Three Ways to Evaluate Real Estate Investments Real Estate Online inFormation

Post on: 30 Март, 2015 No Comment

How many properties can you afford if each one costs you 0/month? The answer for most of us is NONE! So, how do you know whether you should buy that cute little house with two units?

Many of the get rich quick books like Robert Allens Multiple Streams of Income or Russ Whitneys no money down real estate courses are quick to focus on monthly cashflow. They preach that you must buy properties where the rent is high enough to cover mortgage, expenses and profit. We do not disagree, but we look back at our investment goals before we rule out the ones that dont have good cash flow.

Rent Real Estate

When we moved to Toronto almost five years ago we bought a small condo in North York. Rents were higher than the cost of a mortgage, and we thought we would live there for awhile and rent it out. That is exactly what we did, but when we rented it out, we found that it cost us almost 0/month because we were not bringing in enough rent to cover the maintenance fees. But we did not sell it for awhile because it was still working with our goals. Confused?

In an ideal world you would find a property in a location that is right for you that will give you:

1. Positive cash flow each month (you are taking in more money from rent than you are paying out in mortgage and expenses)

2. High potential for appreciation over a five to ten year term (or sooner!)

3. High level of liquidity (in other words, everything about the property is desirable and it wouldnt be hard to sell in a hot or cold market).

Unfortunately, we dont live in an ideal world and you will likely have to prioritize which ones you want based on what your short and long term goals are.

Cash Flow

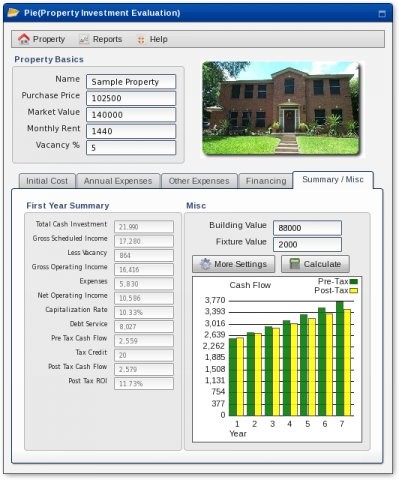

One of the most common methods of evaluating a purchase in commercial and residential real estate investment is cash flow. In commercial real estate you will often here everyone talk about the cap rates. In residential real estate a common one is the gross rent multiplier (GRM). To calculate GRM:

* Estimated (or known) rent x 12 months = Annual Rent

* Asking price (or what you plan to pay for it)

* GRM = Asking Price / Annual Rent .

For example, if your monthly rent is ,000, and the asking price is 0,000 your GRM is:

0,000 / ,000 = 8.33.

The basic rule of thumb is that you need a GRM of 10 or less to have decent cashflow. This is based on the assumption that your operating expenses are less than 40% of your monthly rent. Operating expenses include your property manager, taxes, insurance, and maintenance and repairs. It also assumes that your financing costs do not exceed 60% of your monthly rental income.

Just to give you an idea of expenses, our properties average about 37% of our rental income each month for operating expenses.

Once you narrow down your list of potential investment properties, contact the listing realtor and obtain an income and expense sheet for the property or ask for actual receipts to determine the true expenses and possible rent of each property. Now, you will be more informed whether to continue looking at this property on a cashflow basis or you should move on.

If your goal is to find properties that will provide you monthly income, then you will need to focus on this method of evaluation. The two other considerations (appreciation and liquidity) should be less of a concern. If you are holding properties for the long term, and looking for ones that are less likely to cause you problems with tenants or repairs, then you are likely also going to be factoring in the other two evaluation criteria.

Potential Appreciation

It is difficult to evaluate appreciation potential as it is based on what happens in the future. There are ways to feel more confident in the potential of your property increasing in value though. For example, consider:

* Are more people moving into the area than out of the area?

* Are there new developments around? What about schools, stores and other services?

* Is there a shortage of land to build new homes?

* Are new roads being constructed? Is the economy in the area diverse and growing?

* Is it a Starbucks area? What we like to call an emerging area where Starbucks has just opened up shop and people are buying the ugly houses to make them lovely again.

* Are people renovating and spending money on nice landscaping?

None of the above guarantees appreciation of a property, but if appreciation is a primary concern, you need to be mindful of these elements.

Liquidity of a Property

Many of the same factors that may help to identify properties that will appreciate are the same ones that will help you evaluate its potential liquidity. The objective here is to determine whether you could sell the property in a hot or cold market at a good price.

For us, liquidity is important, but comes in third because we make all our purchases with the intent of holding them for 5 10 years or more. In a long term hold situation, liquidity is less of an issue because you do not need to sell it in the short term, and can hold on to it in bad market conditions and wait for the cycle to return to one of strength.

How do you evaluate liquidity? Current market conditions will help you in the short term (how many listings there are on MLS relative to sales is one way), but when trying to figure out liquidity in the future, you can consider:

* Single family, detached homes are always more in demand than any other product, especially ones that are well taken care of

* Safe locations near parks, schools and shopping are in demand no matter what the market is doing

* Properties that are without extras that people do not need and will not pay for in hard times (pools, 3 car garages, large acreage).

Essentially, you want your property to appeal to the masses in order to ensure liquidity. If it is too unique or too specialized then your market is smaller, and therefore it will be much harder to sell in a market downturn.

Maybe you are tired of hearing it, but it all depends on your goals what criteria are most important in your decision. If you only want only one investment property and you want the most appreciation potential and least hassles, putting 0/month into it is not a bad thing if that is what you are getting for your money. Especially, if you are in a higher income tax bracket. You can write-off the mortgage interest as well as most of your investment property expenses (speak to your accountant). Furthermore, if your mortgage interest rate is reasonable (less than 6%), your tenant will be paying down a portion of the principal, helping you to build equity (which is our situation with the condo in North York). If you cant afford to put a dime into the property each month, then you must find one that has good cashflow regardless of the other criteria.

So, before you pass on that cute little two unit house because it doesnt have a lot of cash flow, you should stop and think about what you need to get from the investment. In the first year of owning any property, its tough to actually put money in your pocket. But if you dont have income to supplement the property then you just have to look harder to find the property that does meet your goals. But remember, theres more than just cash flow to evaluating your purchase.

www.revnyou.com

Sign up for Dave and Julies free monthly newsletter and get a free starter tips guide where youll learn:

* Three easy ways to make money in real estate (so easy youll be making money while you sleep!),

* How to buy properties in Canada with limited cash,

* Your property type

* The easiest way to get financing,

* How to select a location and begin the search for your next (or first) property purchase.