The Unsustainable State Of The Florida Property Insurance Market Part IV

Post on: 10 Май, 2015 No Comment

Summary

- This is the last installment of our four-part series on the Florida property insurance market.

- Reinsurance is a critical part of Florida insurance, allowing local carriers to leverage small capital bases to underwrite large risks.

- Capital has flooded into reinsurance pressuring rates, reducing a key expense for DFIs. Resulting cost savings makes Citizens’ current depopulation effort appear successful and the DFI business model viable.

- The collapse in reinsurance pricing has left some reinsurers holding extremely risky books of business for returns that would have been unthinkably low a few years ago.

- Efforts to side-step the key issue of inadequate premiums for coastal real estate have distorted Florida markets and created unsustainable business models. Ultimately, these issues will need to be addressed.

Introduction

Property insurance is a key factor in how, in defiance of all logic, coastal real estate in Florida became a key economic driver on what is probably the most catastrophe prone strip of land in the world. Property insurance is what makes Florida’s nearly $3 trillion in coastal development possible. Unfortunately, insuring property with massive catastrophic exposure is not easy or cheap. Political intervention in chaotic post-catastrophe environments are attempts to maintain a smoothly functioning and ‘affordable’ insurance market without sacrificing votes in the process. However, the short-term politically driven responses frequently magnify long-term structural problems. As a result, the market in Florida is a highly politicized brew of public and private incentives, which is neither an effective free market nor a sensible publicly-controlled market. Rather, it is a largely closed system in which many small private companies profit through state subsidies and by taking on outsized risks. The state’s taxpayers serve as the long-term financial backstop, paying the bills when the system cracks under the weight of the inevitable storm.

Our analysis of the Florida property insurance market is published as a four-part series. We present a short outline of the series below highlighting the current segment:

- The First Wake Up Call — Andrew, 1992

- The 2004/2005 Season and its Consequences

- Citizens Property Insurance Corporation

- Florida Hurricane Catastrophe Fund

- Florida Insurance Guarantee Association

- Market Structure Evolution

- Get Them Off the Books — The 1996 Depopulation

- Let’s Try This Again — The 2006-2009 Depopulation

- Building on Success — The Current Depopulation and the Old/New Kids on the Block

- The Verdict on the Depopulation Efforts — Political and Inefficient

IV. Reliance on Reinsurance and the Capital Markets

- Glut of Alternative Capital Compresses Reinsurance Pricing

- Why Reinsurance is Critical to the Florida Market

- How Much Reinsurance to Buy or How to Use Catastrophe Models

Conclusion

Recommendations

There are currently five public companies that are direct underwriters of property insurance in Florida. They are, Federated National (NASDAQ:FNHC ), HCI Group (NYSE:HCI ), Heritage Insurance (NYSE:HRTG ), United Insurance (NASDAQ:UIHC ), and Universal Insurance (NYSE:UVE ). In addition to direct insurers, trends in Florida impact numerous reinsurance companies. These companies include ACE Ltd. (NYSE:ACE ), Arch Capital Group (NASDAQ:ACGL ), Axis Capital Holdings (NYSE:AXS ), Blue Capital Reinsurance (NYSE:BCRH ), Everest Re (NYSE:RE ), Fairfax Financial Holdings (OTCQB:FRFHF ) (FFH.TO), Montpelier Re (NYSE:MRH ), and RenaissanceRe (NYSE:RNR ), Markel Corp. (NYSE:MKL ), Oxbridge Re (NASDAQ:OXBR ), PartnerRe (NYSE:PRE ), Validus Holdings (NYSE:VR ), White Mountains Insurance (NYSE:WTM ), and XL Group (NYSE:XL ).

IV. Reliance on Reinsurance and the Capital Markets

I’ve been around long enough to learn that sometimes when it looks like a bubble, and feels like a bubble, it might be a bubble.

