Time value of money_2

Post on: 16 Март, 2015 No Comment

T he time value of money is one of the most important concepts to grasp in investing. Happily, its also a pretty instinctive one. 1

The time value of money reflects how youd rather get a fixed sum of money today than exactly the same amount of money in the future. Money in the hand now is worth more than exactly the same amount received in a years time.

This explains why locking your money away for a longer time (usually) earns you a better return .

The longer you put your money out of reach, the less it is worth. You therefore need to expect a higher return on your investment to compensate you.

Show me the money!

Which of the following would you prefer?

- £1,000 now

- The promise of £1,000 in five years time

Of course you – and all rational investors – would prefer to receive £1,000 today.

Five years is a long time to wait. Even if you didnt want to spend £1,000 right now, you could put the money received today into a deposit account earning interest for five years. If you got 4% interest 2 on £1,000, then after five years your money would have grown to £1,217.

Why choose to have £1,000 in five years when you could have £1,217 by taking £1,000 now and investing it?

Similarly, lets say youre deciding between:

- £1,000 in five years

- £1,000 in ten years

Anyone sensible would prefer to have £1,000 in five years time, rather than to wait ten years for exactly the same amount.

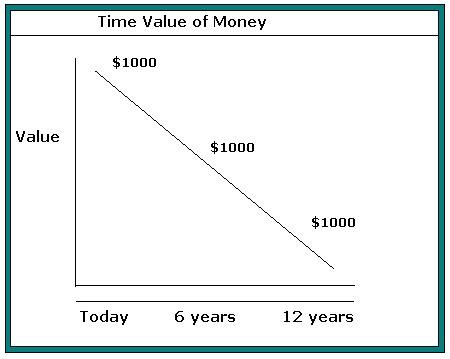

Time value thus describes a continuum. where a sum of money received now is worth more than exactly the same amount in the future, which in turn is worth more than the same sum at a date beyond that .

Lets say you can get 4% interest on cash, as in my example above. Which would you choose of these two options:

- £1,000 today

- £1,040 in a years time

If you could expect to put away the £1,000 received today to earn 4% interest in a year, then (ignoring other factors like tax for simplicity) the value of these two options is the same.

How do we calculate the time value of money?

All other things being equal, the time value of money represents the interest one might earn on a payment received today, if it was held earning interest until a future date.

The fixed income from government bonds is normally used to calculate the present value of a future payment. The income from government bonds is assumed to be a risk-free rate of return.

What if the future payment is not guaranteed? What if your I.O.U. note comes not from the government, but from your cousin Bob, or from a volatile stock market-linked investment such as a share?

Without the certain guarantee that youll eventually be paid the full amount, the future value of the same sum of money is even lower because uncertainty as well as time value makes it less attractive .

A discount rate is used to calculate the present value of the future uncertain payment. This discount rate reflects both time value and risk .

As an everyday investor – especially a passive investor – you may well never bother using a discount rate to work anything out. You might leave that to the analysts.

For now its just important to realise that there is (or should be) solid mathematics and reasoning behind our gut instincts about saving money.

Time value of money and your investments

Time value can be used in financial calculations to work out things like the present value of a growing annuity.

Such calculations are often built into calculators and spreadsheets. You can find some worked examples on the time value of money Wikipedia page .

But as I say, were only really looking to understand the gist of the theory here.

The rule-of-thumb is that money put away for longer periods of time will need to offer a higher rate of return to compensate for it not being available to invest in other (potentially superior) assets during that time.

Uncertainty about the future also plays a part, as weve just discussed.

Uncertainty is in some respects another word for risk. Remember that that there are many different types of risk when it comes to investing.

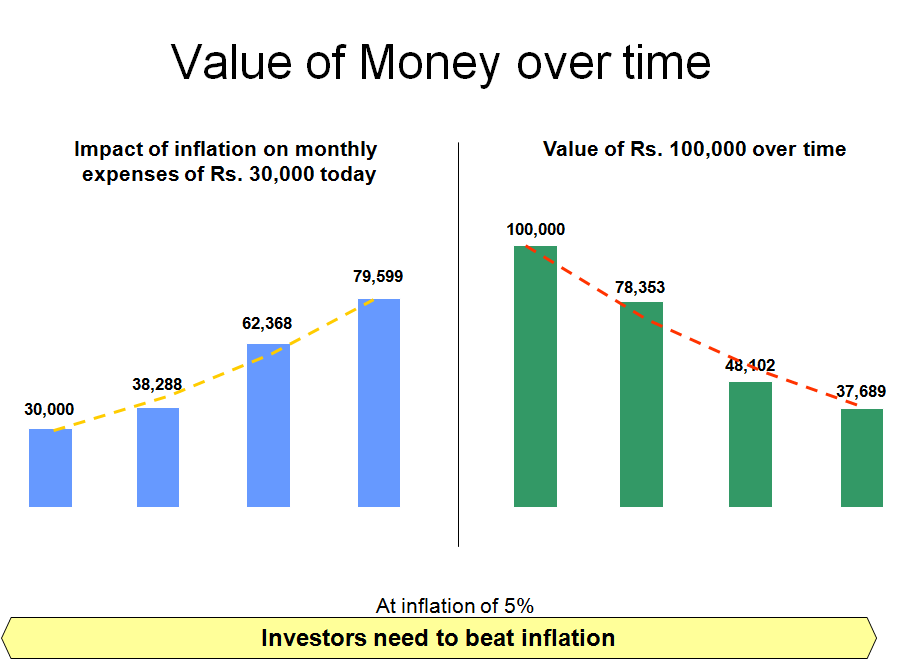

In a savings account youd probably be worried about inflation. for example.

Would you be wise to lock away your money for five years at 5% if inflation was 4% and rising. Probably not.

With a fixed duration security such as a government bond, the nearer todays date is to the date when the government will fulfill its promise to buy the bond back from you, the likelier it is it will be priced close to its redemption value. 3

Go several years out though, and time value and uncertainty about factors such as inflation and government spending will more influence the price of a government bond, moving it above and below its redemption value.

Key takeaways

The maths can get complicated, but the takeaway message is clear. For all assets, time, uncertainty and expectations combine to influence the risk/return profile of that asset.

Time value of money is often neglected by private investors, but you do need to consider it when deciding whether a particular asset and/or the income it produces makes for a good investment.

This is one of an occasional series on investing for beginners. Please do subscribe to get our articles emailed to you (we publish three times a week) and youll never miss a lesson! And why not tell a friend to help them get started?

Note on comments: Please remember this series is for beginners, and any comments should reflect that, rather than confuse. Thanks!

Thanks for reading! Monevator is a simply spiffing blog about making, saving, and investing money. Please do check out some of the best articles or follow our posts via Facebook, Twitter, email or RSS.

- Note: Its not to be confused with option time value. Nothing is simple with options! [↩ ] Ive just picked 4% as an example, to keep the maths meaningful. I know you cant easily get 4% on cash currently. Thats not the point here. [↩ ] The redemption value is the money youre promised to be paid by the government when the bonds lifetime is up. [↩ ]