The Value Of Using Multiple Tools For Analyzing Stocks Trader News and Reviews

Post on: 16 Март, 2015 No Comment

When it comes to choosing the right stock to invest in there are many possible strategies that you can try. One can evaluate the profit and earnings statement of a particular company or study their profit and loss statements and come up with a number of conclusions. With all the possible means of analyzing stocks one might wonder how to decide which strategy will work best for them.

The answer to the question is actually that most of them will be effective in strategizing and analyzing a particular stock; they will just have a different approach to coming up with the final numbers that you will use to determine an investment option. A smart investor will use a number of approaches to determine the right investment option for them. According to Esquire Magazine ,

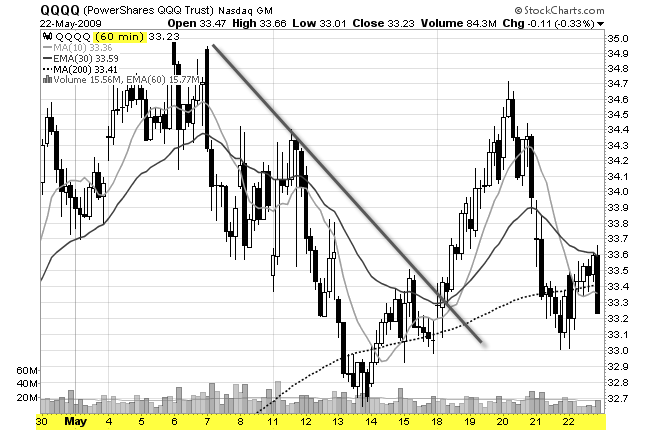

Diversity in a portfolio lessens risk, so too should investors be wary of falling in love with any one evaluation method. Just as owning many stocks all from one industry is less risky than owning a single stock investors should rate stocks by utilizing several types of tools.

Investors should use a variety of evaluation tools in deciding on the right stocks. While using numbers and figures has proven to be a very effective way in evaluating stocks there are other strategies you can also apply to your decision.

Look at the Initial Public Offering

In recent reports youve heard about stocks that initially offer prices as low as $17 a share but within the first day of trading have soared to as much as $130. To understand this you need to know how the IPO is initially determined. Hiring investment bankers to bring the stock to the public usually accomplishes this. These bankers study the companys books and compare its prospects with those of its competitors to decide what the IPO should be.

These investors look at all of the details relating to the stock, poring over every minute detail to gauge the level of interest that will come when the stock goes public. Their strategy is to price the shares high enough to maximize its returns but still low enough so that the investors can make a profit if they choose to turn around and resell it on the same day. Understanding this will help you to determine the profit potential on an IPO before you invest.

Other companies may be in a position to be taken over by another company but how do you determine their value and level of risk? One way to do this is to look at those businesses in industries that are known for mergers or are lacking in some area that their competitors may be strong in. Businesses that have large up-front capital expenses are also very viable options for the intuitive investor.

Another thing that companies looking for takeover targets want to see is the strength of their cash flow. While there may be a number of ways to evaluate the value of the target company, Investopedia explains how studying the cash flow actually works,

A key valuation tool in M&A, discounted cash flow analysis determines a companys current value according to its estimated future cash flows. Forecasted free cash flows are discounted to a present value using the companys weighted average costs of capital.

Many investors often overlook this very valuable tool but studying the cash flow actually gives you one of the best insights into how a company is doing free of the confusing interest rates, taxes and other factors that may blur the perspective of a particular companys potential.

The truth is that most people go into stock market investing with unrealistic expectations because they do not begin their investments with a variety of tools to properly analyze potential. However, if you learn how to use a number of different ways to decide on a stock you have a better opportunity to see success from your investments without too much negative input coming your way.