Things to Know About an FHA Short Sale

Post on: 9 Май, 2016 No Comment

Top 5 Things To Know About an FHA Short Sale

You can opt-out at any time.

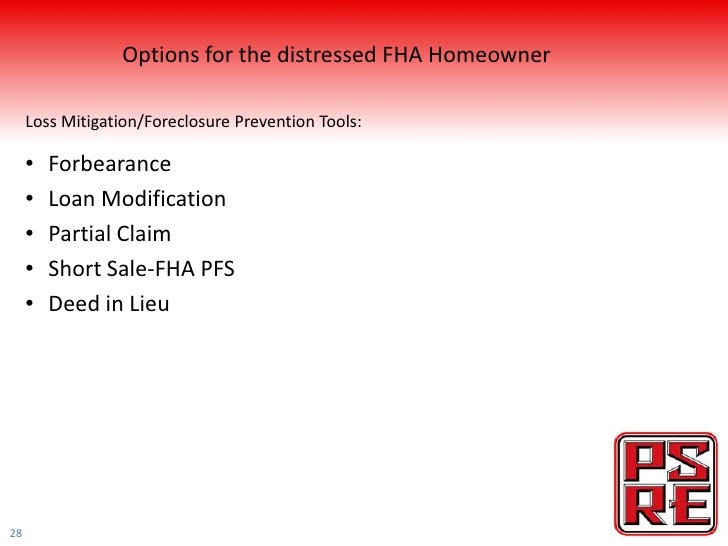

A seller can qualify for an FHA short sale if HUD determines the seller has a hardship. All FHA short sales fall under HUD, Housing and Urban Development, guidelines. Because the government has its fingers in the short sale. the process is a little clunky, and can be confusing to short sale agents and sellers alike. The following tips should help to clear up confusion.

Basic Guidelines for an FHA Short Sale

If your short sale is on the short track to nowhere, it’s possible it is stuck in the FHA waterfall. FHA wants to explore the possibilities of a loan modification. If your loan modification was rejected or denied, this is your lucky day because you will move much faster through the FHA short sale process.

- The home is identified as 1 to 4 units. This means a duplex or fourplex can qualify for an FHA short sale but a 5-unit apartment building cannot.

Common Questions About an FHA Short Sale

- How long does it take to do an FHA Short Sale?

The entire process is about 4 to 6 months, but it can take longer. HUD can issue an extension for another 2 months. It seems that whenever the government is involved, one can expect red tape and delays. First, if the servicer is Bank of America, HUD issues an Approval to Participate — after a lengthy and convoluted process to determine the seller and property qualify for the FHA Short Sale. The seller is then given 4 months to sell the home. Other banks approve the FHA short sale based on the purchase contract.

HUD will perform a full-blown appraisal and expect market value. It will not allow the sales prices of foreclosures and other short sales to be included in the appraisal unless those prices are the only comparable sales. By eliminating nearby competing sales, sometimes the final approved sales price can be unreasonable, which is a flaw in the process.

Yes, although it is better to be approved for the preforeclosure sale first, but it’s not necessary. It’s easier on the buyer, however, if a seller gets preapproved before marketing the home because it shortens the waiting time for the buyer.

Providing the compensation is not used to contribute money to the second loan, the answer is yes. The incentive amount starts out at a $1,000 and if the sale is not closed within 90 days, it drops to $750. If the second lender requires more than $1,500 to settle the short sale, the seller will be required to contribute part or all of the incentive to the second lender.

While it is true that many FHA buyers need a closing cost credit to help pay closing costs. and FHA will allow a 3% credit when FHA is insuring the buyer’s financing, FHA will not allow more than a 1% credit in an FHA Short Sale. It is possible to obtain a variance, however. FHA expects to net 88% of its approved sales price. If the net proceeds exceed the FHA minimum, it is possible that FHA might approve a higher seller contribution to the buyer’s closing costs.

The single biggest drawback to an FHA Short Sale is the time involved to process the short sale. If at all possible, it will make it much easier on all of the parties if the borrower first applies for and rejects a loan modification, followed by an application to get preapproved for an FHA short sale. Once accepted into the FHA Preforeclosure Program, then hire a short sale agent and go on the market at a preapproved price.

There are two important clauses to include in the FHA Short Sale through Bank of America. The first is verbiage for the listing agreement that lets the seller cancel the listing agreement without owing the broker any money. The second is verbiage for an addendum between the buyer and seller that discloses the short sale is subject to approval.

At the time of writing, Elizabeth Weintraub, DRE # 00697006, is a Broker-Associate at Lyon Real Estate in Sacramento, California.