Jed Rhoads, Markel Global Re, June 2014

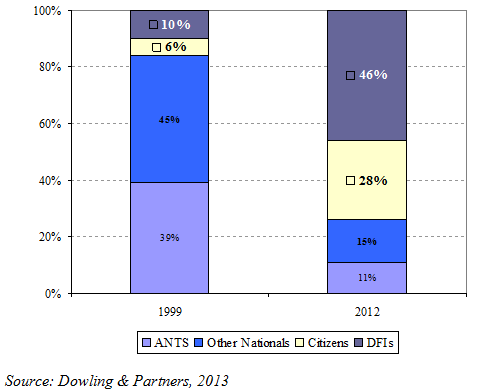

It is the extremely low reinsurance prices of the last few years that have allowed the current depopulation effort to appear a success. Florida has tried to mitigate some the current DFIs risks through reliance on reinsurance (see chart below). In its traditional form, reinsurance is insurance for insurance companies, policies bought in relatively small amounts to protect carriers from the remote chance of a very large disaster. However, due to the structure and players in the Florida property market, reinsurance has replaced traditional insurance altogether in all but name. According to Aon Benfield 2012 report, reinsurers’ exposure to a Florida 1 in 100 year and 1 in 250 year events is 26.4% and 24.4% respectively expressed as a ceded percent of gross loss. [80] We think that exposure has grown further over the last two years.

Bermuda-based reinsurance is the lifeblood for scores of under-capitalized, highly leveraged start-up insurers [81], according to Christian Camara, director of the Florida Insurance Project at the Heartland Institute think-tank in Tallahassee: Reinsurance comprises between 37% to 64% of expenses of the DFIs as compared to a nationwide average figure of 19%. That makes the business model extremely sensitive to changes in reinsurance pricing. Luckily for the DFIs, the influence from direct capital markets’ participation in reinsurance programs, coupled with catastrophic insured losses well below historical averages in 2013, put enormous pressure on global catastrophic reinsurance pricing.

Structure of the Florida’s Property Insurance and Reinsurance Market

- Glut of Alternative Capital Compresses Reinsurance Pricing

The reinsurance industry has changed drastically in recent years. The low interest rate environment has prompted large investors (mainly pension funds) to look for yield and diversification in non-traditional asset classes and has precipitated an influx of capital to ILS (Insurance-linked Securities) space (see chart below).

Being Lured by High-Yield Uncorrelated Cat Risk

Guy Carpenter, a broker, puts the non-traditional capacity at 14% of total worldwide cat limits and predicts that it will ultimately comprise 20% to 30% of total reinsurance spend. Aon Benfield estimates that as much as $100B of alternative capital can flow into reinsurance in the next five years on top of the current record level of $525B of global reinsurer capital. [82] [83] John Nelson, chairman of Lloyd’s, the world’s oldest insurance market, called on regulators in London last month to be extremely watchful of alternative capital, saying the new entrants could pose a threat by pricing risk too cheaply. [84]

Some traditional players like Berkshire Hathaway have pulled back on the U.S. catastrophe re/insurance business as they felt that the rates no longer commensurate with the risks. While pricing and premiums on U.S. catastrophe reinsurance business have declined, Buffett does not feel that the risk of suffering losses have declined, suggesting he no longer finds the market appealing at current rates. [85]

The chart below outlining the rate-on-line, ROL, which is the price paid for reinsurance vs. the expected loss confirms Mr. Buffet’s observation. The ILS market is now offering the lowest cost of reinsurance for peak perils witnessed since [1992s] Hurricane Andrew. [86]

Willis ROL vs. Expected Loss Index

Source: Willis

Lane Financial analyst Morton Lane calculated that deals with expected losses of around 100 basis points (a 1-in-100-year event) have historically attracted multiples of 4.25x in softer markets and 6.25x in harder markets. These boundaries are being pushed lower than ever, with multiples of around 3x the expected loss common for 2014 deals. [87]

The collapsing reinsurance prices for Florida cat risk are reflected in Citizen’s rate on line nosediving from 21% to below 10% in four short years.

