The venture capital model is broken and this damning report explains why

Post on: 16 Март, 2015 No Comment

Industry watchers have been talking for a long while now about how the venture capital industry is broken, highlighted by poor returns that in many cases dont even exceed that of the major stock indices.

Now, thanks to the Ewing Marion Kauffman Foundation which has invested in nearly 100 venture capital firms across the country over the past 20 years were getting an inside look into the problems rattling the industry.

The picture is not pretty.

In a blistering 51-page report out today. the foundation details its own experiences, writing that limited partners such as the foundation routinely invest too much capital in underperforming venture capital funds on frequently mis-aligned terms.

Investment committees and trustees should shoulder blame for the broken LP investment model, as they have created the conditions for the chronic misallocation of capital, notes the report. It also suggests that LPs the large foundations, pensions and university endowments that invest in venture capital are just all too willing to accept the black box of VC firm economics.

But the Kauffman foundation which has about $249 million committed to venture capital and private equity firms doesnt take all of the blame themselves. In fact, the entire report suggests that the business of venture capital is just messed up. Take this portion, for example, which describes how VCs get paid:

The most significant misalignment occurs because LPs don’t pay VCs to do what they say they will—generate returns that exceed the public market. Instead, VCs typically are paid a 2 percent management fee on committed capital and a 20 percent profit-sharing structure (known as “2 and 20”). This pays VCs more for raising bigger funds, and in many cases allows them to lock in high levels of fee-based personal income even when the general partner fails to return investor capital.

This arrangement means that VCs often get paid well, even when performance is poor and they dont return investor capital. In essence, the report suggest that VCs get paid to build funds, not build companies.

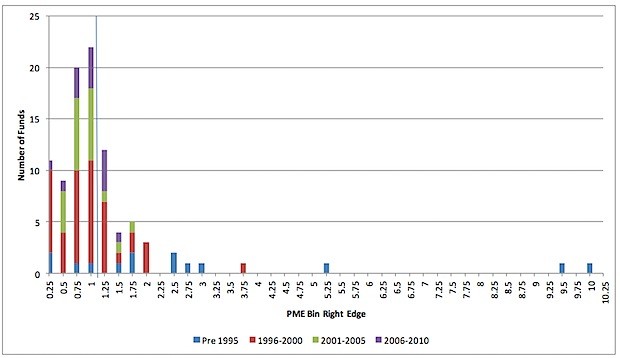

The report is loaded with charts and statistics. And while one could argue that it is based just on the data of one foundation, it offers an enlightening inside look into the murky world of venture capital.

Among the findings the Kauffman report notes that:

Only twenty of 100 venture funds generated returns that beat a public-market equivalent by more than 3 percent annually, and half of those began investing prior to 1995.

The majority of funds—sixty-two out of 100—failed to exceed returns available from the public markets, after fees and carry were paid.

Only four of thirty venture capital funds with committed capital of more than $400 million delivered returns better than those available from a publicly traded small cap common stock index.

Of eighty-eight venture funds in our sample, sixty-six failed to deliver expected venture rates of return in the first twenty-seven months (prior to serial fundraises). The cumulative effect of fees, carry, and the uneven nature of venture investing ultimately left us with sixty-nine funds (78 percent) that did not achieve returns sufficient to reward us for patient, expensive, longterm investing.

So, given all of that, one has to ask whether the Kauffman Foundation will continue to invest in a financial mechanism that they see as broken. The answer is that they will, but they are hoping to push through changes and alter their own practices. That has already begun.

The Kauffman Foundation has already weeded out half of the venture capital firms that it works with, reducing the number to 30. And the winnowing process will continue. Theyve also decided to end relationships with top performing firms that have refused to alter their compensation model.

Venture capital isn’t going away, and we’re not suggesting that it should. But we are arguing strongly that LPs who invest in VC need to rethink how they invest. As investors, we need to require more transparency, better performance metrics, and a lot more alignment Our plan at the Foundation is to continue to invest in VC, but with a different approach than in the past, they conclude.

The full report WE HAVE MET THE ENEMY… AND HE IS US: Lessons from Twenty Years of the Kauffman Foundation’s Investments in Venture Capital Funds and The Triumph of Hope over Experience can be downloaded here . It is also embedded below.

John Cook is GeekWire’s co-founder and editor, a veteran reporter and the longest-serving journalist on the Pacific Northwest tech startup beat. Follow him @johnhcook and email john@geekwire.com .