The Role of International Investments In Your Portfolio

Post on: 19 Май, 2015 No Comment

Tonight, I want to talk to you a little bit about the role of international investment positions in your portfolio; specifically, how changes in the global capital markets have made international investments far more accessible to the average investor than could ever have been imagined even fifty years ago.

Finding International Investment Ideas

For the past few weeks, Ive been going through the reports of some packaged food companies, the major credit card companies such as Visa and MasterCard. and a lot of other sectors, trying to get ideas for one of my retirement trusts. One thing Ive noticed, though, is that a lot of the reports that are making their way across my desk are for international investment; companies not domiciled in the United States or that earn 50% or more of their revenue in a currency other than the United States dollar.

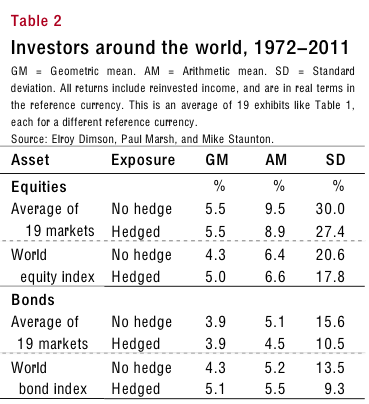

Since I dont have to worry about year-to-year results Im interested in decade-to-decade wealth building, growing my money at the highest rate of return possible, adjusted for risk Im slowly transforming one particular retirement trust, which is dubbed in the accounting records the Kennon Pension Plan, into an entity through which I intend to hold many foreign stocks, that pay dividends in foreign currencies, without any hedges in place.

There is something appealing about continuing to make contributions to the pension plan, year after year from the remainder of my life, and putting it to work in high quality international investments so that my dividends, rents, and interest income are flowing into the plan not only in greenbacks but in British pounds sterling, Swiss Francs, Euros, Yen, Danish Krone, etc.

A Sample International Investment

To give you an example, tonight, I began looking into Diageo, PLC, which is an alcohol company famous for making products such as Johnny Walker scotch whisky and Royal Crown. The companys shares trade on the London Stock Exchange for £12.00 each (British stocks are quoted in pence; that can seem unusual to American eyes. If we did this, we would say a stock traded for 2,500 pennies instead of $25.00.) To see what I mean, look at the tear sheet from the Financial Times:

The dividend yield is good at 3.18% but the price-to-earnings ratio seems a bit high at more than 18x (it got cut off in the graphic) relative to the growth so it is unlikely it will be added to the portfolio for the retirement plan this year. I wont know more until I finish the report. That really isnt the point because this isnt about Diageo.

Making an International Investment Is Easier Than Ever

As an investor, the capital markets have become so easy to use as a result of the rise of the Internet that you can now make international investment a major part of your strategy. In the 1950s, to buy shares of an American company required a commission of several hundred dollars and the ability to purchase in round lots (normally 100 shares). That is, if a company were $40 per share, you had to buy $4,000 worth of it. That is $35,000 today, adjusted for inflation. Buying stock in London or Japan was down right impossible unless you had connections to major banking and brokerage houses, like J.P. Morgans successor entities.

Today, you can make global investments from almost any of the big stock brokers. Discount broker E-Trade offers a global trading account that lets you make international investments and hold foreign currencies. Imagine that I wanted to buy shares of Square-Enix, the Japanese makers of the Final Fantasy game series.

In a few seconds, I could pull up a quote for this potential international investment just as I could a domestic stock trading on the New York Stock Exchange:

You can see the stock is quoted as 1,455.00 JPY, which means 1,455.00 Japanese yen. That is roughly $17.78 at todays exchange rates. The shares pay a dividend of 7.5 Japanese yen, which works out to around 9.17¢. But you wouldnt have to convert it back into United States dollars. You could have the Yen credited to your Yen cash balance and reinvest it in Japan.

E-Trade, as well as many other discount brokers, requires round lot trading on an international investment so Id need to buy 100 shares, or $1,778 + commission. Such a low threshold was unthinkable even ten or twenty years ago. A teenager working at McDonalds could now save enough from his paycheck to begin global trading as if he were John Templeton !

(Side note: I just randomly picked Square-Enix but now Im going to have to pull the report because I want to know why on earth the p/e ratio is 167.24. My guess is earnings must have been down big during the recession and the market didnt overreact so it is artificially inflated but you never know. Crazier things have happened.)

There Are Some Additional Risks with an International Investment

Making an international investment introduces considerable risks that otherwise wouldnt be present. There are differences in accounting rules. One major Western country, for instance, demands that financial statements be presented in inflation-adjusted terms so that investors can see how much purchasing power the company grew, which I think is a magnificent thing. I wish the United States required the same presentation. Others, such as Switzerland, typically have extremely high depreciation rates but build their factories to last for generations, resulting in what would seem to be artificially low earnings per share figures.

Furthermore, an international investment is subject to the risk that the host country blocks outgoing currency flows and forces investors to keep their money invested in the local economy. Following World War II, this was common.

The Securities and Exchange Commission (SEC) provides a list of some of the international investment risks they consider important: