The Secondary Mortgage Market Power Behind the Scenes

Post on: 16 Апрель, 2015 No Comment

auto insurance

The Secondary Mortgage Market Power Behind the Scenes

As the housing market and the greater economy continue to tumble, many questions are being asked about the secondary mortgage market. What role does this misunderstood arena play, and how does it figure into todays crisis?

To explain the secondary mortgage market, we need to explain the full process of obtaining a loan. When homebuyers apply for mortgages. they approach the primary mortgage market banks, mortgage companies, credit unions, and online lenders. These organizations make the loan if the homebuyer meets certain criteria, dependant on the borrowers ability to repay the mortgage. After a thorough and potentially lengthy process, the lender funds the purchase of the home. and the homebuyer agrees to pay back the mortgage under specified terms.

Thats not the end of the story. The lender may hold the mortgage in its portfolio, along with other loans made to other borrowers. Or they can sell the mortgage to the secondary market.

This is the part that may confuse even the most astute readers of real estate and economic events. Primary lenders sell loans in the secondary market, and use the proceeds of the sale to make new loans to other homebuyers. Who buys loans in the secondary market? Organizations like Freddie Mac and Fannie Mae (created in 1938 by the federal government to establish the secondary market) are key in this area. But other private mortgage companies are also players.

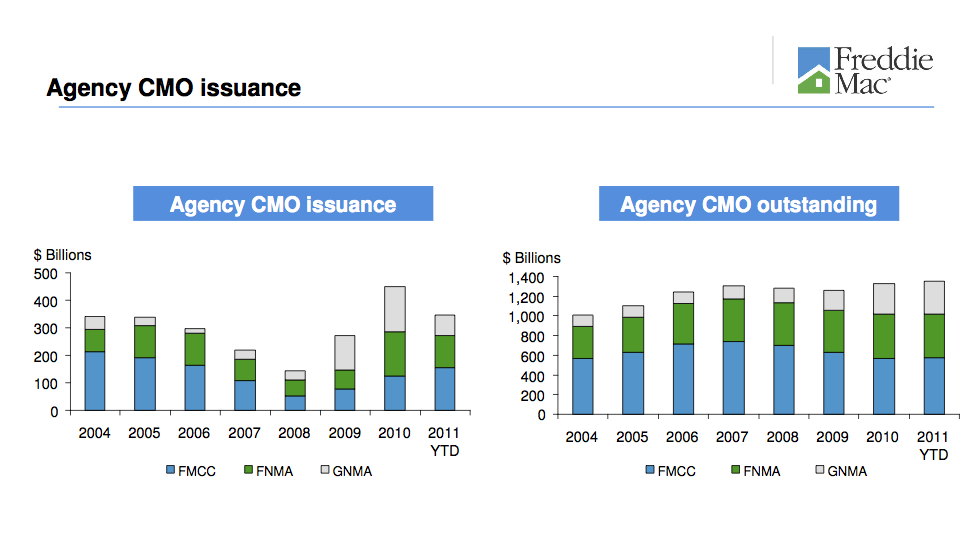

Once the loans are sold in the secondary market, the buyers package these loans into mortgage-backed securities. The securities are then sold to investors on Wall Street. When Freddie Mac and Fannie Mae do this, they guarantee timely payment of principal and interest to the investors who invest in these pools. When other players do this, packaged loans are often called collateralized mortgage obligations (CDOs). Mortgage backed securities are attractive to many investors, especially large-scale institutional investors such as pension funds or mutual funds.

About half of all new single-family mortgages originated today are funded in the secondary mortgage market.

The secondary mortgage market plays an important role in the housing and lending market:

- Through this process, extra cash is available to lenders. This can drive down mortgage rates (30 year mortgage rates ) and make homeownership more affordable.

- Mortgage originators, no matter where they are located, have access to pools of capital. Homebuyers then, no matter if theyre in big cities or small towns, can have greater access to reasonable mortgage financing.

So what about todays crisis? Problems began with the over issuance of subprime loans. This year, and in the past few months in particular, many homeowners with these loans felt the sting of reset rates and payments. Defaults and foreclosures spiked. Suddenly, these mortgage-backed securities were not the bastion of safety and steady returns they once were. With investors staying away, the whole process of the secondary mortgage market stalled, meaning less money available for loans.