Thoughts on Paying Extra Towards Mortgage Principal

Post on: 3 Май, 2015 No Comment

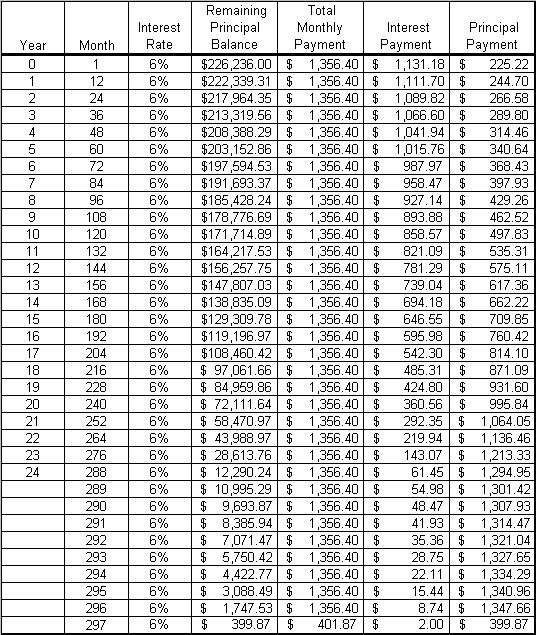

Ive been thinking more about whether I should commit some additional funds to pay down the principal on my mortgage and reduce my interest paid.

There is already a good deal of discussion on this topic in my posts Why Paying Down Your Mortgage Early Can Be A Smart Investment and 10 Reasons You Should Never Pay Off Your Mortgage. but Ive tried to summarize and update all the pertinent points into something more coherent below.

Other Higher Priorities?

I dont think paying extra towards a mortgage should be the highest priority. If you have no emergency fund, high-interest credit card debt, proper insurance, or dont have your IRAs/401ks maxed out, then you probably should focus on those things before worry about paying extra towards your mortgage.

What is your tax situation?

Next is the topic of tax-deductibility of mortgage interest. Everyone already gets the standard deduction, which in 2012 is $5,950 for singles, and $11,900 for married filing jointly. Only the amount that your itemized deductions exceed this amount actually saves you money. If you have a $200,000 mortgage at 4%, your interest is only $8,000 the first year (and decreasing in subsequent years). If thats your only deduction as a married couple, youre not getting any real tax benefit at all.

However, some people have a big cushion of deductions, like high property taxes, state income taxes, charitable contributions, etc. Some dont. Some people are in high marginal tax brackets, where saving 35% sounds really nice. Some are in the 15% or lower tax brackets. As for us, we are in a high marginal tax brackets, and pay a good deal of state income tax, so the deductibility is definitely in effect.

Paying 4% mortgage interest fully-deductible would be perfectly counteracted with a bond earning 4% interest fully-taxable.

Comparing with other investment options

One major argument against paying extra towards a mortgage is that you can earn a better return elsewhere. Who cares about saving 4% interest annually when your money could be earning 8% somewhere else? As weve seen recently, stock market returns are not guaranteed, and also not without lots of heartburn. Do you really want to invest in stocks using borrowed money? If anything, you should compare your mortgage interest with a high-quality bond or bank account interest.

Liquidity

Another argument against paying extra is that it is hard to access the equity in your house. You may not get a home equity line of credit, or it may be frozen later. However, if your alternative investments are in IRAs or 401ks, then those arent exactly liquid either. Also, if you have an adequate cash cushion (as we do) and proper insurance, then liquidity will become a lesser concern. I dont need to have access to every penny of my portfolio at all times.

Inflation hedge

A nice thing about mortgage payments is that if you have a fixed mortgage, the payment stays the same each month. Meanwhile, rents will increase with inflation. If inflation starts to rise significantly, youll be very happy to have a loan at 4-5%. But we also may stay in an era of prolonged low interest rates.

A possible strategy?

After all that, my idea is to simply look at the current yield of a comparable U.S. Treasury bond and compare it to my mortgage interest rate. If my mortgage interest rate is a lot higher than the bond rate, then I should pay extra towards the mortgage. Otherwise, if the Treasury rate is higher, then I should invest in bonds or bank accounts directly instead. If its close, stick with liquidity.

As of 2012, my mortgage rate is now slightly under 4%. I expect to pay off my mortgage in under 10 years, ideally closer to 5-7 years. This means that Ill effectively be earning 4% a year for 10 years, whereas the Treasury rate for a 10-year bond is only 2%. If rates do rise, then Ill stop paying extra toward the mortgage. In the meantime, since I already have bonds in my asset allocation, Id much rather earn 4% by paying down the mortgage than 2% in the market. (Remember, Im already maxing out both IRAs and 401ks for the year.)