Time Value of Money Rate of Return

Post on: 28 Май, 2015 No Comment

Estimating value of an income-generating asset or group of assets such as a business requires considering concepts such as the time value of money, risk and required rate of return. Here is a brief summary.

Time Value of Money. Most people would rather receive a dollar today than in the future, and would pay less for a dollar to be received in the future than today. This is the concept of time value of money. A dollar received today can be invested to earn a profit. The simple fact that a dollar received today can be deposited into a bank account to earn income supports the concept.

Risk. The level of uncertainty about whether expected returns will be realized is referred to as risk. Because virtually no investment is 100 percent certain to provide expected return, investors discount anticipated future cash flows by a rate greater than the standard for risk-free investment — U. S. Treasury obligations (the risk-free rate). When presented with an investment opportunity, one of the key tasks in assigning value is to estimate risk.

Risk-Free Rate. If receipt of a future stream of cash flows were completely certain, the discount rate used to convert them into present dollars would be the risk-free rate. For the past 100+ years, the financial world has looked to U.S. government obligations as the benchmark for risk-free investments, and we presume it still does. As such, we can look at the rate of return or yield paid or earned on U. S. obligations as a pure representation of the time value of money for investors. In theory, to entice investors to contribute money to an investment that is risk-free, a rate of return at least equal to the rate paid on U. S. obligations would be required. A one-year U.S. Treasury bill today earns around 0.2 percent, a very low rate historically.

Discount Rate. The rate at which future dollars are converted or discounted to present dollars is called the discount rate, also commonly referred to as the hurdle rate, cost of capital, opportunity cost of capital or required rate of return. The discount rate is made up of two components, the risk-free rate (to compensate for the time value of money) and the risk rate (to compensate for the uncertainty of the expected future cash flows). This can be represented by the equation Rf + R = D, where Rf is the risk-free rate, R the risk rate and D the discount rate.

Discounting. The mechanism used to adjust the value of a dollar received in the future into value today is called discounting. If one were to determine that he or she would pay just 80 cents for a dollar that was certain to be received in one year, the implied discount rate is 25 percent. If the time value of money for this particular investor is consistent over time, then for every year a dollar’s receipt will be delayed, a discount of 25 percent will be applied.

The present value of a delayed payoff may be found by multiplying the payoff by a discount factor. If C1 denotes the expected payoff at time period 1 (one year from today), then:

Present Value (PV) = Discount Factor x C1

The discount factor is expressed as the reciprocal of 1 + rate of return:

Discount Factor = 1 / (1+r)

The rate of return r is the reward the investor demands for accepting delayed payment. If we use the numbers from the hypothetical example above, we find that $100,000 to be received in one year, discounted at 25 percent, is indeed $80,000.

PV = [1 / (1+.25)] * $100,000

= [1 / 1.25] * $100,000

= 0.80 * $100,000

= $80,000

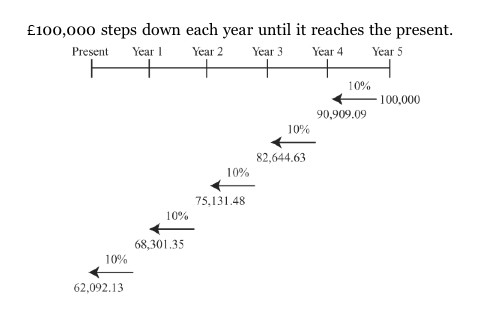

To illustrate how this concept is applied, let’s assume we buy XYZ business and expect to receive $100,000 at the end of each year for five years. To calculate the present value, list the payment to be received in each year, then discount the dollars to the present value as follows: