the additional rider.

This type of annuity can be more complex than immediate fixed annuities, so it’s important to examine the details and talk with a professional to make sure you understand them thoroughly. But at the most basic level, purchasing a GLWB rider with a variable annuity adds an additional layer of protections to a portfolio of investments held within a variable annuity to generate retirement income. If markets don’t perform well, you have protections, and if they perform better than expected, you have some potential for growth (after accounting for fees and withdrawals).

One tradeoff compared to immediate fixed annuities is that variable annuities with GLWBs generally promise a lower guaranteed payment initially once withdrawals begin. A typical guaranteed annual withdrawal rate from a variable annuity with GLWB may be 5% of an income base generally based on the highest contract anniversary value the contract achieved since purchase of the GLWB rider. An immediate fixed life annuity will generally quote a monthly or annual payment. But the amount of the withdrawal, if calculated as a percentage of the lump sum invested, will generally be higher.

Another consideration is cost. GLWB riders are purchased at an additional cost, generally starting at around 0.8% per year and rising. This is the cost of adding more protections to the flexibility and growth potential. Besides the cost of the rider, variable annuities are subject to a number of charges. These charges will reduce the value of your account and return on your investments.

How to choose an annuity for you

Both types of annuities—immediate fixed and variable with GLWBs—provide guaranteed income in retirement, but neither type will be right for every investor. Do you value a higher guaranteed lifetime income in a simple package, or do you value flexibility and growth potential? Are you still preparing for retirement and looking to protect part of your savings, or are you already well into retirement and looking for income now?

The table below shows factors to consider when choosing which type might make sense for you compared to, or (more typically) as a complement to a traditional portfolio.

Factors to Take Into Account When Considering Annuities