Top Reasons to invest In real estate

Post on: 22 Июнь, 2015 No Comment

Top Reasons to invest In real estate

Investing in real estate may be an overwhelming thought for many people. the thought of finding a good property, in a very smart neighborhood, with a growing population, then finding a trustworthy renter will appear discouraging. however as overwhelming as this might appear, with somewhat effort comes nice reward. With myriad edges to owning an investment property, here ar our prime 10 reasons to take a position in real estate:

The selection is Yours

Residential or commercial, multifamily or single family, hotels or offices? You get to determine. There ar many choices out there, and performing some analysis can assist you realize the correct property for you. investment in a very property that you just ar aware of, can facilitate calm the nerves that may be current once creating an enormous call.

Value will increase because it appreciates

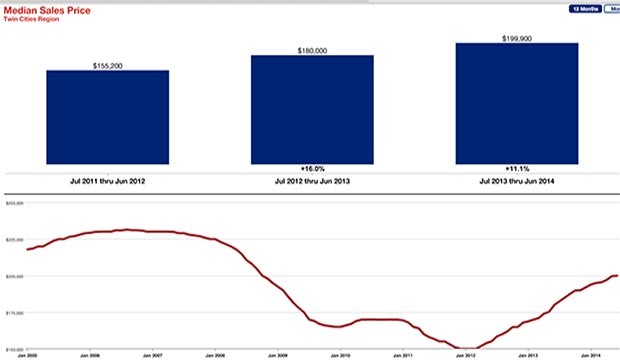

As communities grow, thus too will the worth of your property. History has shown that assets costs have continuing to steady increase over the years. The longer you hold onto your investment property, the a lot of potential you’ve got to induce a high come back. that leads us into #8 on our list.

Long-Term Investment

Many people just like the plan of associate investment that may fund them in their retirement. Rental housing is one sector that seldom decreases in value, creating it a decent choice for long investments. assets can generally increase in price as time goes on, compared to a bank account or associate RSP that may lose price as inflation rises.

Positive income

Many real estate investments supply positive monthly income when your mortgage and other related expenses ar paid. This income can increase over time as your mortgage funding decreases incrementally and rental rates increase. this can produce a growing supply of secure retirement financial gain for you.

Diversification

As the cornerstone of a well-balanced investment portfolio, diversification helps to offset volatility in anybody explicit quality category and ultimately reduces your overall portfolio risk. investment in assets may be a powerful method for you to feature a valuable layer of diversification to your investment portfolio.

Inflation Hedging

The inflation hedging capability of assets stems from the positive relationship between GDP growth and demand for assets. As economies grow and develop, further pressure is placed on rental properties. This causes rental costs to extend, which will ultimately increase your revenue.

Leverage

Leverage merely means that victimization borrowed capital to boost the earning potential of associate investment, and in comparison to alternative investment categories, assets delivers the best chance to use the facility of leverage. Since real estate may be a tangible quality, funding is mostly a lot of simply earned and your potential returns ar heightened significantly compared to a non-leveraged investment.

Tax edges

A number of deductions may be claimed on your income tax return, like interest paid on the loan, repairs and maintenance, rates and taxes, insurance, agent’s fees, trip and from the property to facilitate repairs, and buildings depreciation. Also, after you own associate financial gain property, the interest on the mortgage payments is tax deductible. All this can assist you save cash once it involves tax time.

Reliable Returns

While tradition investments like stocks and bonds will offer exceptional opportunities for wealth, the inherent risks ar evident with the market’s constant fluctuation. assets, on the opposite hand, is much a lot of consistent in terms of market volatility, it will continue providing you steady returns even throughout lulls within the economy.

Other People’s cash

One of the hallmarks of real estate investment is that the ability to use the income you earn monthly to pay down your mortgage funding. This profit is exclusive to assets investment. typically speaking, the income you earn are decent to hide your mortgage payments and also the alternative expenses related to your investment unit.