Citizens Risk Transfer and ROL 2011-2014

Source: Artemis

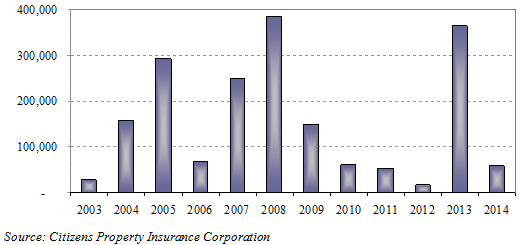

In April 2012, Citizens issued its first catastrophe bond through Everglades Re Ltd. a special purpose vehicle formed for the issue. The $750M bond has an expected loss of 2.53% and a coupon of 17.75%. However, the $250M Citizens’ bond issued in 2013 yields only 10% (below its suggested range of 11%-12%) despite sitting lower in the loss structure. In 2014 Citizens increased the size of its bond offering from $400M to $1.25B with yield pushing lower to 7.5% for the much broader cover of an aggregate protection and the much larger amount of coverage secured. As Artemis commented:

The reinsurance and capital markets have supported Citizens risk transfer needs at a low-level of pricing that it may never witness again. [88]

The 2014/2015 Florida cat reinsurance market has been described as a bloodbath by some analysts with rates dropping between 15% and 30%.[89] Universal Insurance Holdings, a DFI, has recently reported that it has achieved extraordinary cost reductions at its 2014/2015 reinsurance contracts with pricing some of the most competitive the firm has seen in its history. Further, it noted that the traditional reinsurers matched the quotes offered by the ILS space.

In fact, in some cases the ILS specialists have been the ones matching prices proposed by the traditional market as the competitive desire to sign premiums has resulted in reinsurers outpacing ILS price declines on some programs. [90]

Please contact us if you have an interest in discussing the specific reinsurers’ and others exposures to Florida risks and particular programs.

Kevin O’Donnell, the President & CEO of Renaissance Re, the largest Florida reinsurer has commented on the company’s last conference call (April 30th, 2104) that:

At a macro level, we are starting to see undisciplined behavior with some risk being priced below an acceptable level of return for any form of capital. This behavior cannot persist permanently in financial markets. On the other hand, it can exist for a long time, and pricing decisions by suppliers are often only revisited after an event. [91]

Markel Global Re president Jed Rhoads said:

There is some fundamental core pricing to our business or it makes a mockery of what I’ve done for a living for a very long time. [92]

Reinsurance companies have traditionally provided reliable coverage to Florida losses and have maintained high credit ratings. The rating agencies (A.M.Best and S&P) have increased the industry’s capital requirements following the WTC attacks and the U.S. hurricane activity of 2004/2005. The four reinsurance companies that were placed in run-off following catastrophic losses in 2004/2005 — Olympus Reinsurance, PXRE Reinsurance, Quanta Reinsurance and Rosemont Re — settled most of their claims (over 99% of the catastrophe loss balances have been paid). [93]

However, the reinsurance industry is facing some significant changes. As Willis Re Chairman noted:

To date, the traditional model of fresh capital coming into the market has been through the formation of new companies but it is being overtaken by a new model of fast capital flowing in through less permanent structures. For an industry where primary insurance companies value sustainability, this emerging model brings many challenges. While some reinsurers are considering how to respond, others are developing third party capital management propositions to offer their own skills and platforms as fund managers. The advent of new capital is likely to have a significant impact on any post-event response which may occur after a major loss. [94]

In a recently issued report on the state of Bermuda reinsurance, the S&P analyst Gharib argues:

We think that companies without a defendable competitive position, or those that are more aggressive in maintaining market share by competing on price or relaxing their underwriting discipline, are most at risk. We could revise our assessment of those insurers’ business risk profiles to reflect the relatively higher risk. In addition, we believe Bermudian insurers with diminished capital buffers, or those whose earnings capacity is persistently constrained. [95]

Adding to the weakening reinsurance fundamentals, in 2007 Florida became the first state to enact a statute authorizing waiver or reduction of collateral requirements for non-U.S. reinsurers. The move was a direct response to the 2004/2005 hurricane season and the state’s desire to attract more reinsurance capital to its property insurance industry. Prior to the 2008 rule based on the law, foreign reinsurance companies generally were required to post 100% collateral while regulated United States insurers posted no collateral.

