Toxic Assets How Toxic Assets Brought Down the Economy MortgageBacked Securities

Post on: 30 Апрель, 2015 No Comment

Toxic Assets Helped Cause the U.S. Recession

You can opt-out at any time.

In the U.S. press, we are constantly hearing about something called toxic assets. We hear that banks’ balance sheets are full of toxic assets and that is why they can’t loan to businesses and individuals. But we don’t seem to really understand what these toxic assets are and how they have caused such a problem in our economy.

Mortgage Loans

Toxic assets are largely investments backed by risky subprime mortgages. CBS News Correspondent Bianca Solorzano reported recently that when you see foreclosure signs littering neighborhoods, you’re probably looking at toxic assets.

These toxic assets are held by large U.S. banks and are dragging down their balance sheets because they have lost their value. When the housing crisis started in 2007 and people started defaulting on subprime mortgage loans (toxic assets), the value of mortgages on banks’ balance sheets was gutted. As a result, banks lost confidence regarding lending to each other and they had no money to lend to the public because of these toxic assets crowding up their balance sheets. Result? The nation’s financial system became clogged up. You heard it called the credit crisis.

Toxic assets start with a bank lending money to an individual who is buying a home. That money is called a mortgage. The new homeowner agrees to repay the mortgage loan over some agreed-upon time period usually on a monthly basis. The repayment is composed on principal and interest on the loan.

In the past, buying a home was a huge commitment and one that usually lasted for a lifetime. A home was often the largest asset most Americans ever owned. It was often quite difficult to qualify for a mortgage loan. Most banks and mortgage companies required the homeowner to put 20% of the price of the house down before a mortgage loan could be granted. That was a barrier to entry in the home ownership market. Many people could not own homes due to that 20% down payment.

If you could afford the 20% down payment, you still had to qualify for the mortgage loan. Qualifying was quite a process. You had to submit paperwork listing your assets and liabilities and calculating your net worth. Your credit score, income, and employment were considered. A formula was used taking all of these factors into account. Only if your financial position met the qualifications of this formula, and you had the 20% down payment, were you approved for a mortgage loan. All of this was called due diligence.

Bundles of Subprime Mortgages Became Toxic Assets

Then came the 21st century and bundles of subprime mortgages became toxic assets. Banks started putting these loans together, hundreds of them, and selling them to larger banks. Banks like Citicorp and other very large banks. The larger banks packaged the mortgage loans together into what they call a mortgage-backed security.

A mortgage-backed security, actually a pool of mortgage loans, pays out the cash flows that homeowners pay, to investors. In other words, the loan payments from homeowners are passed through to investors each month. Fannie Mae and Freddie Mac are two of the organizations that repackaged these mortgage loans and pass through income to investors each month. These packages of mortgages, through Fannie Mae and Freddie Mac, have backing by the full faith and credit of the United States government.

The Subprime Mortgage Market

In the early part of the 21st century, the U.S. housing market was booming. Gradually, just about everyone who could qualify for a mortgage loan and wanted to buy a house was in a house. However, there was still high demand for these very profitable mortgage-backed securities. As a result, banks started to consider lending money for mortgage loans to people who they had never considered before. These people did not have the level of income or credit that previous borrowers had. These were called sub-prime borrowers because they had a low credit rating.

Banks started to loan to these sub-prime borrowers and often they made adjustable-rate mortgage loans to these borrowers. These loans often started out at very low, affordable interest rates. These low interest rates were fixed for a certain number of years but then they adjusted to a higher interest rate. Just like the conventional mortgages, they were packaged into mortgage-backed securities and sold to investors. Because the credit risk was higher for these subprime loans, the possible return on the mortgage-backed securities was even higher and investors were clamoring for them.

The Decline of the U.S. Housing Market

As the interest rates on these subprime mortgages began to adjust upward, the homeowners couldn’t afford their mortgage payments. Home foreclosures started to rise. As foreclosures started to rise, the mortgage-backed securities lost their value and began to perform poorly for their investors.

