Tulett Matthews Associates Steer Clear of these 8 Common Investment Pitfalls

Post on: 17 Июнь, 2015 No Comment

Steer Clear of these 8 Common Investment Pitfalls

To ensure a prosperous and financially secure future, we need to understand the potential roadblocks that can prevent us from succeeding. All too often, investors rush to implement a solution or buy an investment hoping that it will fill the gap created by previous portfolio hiccups, shortfalls, or downright mistakes. The desire to repair our immediate investment concerns may be quite valid; however, short-term adjustments usually do not result in any meaningful long-term impact. For winning strategies to work, investors must be aware of the pitfalls that await the unsuspecting. Knowing the rules of the playing field can save you a lot of headaches down the road—and dramatically improve your odds of future success.

While the eight common investment pitfalls discussed in this white paper are not new, they are now more relevant than ever. Investors are more likely to make knee-jerk decisions during periods of extreme volatility, which is precisely what we have endured since the financial crisis of 2008. Unfortunately, the data on investor response are not encouraging. Figure 1 is a dramatic illustration of how investors have reacted to market moves in recent years. The blue line represents global stock market returns between 2006 and 2010, while the blue bars represent the amount of money added to (or removed from) equity mutual funds during that period.

Figure 1: Buying High and Selling Low: An all too Common Reality

Investors reliably poured new money into equities after they had gone up in value and pulled money out of the markets after prices declined. In other words, they bought high and sold low with depressing consistency.

Errors like these are often caused by our emotional attachment to money. Family finances and investing stir up our most primal feelings of security and our desire to “make it” in life. Wrestling with these feelings while riding the rollercoaster of stock and bond returns may lead us to make portfolio decisions that we later regret.

Thanks to the new field of behavioural finance, we now know that humans have biases and filters that cloud our financial judgment and ultimately lead to poor decisions about when to buy or sell assets. While some of these biases are positive attributes in other areas of life, they can be disastrous in investing. For example, high levels of confidence may help you in a job interview, but bravado as an investor can lead to self-destructive behaviour.

What is the value of reviewing these common investing pitfalls? First, simply becoming aware of them can help you avoid the costly mistakes that plague many investors. It will also provide you with a foundation on which to base your understanding of the winning investment principles.

More experienced investors may feel they are already aware of these common mistakes. However, investors would be wise to review these eight pitfalls annually. Constant vigilance has tremendous value when it

Pitfall 1: Lack of an Investment Policy Statement (IPS)

The lack of a clear vision is the root cause of the majority of challenges faced by investors. Many people feel confused or apprehensive when it comes to their portfolio—and rightfully so. They’re bombarded with all kinds of information and they don’t know what it means for them. Investing is a daunting task and for many people it is uncharted territory. An investment policy statement (or investment plan) acts as a map to guide you along your investment journey by taking the following into account:

- your long-term objectives

- your time horizon

- your saving and spending rates

- diversification decisions for your portfolio

- your tax consequences

- associated risks with your portfolio strategy

- rules of engagement for dealing with industry professionals

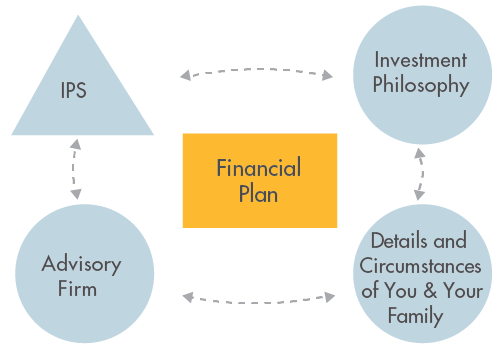

Think of these as landmarks that your IPS will help you navigate. By putting your plan in writing and linking it with your investment philosophy, you create a blueprint for your investments that will help guide you along the path to achieving your goals. A good IPS highlights how all the moving parts work together and elaborates on the decision-making process used to execute the investment philosophy for you and your family. Why is it important to have an investment plan? We work with plans when we build our homes or cottages; successful entrepreneurs and business owners have a vision and a plan; companies and organizations have them as well; so too should our investments.

The world of investing is always changing, but a well-constructed and disciplined plan will allow you to be well positioned during good times and bad. Instead of worrying about the challenges presented in the short term, a sound investment plan will help you become better informed about the relationship between returns, risk, and time horizons. It will shift the focus to the proper management of your long-term portfolio. By prioritizing the long-term health of your investments, you’ll be better positioned to weather challenges and common pitfalls in the short term. An IPS is a key component of investment success.

Pitfall 2: Lack of an Investment Philosophy

An investment philosophy (also called investment strategy) is a set of guiding principles that shape and inform an individual’s, an advisor’s, or an advisory firm’s investment decision-making process. While an IPS can be thought of as a map, your investment philosophy is a code of conduct that defines how your money will be managed. The investment philosophy is the star by which you steer; it is the approach you take when it comes to managing your money.

