The Stock Market Crash Risk Calendar for October 2014

Post on: 2 Июль, 2015 No Comment

by John Galt

September 30, 2014 21:45 ET

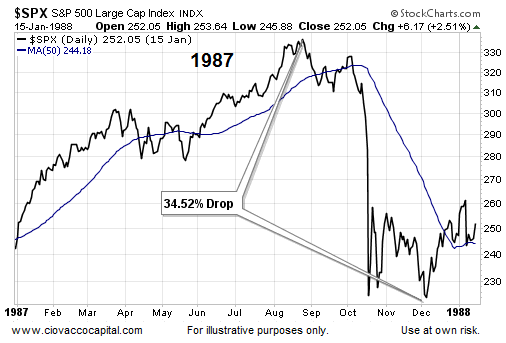

The silence I have been projecting lately via the written word has been far surpassed if one has taken the time to listen to my recent radio programs via JMR. Over the last three weeks, I have outlined the threats not just to the stock markets but to the United States economy as a whole and defined why the risk is as great now as it was in 1987 when a series of unrelated events led to a finale with a Federal Reserve policy mistake which injected a variable the destroyed the perceived safety of portfolio insurance which was all the rage at that time (thats derivatives in 1980s terms).

The news over the last few days and weks has been of drastic importance to our economy and markets:

Commodities are indicating a major deflationary risk has been introduced into the economy

The US Dollar is peaking with little resistance to achieving new decade long higher prices

Add in the fact that the dollar is getting stronger but Monetary Velocity (via the M2 measure) is at HISTORIC LOWS:

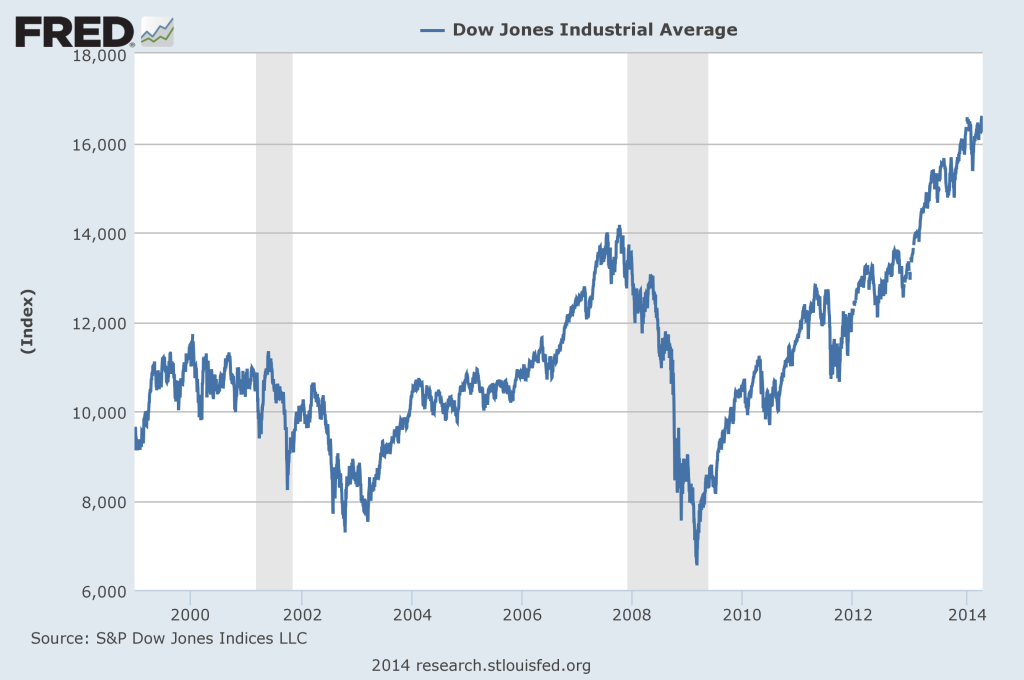

Then destroy the myth that bank lending is increasing via the fact that Commercial and Industrial Loans (C&I) are now collapsing back to 2008-2009 depression era levels:

Then of course the happy happy joy joy news about the first recorded Ebola case in the US and the formula is in place to set up a massive month of risk and danger. Thus why I think October 2014 could easily parallel 1987 not directly in stock market or commodity market risk, but in the massive size of the shock.

The calender below is fairly simple as well as the the legend below it:

While I can not offer any technical reason for a market to crash on those days, keep in mind not just the news flow but the market balance. Less than 30% of the major stocks in the S&P 500 are in a bull market which is the reason current prices are being supported. The small and mid-cap indices are indicating that they are already in a bear market as well as the commodity complex and foreign economies flashing major warning signals of worldwide deflation.

The bad news about Ebola today will be offset by the Fed and PPT rally the markets by buying futures in the morning of October 1st to drown out the bad news along with the MSM business journalists touting the bullish sign of the PayPal spin off and the European Central Bank guaranteeing the collapse of the Euro versus the US Dollar.

The high risk days are those that I selected based on market history and as I perceive the news flow not just on earnings but politically, the Middle East war(s), and the suddenly not so shocking Ebola outbreak in the United States. Once word leaks out that there is more than one case in the US and Europe panic will set in and as the so-called retail investor tries to cash out, the large players will simply short the markets ahead of them even if it shaves thousands of points off the DJIA.

The highest risk days in my opinion are October 9-14 and the 17th throug the 22nd. If anything happens which destabilizes the economy or even Russia and China electing to officially ban the use of the US Dollar in trade of any type, then God only knows how low the markets could go. My worst case scenario is a 13-21% decline in the S&P 500/Dow Jones Industrial Average over a one to three day period, with the worst case scenario, a one day drop, resulting in a bank panic which motivates the average American to clean out the local ATM.

Stay tuned because if October isnt it, this does not mean America is free and clear; the Ebola outbreak could be the Grinch which kills Christmas shopping this season which would indeed trip the US economy into an instant recession if not worse.