To qualify for waiver or reduction of collateral, a non-U.S. reinsurer must meet certain minimum financial requirements. The reinsurer must have surplus in excess of $100 million and have a secure financial strength rating from at least two nationally recognized statistical rating organizations deemed acceptable to Florida. Generally speaking a credit rating of AAA from the S&P allows a foreign reinsurer to post no collateral, AA allows for 10%, A allows for 20%, and BBB for 75%. [96] The first agreement was signed with Hannover Re in 2010. There are now over 20 Eligible Reinsurers in Florida. [97]

Back in 2007, the National Association of Mutual Insurance Companies (NAMIC) with members representing 31% of the Florida market wrote in its comments opposing the waiver rule:

The proposed rule could lead to a weakened solvency position for U.S. primary insurers. It is critical to note that any weaknesses in a relaxed collateral regime will be revealed only in the wake of catastrophes or events leading to large numbers of claims. Even the reinsurer with superb financial strength before a major catastrophe may be sorely tested by such an event and experience financial weakness as a result of having assumed catastrophe and related risk. [98]

Rating downgrades of some of the Bermuda reinsurers can potentially trigger a daisy-chain of collateral requirements. The search for uncorrelated yield has once again resulted in pricing that does not compensate for the risks. Reinsurance pricing can be a fickle matter especially if market conditions tighten and/or catastrophic events test the new alternative structures.

- Why Reinsurance is Crucial to the Florida Market?

Florida as a state comprises nearly 10% of the nation’s total direct premium written, DPW, in homeowners insurance. Selling nearly 29% of the State’s DPW in homeowners insurance, DFIs are responsible for a substantial portion of homeowners risk in the State. Clearly, Florida independent insurers collect a lot of premium.

The surplus levels shown in table below reflect the most disconcerting difference between Florida and other states. Despite its relatively large market size, Florida’s year-end 2011 policyholder surplus (PHS), at just under $93 billion, was lower than any of the other hurricane-exposed states. Despite their 29% market share of premiums, DFIs contributed only slightly more than 1% of the State’s total PHS, at slightly over $1 billion. [99]

The current Florida homeowners’ insurance market is heavily dependent on small companies with limited capitalization and risk diversification capabilities. Despite collecting a lot of premium, they operate on a tiny level of capital surplus.

Group and Independent Insurers’ Share of DPW and PHS

Source: The Florida Catastrophic Storm Risk Management Center

The DFIs have very limited levels of capital surplus. Instead of trying to build reserves over time, the current model encourages the siphoning of cash out of the statutory insurance companies through different mechanisms. Reinsurance enables the fast growth. Instead of building up a company slowly by amassing enough surplus to write new policies, new insurers can pledge a portion of future premiums and instantly take on thousands more customers and billions more dollars in hurricane risk. [100] In the absence of reserves, the only thing standing between disaster and billions of dollars of coastal exposure is reinsurance.

The question is whether the DFIs are buying enough or the right coverage for their exposures.

- How Much Reinsurance to Buy or How to Use Catastrophe Models?

That is a difficult question to answer. Current insurance pricing and probable maximum loss, PML, estimates are based on computer models that came into existence post hurricane Andrew. Back in 1992, a woman by the name of Karen Clark contended that the industry vastly underestimates losses following a few quiet decades. She was proven right as her estimate of Andrews’ damages of $13B came much closer to the $15.5B of actual losses compared to that of Lloyd’s at $6B. [101]

This event gave rise to the computer hurricane loss estimation modeling industry that uses long-term storm historical data, building codes and structure information to calculate PMLs for the insurance industry. There are three major players: AIR (Ms. Clark’s firm which she sold in 2002), RMS and Eqecat. Conceptually the models consist of three modules: the hazard module simulates possible storm paths and wind speeds, the engineering (vulnerability) module applies engineering statistics to calculate exposures affected by the storms and the financial module providing loss estimates. Some of the models are even incorporating the probable effects of the warming of the Altantic Ocean on hurricane landfalls along the US coast. [102]

However, the models have overestimated the insured losses from 2006 to 2010 by as much as $45B. Ms. Clark has cautioned against the use of long-term models to provide short-term estimates. Using the information in models to pinpoint a metric (such as a 1-in-100-year PML) is not helpful, she said. Models can get you a range-they can get you in the ballpark-but you can’t narrow the range. That is the whole point, she said. [Hurricanes] are random. You can’t predict when there will be an increase in losses and there is no connectivity to the frequency of storms. [103]

