Top Canadian Discount Brokerages with Commission Free ETFs

Post on: 10 Июнь, 2015 No Comment

A young reader who is currently in University emailed me about investing possibilities. The students financial situation is relatively stable where he has excess cash after paying tuition from a summer part time job. Typically, I recommend paying down debt before starting the investing route, but in this case, he has no debt and no foreseeable future expenses (house etc).

In this case, the student has small amounts per month to invest and is interested in investing in the stock market. In the past when investing small amounts per month, low cost mutual funds were the way to go because they avoid commissions with every purchase. While ETFs are lower cost overall with lower management expense ratios (MERs), investing a small amount monthly would be quite expensive with the trading fees.

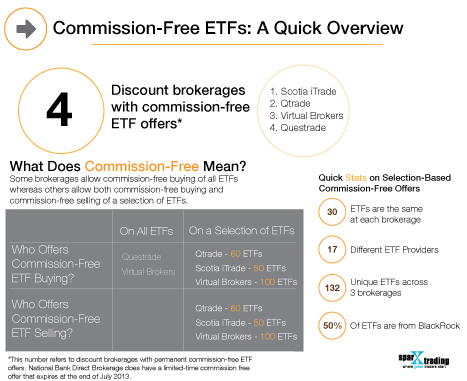

Fortunately the discount brokerage landscape has evolved and some of the more competitive brokerages are now offering commission free ETFs . What does this mean? Typically buying and selling an ETF is treated like an equity/stock so an investor would need to pay their $4.95-$29.99 per trade. Now investors can purchase small amounts of ETFs per month without any added fees. This is great news for investors who regularly contribute small amounts per month into an index based portfolio .

Canadian Discount Brokers that offer Commission Free ETFs

Currently, there are four discount brokers that offer commission free ETF trading but some with limitations. In addition to commission free ETFs, a desirable discount broker for investors just starting out will have the following features:

- No annual fees;

- Low commission/trading costs even with smaller balances; and

- Ability to hold USD in an registered accounts (RRSP, TFSA etc).

Virtual Brokers

Virtual Brokers is known for their ultra low trading fees with not many stock brokerages out there that can compete with $0.99 trades. This company is very progressive with their offerings that include USD RRSP/TFSA (for $50/yr), and commission free ETFs on the buy side, and the regular trading commission on the sell side. Read our Virtual Brokers Review here.

- Annual Fees. $0 for regular accounts, $25/yr for RESP.

- Commission s: $0.01 per share (min $0.99 and max $9.99/trade including ECN fees) or $6.49/trade not including ECN fees.

- USD Reg Accounts : RRSP and TFSA offered at $50/yr.

- Commission Free ETFs. Free to purchase any ETF, but trading commissions apply when selling.

Scotia iTrade

iTrade was bought out by Scotia Bank not too long ago and fortunately, Scotia hasnt changed too much of the platform. While the trading commissions are fairly high for investors just starting out ($24.99/trade), it gets better once assets reach $50k ($9.99/trade). Scotia offers a pseudo USD RRSP which gives you a favourable exchange rate at the cost of $30/quarter. While the fees are high for a new investor, iTrade has eliminated the commission on a select group of ETFs .

- Annual Fees. $100/yr for RRSP and non registered if less than $25k value, otherwise no fee. No fees for TFSA.

- Commission s: $24.99/trade (if $50k+ assets, $9.99/trade, 150+ trades/quarter gets $6.99/trade).

- USD Reg Accounts : US Friendly RRSP $30/quarter.

- Commission Free ETFs. They offer a select list of ETFs that are eligible for free trades buy and sell.

Qtrade

Qtrade is always popular with GlobeInvestor for their customer service. Qtrade is in the middle of the pack with average commission fees and a selection of commission free ETFs. For investors just starting out, they charge $19/trade, but decreases to $9.95 once the account reaches $50k. For active traders making 30-149 trades/quarter, the fees are $9.95/trade and 150+ trades/quarter gets the preferred rate of $7/trade. Qtrade offers a USD RRSP for $50/year and a select list of ETFs that can trade commission free.

- Annual Fees. $50/yr for RRSP and non registered if less than $15k value, otherwise no fee. No fees for TFSA.

- Commission s: $19/trade (if $50k+ assets, $9.95/trade, 30-149 trades/quarter gets $9.95/trade, 150+ trades/quarter gets $7/trade).

- USD Reg Accounts : $50/year.

- Commission Free ETFs. They offer a select list of ETFs that are eligible for free trades buy and sell.

Questrade

Questrade is a popular discount broker with MDJ readers because of their low fees. For the beginner investor (not using their advanced/expensive data packages) they charge $0.01/share with a min of $4.95/trade up to a max of $9.95/trade. A big advantage of Questrade is that they offer all of their accounts without any annual fees, including their USD RRSP. They are similar to Virtual Brokers in that users can purchase any ETF without paying commission, but will have to pay regular commission when selling the ETF. Note though that if you dont trade in a quarter and your account is under $5k, they will charge a $19.95/quarter inactivity fee. You can find our full Questrade Review here .

- Annual Fees. $0 for all accounts, but note the $19.95/quarter inactivity fee for accounts smaller than $5k.

- Commission s: $0.01/share with min of $4.95/trade up to a max of $9.95/trade.

- USD Reg Accounts : No annual fee.

- Commission Free ETFs. Free to purchase any ETF, but trading commissions apply when selling.

Final Thoughts

When it comes down to it, new investors should try to reduce their investment costs as much as possible. For new investors who want to regularly invest small amounts per month, then buying index ETFs with a stock brokerage that allows commission free ETFs is a good bet. Out of the four brokerages listed, Virtual Brokers and Questrade both have the lowest fees and a similar offering with their ETFs (free to buy, fee to sell). iTrade comes in with the highest cost, but has the backing from Scotia Bank. Qtrade falls in the middle of the pack, but has been highly rated for their customer service.

What broker would you recommend for a beginner investor whos looking to invest small amounts per month?