This One Indicator Could Help You Make Enough to Trade for a Living

Post on: 16 Март, 2015 No Comment

Trading for a living is a dream many people have. It is actually possible to reach that goal, although it can be difficult. To trade for a living requires different strategies than long-term investing. Risks are higher for short-term strategies, but the rewards, especially the ability to work from home or anywhere in the world, are also high.

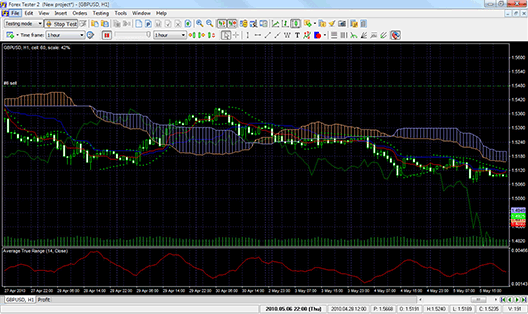

The first difference between trading and investing is the time frame. Traders are looking for short-term, high-probability opportunities. Investors are looking for something that can be owned for years and offer steady gains. Investors will generally need to consider a companys financial statements. Traders usually look only at recent price action to make buy and sell decisions.

One popular short-term trading strategy is the 2-day Relative Strength Index (RSI). Usually RSI is calculated using 14 days worth of data. Short-term traders use only two days in their calculation. Buys are taken when RSI falls below 5, and a variety of sell rules can be applied. The simplest strategy closes positions five days after they are opened.

While it is simple, the 2-day RSI strategy is also effective. Traders buying SPDR S&P 500 (NYSE: SPY ) when RSI fell below 5 and selling after five days would have seen winners 61.1% of the time over the past five years. However, because the system trades infrequently, the average profit per month on a $10,000 account would only be $32, which is not enough money to make trading for a living a reality.

Different ETFs yield similar results. With PowerShares QQQ (NASDAQ: QQQ ), the win rate remains high at 61% and the average monthly income rises slightly to $75. The iShares Russell 2000 Index (NYSE: IWM ) boosts the average income to $84 per month.

To increase the gains, traders will need to add money to their account, which is not always possible, or use leveraged investments. We prefer the second approach.

Traders using the 2-day RSI with ProShares UltraPro S&P500 (NYSE: UPRO ) would have seen wins 62.1% of the time and enjoyed average income of $157 per month with only a small increase in risk compared to SPY. UPRO is a leveraged fund designed to move twice as much as the S&P 500 on any given day.

Using futures is another option. Trading one e-mini S&P 500 contract instead of SPY, the win rate falls to 56.8%, but the average profit per month increases to $198. This would require a margin deposit of about $3,850 for each contract traded. With a $10,000 account, you could trade two contracts at a time and average gains of $400 per month. Risks are increased with this strategy along with the income, and futures are certainly not for everyone.

Call options could be the most powerful way to trade this strategy. Using in-the-money calls on UPRO that expire within a month or so minimizes the amount of cash needed to trade while allowing traders to benefit from nearly all of the market movement.

For example, if UPRO is trading at $62, call options with an exercise price of $50 that expire in one month could be trading at about $12.50. If SPY gains 2%, UPRO should gain 4% and move up to $64.48. The options would then be worth about $14.50. That $2 gain would be a return of about 16% on your options investment.

Assuming traders use three option contracts instead of buying $10,000 worth of SPY, it might be possible to trade for a living starting with a relatively small account. Average monthly gains would be about $450 a month and the level of risk would still be reasonable. Only 10% of the individual months ended in a loss.

If you have a smaller account size, it will take time to build up enough capital to earn a living solely from the markets. But the first step is to simply get started. Define how much you need in average profits per month and work toward that amount by reinvesting your profits into each trade. In time, trading for a living is possible for almost anyone willing to work at it.

If you want to trade for a living, develop your plan today and start using a strategy that offers a high probability of delivering winning short-term trades like the 2-day RSI.