The problem is how to measure the level of reinsurance necessary for thinly-capitalized DFIs. In 2010 Florida removed its long standing mandate that required insurers to purchase reinsurance up to 1 in 100 PML based on an approved model. The Insurance Commissioner Kevin McCarty argued that the move will lower consumer premiums. [104] Instead, the OIR has focused more on multiple events, side coverage, and reinstatements as opposed to one-storm coverage (top). [105] The Demotech rating agency still requires the DFI to purchase reinsurance covering both 1 in 100 PML for a first event and 1:50 PML for a second event in order to keep their A rating. [106]

Although according to Florida’s Insurance Commissioner, nearly all private insurers in Florida purchase insurance up to at least 1 in 100 year storm, the financial impact on any given storm is expected to vary widely between insurers depending upon their individual reinsurance programs and spread of risk. As Robert Westcott, the state’s insurance consumer advocate sums it:

It is conceivable that some private domestic insurers will fail in events less than the 1 in 100 year storm. [107]

The exposure estimates vary significantly depending on the model/s used and the different model versions. AIR and RMS estimate losses from 1 in 100 U.S. hurricane event at $124B and $180B respectively (over 30% difference) and losses from 1 in 250 US hurricane at $199B and $263B respectively (24% difference). [108] Guy Carpenter analysis shows that the uncertainty around the mean estimated values is so significant that a two standard deviations interval for a national writer’s 100-year or higher PML goes from 50% to 230% of the PML estimate. [109]

Given the very limited historical data on event generation, the models are unlikely to ever be accurate despite the scientific advancements. As a result, the insurers (and the regulators) need to operate with the understanding that catastrophe risk is characterized by deep uncertainty and work to diagnose the sensitivity of their own portfolios to key uncertainties in the model. The hurricane risk should be thought about as a fairly wide band of uncertainty around the output of any cat model, typically illustrated as a loss exceedance curve (see graph below). Such a view lacks the comfort of a single point estimate but paints a more realistic picture of cat risk.

Loss Exceedance Curve

How protected are the DFIs from a big hurricane or a series of storms? It depends. Some companies have purchased much more coverage than others. A review of the DFIs 2011/2012 storm season coverage by the Herald Tribune revealed that about half the companies barely had 1 in 100 year coverage while the other half had programs as robust as 1 in 250 year suggesting that there are two business models at work: companies interested in staying in business for the long run where premium is enough to properly reinsure the book and risk brokers that are unable to finance a proper program and are willing to take big risks while in the meantime reaping the benefits of the event-free years. [110]

The importance of the intersection between models and insurance is highlighted by reviewing the reinsurance practices of the biggest private Florida insurer — Universal Property and Casualty Insurance, a public company. It carries 500,000 policies for a total insured value of $107B. [111] The company is an example of an odd Florida growth story that started life as a distributor of sports memorabilia and then dabbled in pest control and pool cleaning. In 2006 Universal’s small insurance operations took off with the help of a $25M surplus note from the state of Florida. The company underwrites risky policies in the Miami-Dade, Broward and Palm Beach counties most of which otherwise will be taken only by Citizens.

We have reviewed the company’s OIR filings since 2008 and discovered that the catastrophe models that the company uses to evaluate the level of reinsurance required are all marked as trade secret. The company’s PMLs for each of those years for different frequencies of events are also not available. Some disclosures are made in the SEC filings for certain years but, by and large, the information is not available. Some of these confidential documents were leaked to the Herald Tribune in 2011 and revealed that for that particular year UVE had coverage to about 1 in 80 event, putting the company in direct violation of its surplus note covenants. The insurance commissioner refused to comment saying to do so could imperil the company. [112]

As the table below highlights, not only was UVE in violation of its covenants but the company would have been insolvent had one storm occurred with a first event representing 145% of the company’s surplus at the time. Based on our analysis, the book was largely uninsurable in an economic way at the time which UVE tried to circumvent by employing segregated cell T25 to reinsure itself. The OIR questioned the practice and more specifically the provision of a guaranteed profit of 25% to the captive reinsurer in a filing but ultimately chose not to act.

Universal Insurance Surplus and 1 st Event Exposure 2008-2014