Two Bill Gates Stocks to Buy Now

Post on: 14 Май, 2015 No Comment

July 1, 2014

One of the richest men in the world is finding value in one of the dirtiest industries in the world.

With a net worth of over $75 billion, Bill Gates loves the railroad industry but hes also heavily invested in another must-have business.

The railroad industry is instrumental in moving products from one region to another, but there are substitutes available, such as planes and ships.

However, there are virtually no alternatives for garbage disposal.

This is truly a must-have industry.

Its a business that performs well regardless of the broader economy.

Gates has recognized this long-term trend and owns two of the industrys largest players.

Waste Management (NYSE: WM) is the leader in the industry, with Republic Services (NYSE: RSG) coming in second.

The low-yield environment, coupled with a market thats trading at lofty valuations, makes high-yield defensive stocks attractive.

Waste Management and Republic Services pay solid dividend yields and are quite defensive.

The Bill & Melinda Gates Foundation owns 18.6 million shares of Waste Management, equal to 4% of the company. The private investment fund that manages Gates personal wealth, Cascade Investments, owns 90.9 million shares of Republic Services, a staggering 25% of the company.

Republic Services is the #2 player in North Americas waste management market. Republic Services owns and operates 191 landfills and 75 recycling facilities. The waste collection segment generates the bulk of its revenue, just over 75% of revenues. Meanwhile, its commercial and industrial business should get a boost from the rebounding economy.

As construction picks up, the demand for waste generators and contractors should increase. The other angle to Republic Services is that its increasing its operational efficiency by switching its vehicles to natural gas.

On his blog, Gates wrote, Humans have an amazing capacity for finding ways around scarcity by using materials more efficiently, recycling them, or finding substitutes. The key here is recycling. Republic Services has noted its focus on making key acquisitions in the recycling space.

Waste Management is the #1 waste management company in North America, serving some 20 million customers. It also owns waste-to-energy and landfill gas-to-energy facilities as part of its Wheelabrator segment.

Waste Management is really leading the move to natural gas as a viable fuel. It has over 50 natural gas fueling stations, almost 20 of which are publicly accessible. Just under 15% of its vehicles run on natural gas, but it hopes to have over 80% converted by 2020.

Neither of these waste management companies will make you rich overnight. But thanks to their free cash flow generating capabilities, the two have been resilient when it comes to returning cash to shareholders through dividends or share repurchases.

They both have free cash flow yields of above 5%. Waste Management pays a 3.3% dividend yield, while Republic Services is around 2.8%. The two have raised their dividends at an impressive rate over the past 10 years.

Republic Services has bought back $1.2 billion in shares since starting its buyback program in 2010, reducing its outstanding share count by 7%. Waste Management has reduced its share count by 5.5% over the past five years.

There are high barriers to entry when it comes to waste management, including capital costs and permitting. The government scrutiny alone is enough to scare off many potential entrants. As a result, these two waste-management companies are poised to continue to be steady long-term performers.

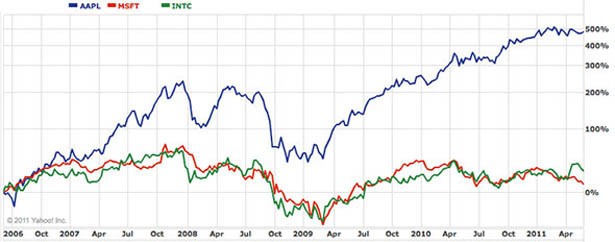

Each stock has a beta of 0.6, meaning theyre less volatile than the broader market. Since 2000, Waste Management has outperformed the S&P 500 by over 300%, and shares of Republic Services have outperformed by better than 700%.

282%29_6-26-14.gif /%Risks to Consider: A larger push toward recycling could lead to a decline in collection revenues. Another rough winter could also have a negative impact on garbage collection and transportation, leading to revenue declines.

Action to Take > Buy these two stocks for solid upside and dividend yields as the demand for garbage removal and recycling continues to rise. They are long-term investments that are perfect for buy-and-hold investors.

Marshall Hargrave

The 10 Best Stocks to Hold Forever [sponsor]

Few people realize it, but there’s really only one set of stocks you can buy today and hold for the rest of your life. They’re called Forever stocks, and when you own them, you may no longer need to worry about things like inflation or deflation, bear markets or recessions, flash-crashes or fiscal cliffs. It’s for this reason that many of the world’s richest investors, politicians, and businessmen have owned shares of these stocks for decades, using them to profit in any sort of market. If these are the kind of sleep-at-night stocks you think you could benefit from, we encourage you to click here to learn more.