TIAACREF Withdrawals from Retirement Plan

Post on: 16 Март, 2015 No Comment

Im not at retirement age yet, but need to withdraw funds from my retirement plan. How would I do that? Will I pay any penalties?

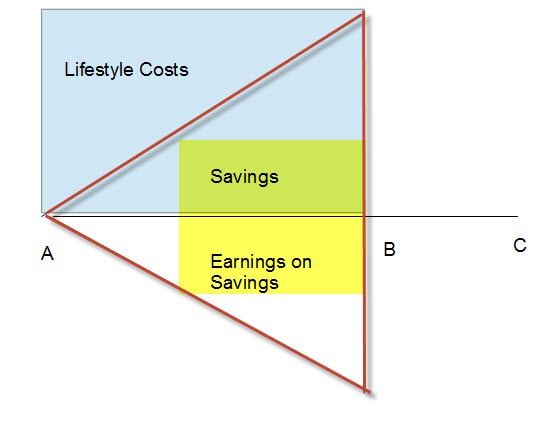

Making early withdrawals from a retirement plan has consequences, both short- and long-term. Early withdrawals from a retirement account should be a last resort for funds as it puts your ability to save enough to retire at risk. Consider other funds outside of any retirement funds and learn how to build savings.

Tap an Emergency Fund

Try to avoid having to withdraw from retirement accounts to cover the unexpected, and instead tap any savings outside of your 403(b) or other retirement savings. Maintaining healthy cash balances in FDIC-insured accounts should be part of your long-term plan, particularly through an emergency fund that can help you cover job loss, expensive repair or other unexpected expenses. Normally, such a fund should cover six months of normal living expenses. Given todays environment, however, try to cover a full year, if possible. You can do that through a TIAA-CREF Money Market Fund a bank savings account, or self-directed certificate of deposits. To build the emergency fund:

- Look at where you are spending money now what is spent on needs versus what is spent on wants

- Set up a budget by saving receipts on what you spend to find areas where you can save. It is surprising how much money is not accounted for and it is human nature to guess low on spending

- Put any money from a raise at work into the emergency fund

- Any unexpected or bonus money can also go into an emergency fund until the desired amount of money is raised

Roll Over to an IRA

If you are leaving a job and want to cash out of your retirement plan, you will pay penalties to do so. Before you receive your payout, your employer must withhold 20% of the taxable portion of your distribution for federal income taxes. Also, if youre younger than age 59, you may have to pay a 10% early withdrawal penalty on the taxable portion of your distribution. You may also owe state and local taxes on the taxable portion of your distribution. Since the contributions to your retirement plans are made on a pre-tax basis, at the time of cash out, taxes would apply on the entire distribution amount.

Instead of cashing out your entire account balance, consider taking a distribution for just what you need. One of the best options for how to handle a retirement account after you leave a job is to keep the money in the existing plan or roll it over to an Individual Retirement Account (IRA). Rolling over your retirement assets into an IRA offers several benefits, all of which can potentially save you time and money. Whether youre consolidating your own retirement accounts from various employers, or consolidating your and your spouse or partners accounts, you enjoy:

- Simplified recordkeeping

- A comprehensive picture

- Single source of income at retirement

You can learn more about IRAs here .

Retirement Plan Loans

If youre still working and need to withdraw money from a 403(b) or other workplace retirement plan, you may be able to borrow from your own accumulation and pay yourself back without penalties. You will pay interest in addition to paying the principal on the loan to yourself, usually through automatic payroll deductions. The interest you pay usually goes back into your account. Learn more about taking loans from your retirement account here. Again, tapping an emergency fund or other non-retirement account savings will give you access to funds while not disturbing your nest egg. Loan availability depends on the provisions of the plan.

Cash Withdrawals

Cash withdrawals from a plan will trigger penalties because they are taxed as ordinary income unless you have after-tax funds in the account, which are returned to you free of taxes. For certain withdrawals, the retirement plan is required to withhold 20% of the taxable amount withdrawn as a prepayment of the taxes due.

Additionally, withdrawals from employer-sponsored plans before age 59 may be subject to a 10% early withdrawal penalty. However, the penalty does not apply if you meet certain conditions, including disability, needing the money to pay medical expenses or if you begin receiving income. The ability to make cash withdrawals depends on the provisions of the plan.

Withdrawal Pitfalls

There are drawbacks to taking money out of retirement accounts early through withdrawals, loans or cashing out. The money you withdraw or borrow will no longer earn investment returns that are tax-deferred. You may have to increase contributions in the future or work more years to accumulate enough funds to live comfortably in retirement. In addition, if you take a loan from your 403(b) and change jobs, you may have to repay the whole loan within 60 days of leaving the position.

Contact us for more information on the pitfalls of retirement plan withdrawals and other potential options to preserve your retirement savings.

1 An investment in the Money Market Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

2 Before transferring assets or replacing an existing annuity, be sure to carefully consider the benefits of both the existing and new product. There will likely be differences in features, costs, surrender charges, services, company strength and other important aspects. There may also be tax consequences associated with the transfer of assets. Indirect transfers may be subject to taxation and penalties. Consult with your own advisors regarding your particular situation.

TIAA-CREF Individual & Institutional Services, LLC, and Teachers Personal Investors Services, Inc. members FINRA, distribute securities products. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association (TIAA) and College Retirement Equities Fund (CREF), New York, NY.