Time To Buy Oil Stocks This Market s Whipping Boy

Post on: 13 Апрель, 2015 No Comment

Follow Comments Following Comments Unfollow Comments

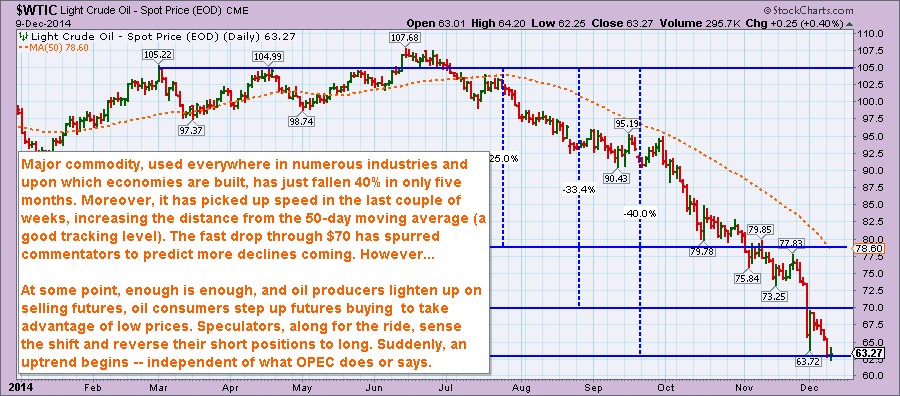

Oil is the whipping boy for this stock market correction. However, the punishment has been overdone.

- First, there was reasonable discussion of oil’s weakening demand and plentiful supply (

Oct 1)

Thus, the view of oil is now excessively pessimistic. However, it is such periods that produce the best times to “buy low.”

Disclosure: Author has purchased Chevron Chevron and Petroleum & Resources (PEO) (a closed-end fund). The balance of the portfolio remains in cash reserves.

Because the explanation of erroneous commentary and analysis takes some explanation, let’s start with the stock investments.

Two examples of attractive oil investments

Chevron is a well-managed major, integrated oil company. Importantly, management has what appears to be a sound, long-term strategy for building reserves. With the sharp sell-off in oil stocks, Chevron is now at an especially good price: dividend yield = 4%, forward earnings yield = 10% and price level = 20% below its recent, all-time high.

Petroleum & Resources (PEO) is a well-managed, well-diversified closed-end fund (website ). Not only does PEO offer good value from the sell-off, it also has a 15% discount to its portfolio value.

While these are my favorite positions, the widespread selling has driven many (most?) oil stocks to desirable prices.

Now to the flawed commentary and analysis:

Most (all?) commentary and analysis overstates oil’s price decline

The problem is the use of the U.S. dollar. Yes, the dollar is the accepted currency for quoting the price of oil but it is not the effective price in all countries. Oil, like any global commodity, actually has no home currency. Its “price” and price trends are dependent on exchange rates. Normally, that would not create much of a distorted picture, but today it does.

Here is how oil prices look in various currencies. Note that, because the dollar has risen against every other currency except the Chinese yuan, the price elsewhere has fallen less.

Note that this is not the first time the dollar’s exchange rate affect affected the U.S. dollar oil price.