Top Down Investing Trading Methodology

Post on: 7 Апрель, 2015 No Comment

What is Top Down Investing

Top down investing is the process of first assessing the health of the broader market before analyzing individual securities. This trading methodology is based on the premise that if an investor trades in the direction of the larger trend, it greatly increases the odds of putting on a winning trade.

Top Down Investing Methodology

Below is a simple process for how to analyze the market with a top down approach. The top down approach can be broken out into 4 phases: (1) first assess the global market, (2) identify the strongest industry, (3) determine the strongest stocks in the sector, and lastly (4) locate the best time to enter the trade.

Assess the Global Market

It is important monitor more than 1 trading market. In order for a trader to fully understand how the market works, he or she must monitor a number of markets (energy, forex, etc.) While it is not required to be an expert in every market, it is important to understand how these global forces can influence securities within your portfolio.

Identify Strongest Sector

After assessing the global market to identify a trading opportunity, the next step is to find the strongest performing sectors. This does not necessarily translate into raw percentage gain for the year, but the sectors with the smallest retracement from its highest point to each reaction low within the context of the larger bull market. Remember, volatility does not equal gains, but the strength of the trend.

Locate the Strongest stocks

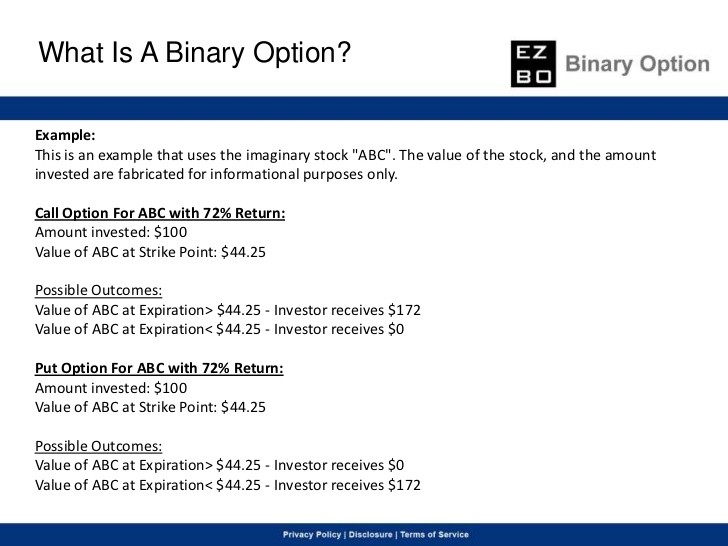

Once a trader has identified the strongest sector, the next step is to select the best performing stocks in the sector. This can be done by looking at cash flow statements. earnings reports, and utilizing technical analysis techniques. Many trading applications will plot more than one security and this can provide a quick visualization of how the respective stock compares to the index.

Entering the Trade

Below is a trading example of how to implement the top down approach. This example will cover the bull market in oil, which saw a number of securities double and triple in price over a 2 year period. The first step was to look at the Oil Services Holder (OIH). Notice how the oil market was in a strong uptrend over the last few years.

Within the oil industry, drilling was one of the best performing sectors. Below is a chart of the Offshore Drilling Index (DO) which is a basket of drilling stocks. Notice how the DO chart has a greater percentage gain than the OIH, thus outperforming the industry.

Apache was one of the top performing stocks within the Drilling Index, hence Apache would be a great long candidate.