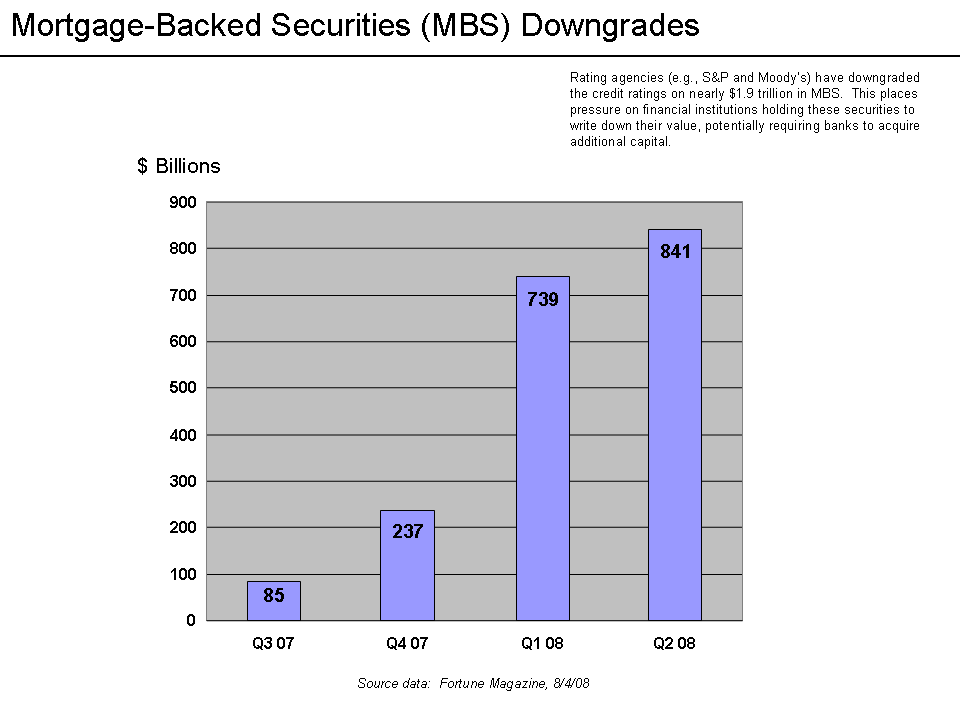

In late 2006, foreclosures rose at an alarming rate and the value of mortgage-backed securities fell at an equally alarming rate. By 2008, it was clear that the big banks, those considered too big to fail had balance sheets full of mortgage-backed securities that were worthless because homeowners were not paying their mortgage payments and banks had foreclosed on their homes.

The Result: Recession

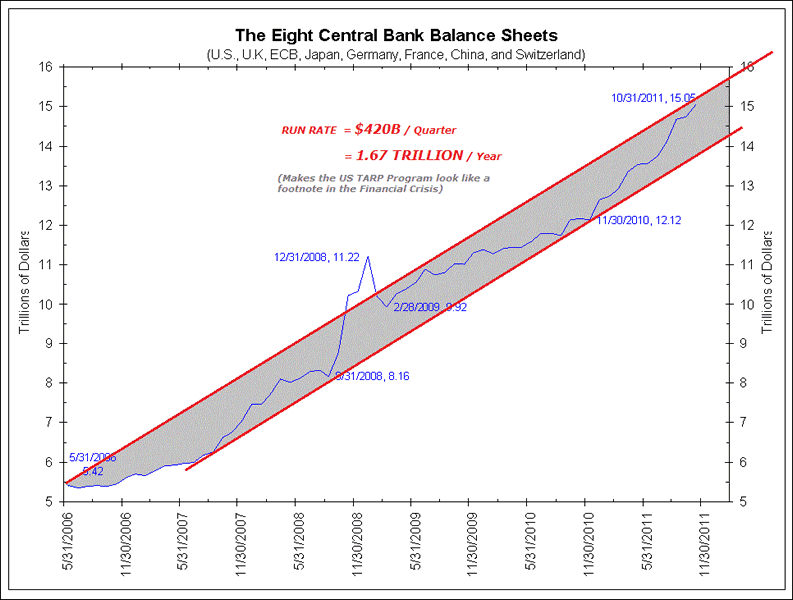

Because of the dollar amount of mortgage-backed securities held by the banks, suddenly banks had no money to loan. They started posting huge losses.

Consumers and businesses couldn’t borrow money. When consumers and businesses can’t borrow, they can’t spend and companies can’t sell their products and services. The housing market was oversold and new houses didn’t sell. Existing houses up for sell didn’t sell because there were so many of them. Companies that can’t sell products and services experience a drop in their stock price and have to lay off workers. Unemployment rises and consumers spend even less. It becomes a vicious circle and a recession happens.

This is how these toxic assets, had a role in bringing down the brought down the market or the U.S. economy.