Your investment philosophy determines how you behave as an investor. There’s an old adage that says, “If you don’t stand for something, you’ll fall for anything.” Without a clear belief system to govern how you invest, you risk falling into the other pitfalls on this list.

Investors who are frustrated or confused about their portfolio, or are having a hard time understanding the big picture, often either don’t have, or fail to adhere to, an investment philosophy. They claim that their approach to investing is to buy “good deals.” This does not constitute an investment philosophy and such behaviour will more often than not lead to chaotic, random, and risky portfolio construction. An investment philosophy has a set of principles and guidelines that provide direction and perspective for the decisions you should and shouldn’t make with your investments.

Pitfall 3: Being Unaware of the Mathematics of Sustainable Portfolios

Canadians remain unaware of or unable to appreciate the significance of the mathematics of sustainability, despite the fact that numbers don’t lie. Sustainability means taking proper care of our resources so that we may continue to use them in the future. In financial terms, it means setting aside enough money for financial independence and a fiscally healthy retirement. Most of us are not doing this.

In 1989, Canadians were introduced to David Chilton’s The Wealthy Barber, which suggests investing a percentage of what you earn in long-term growth. Be it 10%, 15%, or 20% (perhaps even 30% if you have neglected your savings), you should set aside an annual percentage of your earnings for your retirement. The amount you save affects how much you will be able to draw down after you retire. Sustainable portfolio drawdowns must be used throughout retirement. For 60-, 65-, and 70-year-olds who want to have thirty years of inflation-protected retirement funding, prudent and conservative amounts to withdraw each year are 3%, 4%, and 5%, respectively. However, many Canadians reach the age of retirement with the impression that they can draw down 10%, 15%, or even 20% of their portfolios. Once again, this is a case of people misunderstanding or simply being unaware of the mathematics of financially sustainable portfolios.

Sustainability is the key word when it comes to planning for retirement. Ask yourself, “Is the life I live now going to be sustainable in the future?” The answer should always be a resounding “yes.” Today’s challenge, unfortunately, is that you almost need to be an actuary in order to appreciate the consequences that arise from not living a sustainable lifestyle. At a bare minimum, Canadians need to become aware of the math involved in a sustainable lifestyle and the factors that affect its outcome. We are seeing the effects this lack of sustainability has had on Europe. Entire nations are in crisis because governments and people were unable to grasp the mathematics of sustainable economies.

By not adhering to a sustainable financial lifestyle, investors often fall into the trap of looking for solutions that will recover the ground they’ve lost due to their lack of necessary savings. This emotional reaction causes investors to have unreasonable expectations of their investments and costs them in the long run. Instead of staying the course laid out by their IPS (assuming they have one), the desire to remedy their lack of savings and ensure their retirement wellbeing may lead investors to gamble, speculate, and chase performance.

It is impossible to overstate the importance of understanding the mathematics of sustainability.

Pitfall 4: Trying to Profit by Timing the Market

A classic study of American investors by Dalbar—one of North America’s leading financial services research firms—clearly shows the negative effects of trying to time the market. Dalbar tracked monthly cash flows in and out of mutual funds from 1993 through 2012 and came to the following dismal conclusions: over the last twenty years, the average U.S. equity fund investor earned 4.25% annually, falling far short of the 8.21% the S&P 500 earned over that period; the average bond fund investor earned 0.98% annually, compared with the Barclays Aggregate Bond Index return of 6.34%.

Table 1 shows the 1-, 3-, 5-, 10-, and 20-year annualized returns for the average equity and fixed income investor in the U.S. When comparing these annualized returns to corresponding benchmarks, we see both equity and fixed income mutual fund investors underperforming the market in nearly every time frame.

Table 1: Annualized Fund Investors Return vs. Benchmark

Investors can capture everything the markets have to give (minus very small fees) simply by staying invested at all times. But we are humans with emotions and instead of sticking to time-tested, winning strategies based on diversification and long-term asset allocation, we often engage in market timing. We buy or sell assets based on predictions and the emotions we feel at the time. Inevitably, it ends up costing us in the long run.

Current world events or media frenzy, rather than future economic reality, can drive panicked investors to sell. Whether caused by 9/11, the financial crisis of 2008, or the ongoing debt problems in Europe, anxiety spurs investors into wild selling sprees. Dalbar’s 2013 survey revealed that investors continue to make these same mistakes. The fear generated by negative headlines or a lackluster earnings report prompts investors to deviate from their plan and sell their assets. They then miss the recoveries that inevitably follow and buy back in only after prices have increased. Countless studies and reports have proven that you are better off staying in the market throughout the good times and the bad.

Market timing is not always about emotions: some people insist that they can use charts and other indicators to determine the best times to get in or out of the market. In an article in the Journal of Financial Research, Larry L. Fisher and Meir Statman analyzed various market- timing models that try to determine when the market is “expensive” and should be sold, or “inexpensive” and should be bought. Figure 2 shows that the “Stock Buy and Hold” approach would have provided the highest growth of assets compared to timing the market based on P/E trading rules.