Time Value Of Money Determining Your Future Worth_1

Post on: 9 Октябрь, 2016 No Comment

Advertisement

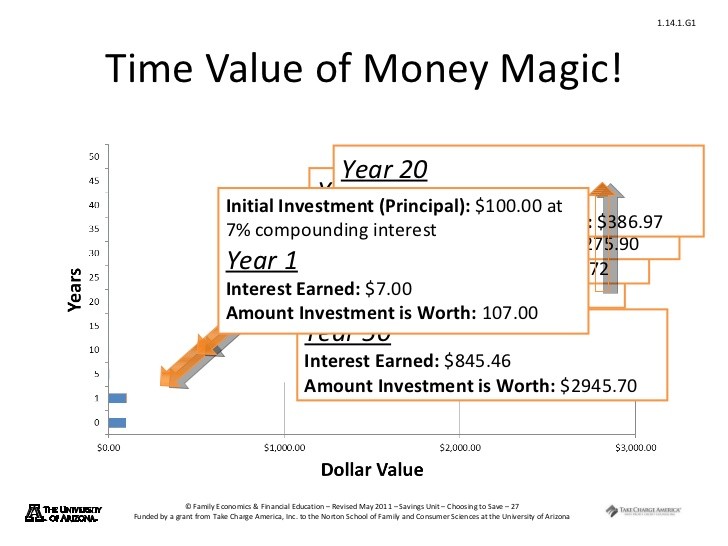

Net Present Value (NPV) is a way of comparing the value of money now with the value of money in the future. A dollar today is worth more than a dollar in the future, because inflation erodes the buying power of the future money, while money available today can be invested and grow.

The term constant dollars refers to the net present value relative to a fixed date. The term current dollars refers to the unadjusted value of the money. The term discount rate refers to a percentage used to calculate the NPV, and reflects the time value of money.

For example, assuming a discount rate of 5%, the net present value of $2,000 ten years from now is $1,227.83. So if someone offered you $1,000 now or $2,000 ten years from now, you’d pick the latter because its net present value is higher.

Advertisement

Calculating NPV is difficult, in part, because it isn’t clear what discount rate should be used, nor is it clear how to project future changes in the discount rate.

Typically, when the term ‘constant dollars’ is used, it reflects the NPV of historical data using the consumer price index (CPI) as the discount rate. Since the CPI is known in this case, this provides a method of adjusting figures for the effects of inflation.

Since the discount rate reflects the future value of money, it typically has two components: an adjustment for inflation, and a risk-adjusted return on the use of the money. Since market forces typically incorporate inflation adjustments into investment returns and borrowing costs, often the discount rate is keyed to a standard reference rate.

We use the current 30-year Treasury bond rate as the discount rate throughout FinAid because it is a conservative figure, is risk-free, and it is the discount rate typically used by banks for economic analysis of loan programs.

The discount rate used by individuals can and should vary from this figure, which is why we allow you to set your own discount rate. In fact, the discount rate should potentially change every year as your financial circumstances change, but that is very hard to model.

The discount rate should be the APR of the highest risk-adjusted rate of return the you can obtain by investing your money, or the lowest rate at which you can borrow money, whichever is higher. The reason is your decision of whether to pay off your student loan depends on whether you can earn more by investing the payoff funds in a different vehicle or spend less by refinancing the loan with a lower cost source of funds. If you have both a lower borrowing cost with a different loan and a higher investment return, the higher rate wins, because you could use the other loan to borrow money to invest, and therefore be financially better off than you would be by paying off the student loan.

The discount rate is therefore sensitive to your risk tolerance. For example, the average rate of return on stock market investments is 10%. If you like taking risks, you might earn more. But if you dislike risks, you should use the rate of return for a bank Certificate of Deposit or Money Market Account.

In the case of a student loan, the cost of the future payments should be discounted to present value. However, these figures are extremely sensitive to the discount rate. The NPV of a loan under standard amortization equals the original loan balance when the discount rate is set to the APR of the loan interest rate. For example, for a Stafford loan with an interest rate of 8.25%, the discount rate required for an NPV equal to the loan balance is 8.57%. This is the same as the APR of the loan, since the loan is amortized monthly.

If the discount rate used is lower than the APR of the interest rate for the loan, the NPV will be higher than the original loan balance. Likewise, if the discount rate is higher, the NPV will be lower. The higher the discount rate, the less expensive (more discounted) the future payments will be when represented in constant dollars.

Clearly, no student would rationally accept a loan with a higher NPV than the amount borrowed, so perhaps the discount rate should also be at least as much as the APR of the student loan interest rate. On the other hand, if the student has access to no other loans, and their highest investment rate of return is the long bond (30-year Treasury), then the long bond is the correct discount rate to use. The difference between the amount borrowed and the NPV could be consider a premium the student is paying for cash flow assistance.

When comparing loans with short and long repayment terms, the NPV of the total payments depends significantly on the discount rate. A higher discount rate can make the long-term repayment plan more attractive than the short-term plan. So the choice of whether a student participates in the income contingent repayment plan, the standard repayment plan, or the extended repayment plan will depend to a great degree on their choice of a discount rate.

For example, when the discount rate is somewhat higher than the APR of the interest rate, the graduated repayment plan has a lower NPV than the standard or extended repayment plan because it shifts the larger payments toward later in the term when the constant dollar value of the payments is lower.

Generally speaking, the lower the NPV, the better the loan. But since the relative order of the NPV values for different loans depends on the discount rate (i.e. whether it is higher or lower than the APR of the interest rate under standard amortization), care should be exercised in the choice of a discount rate.