The Rise of Triple Leveraged ETFs

Post on: 16 Март, 2015 No Comment

I work with a niche fund of funds and hedge fund advisory business. We are always on the outlook for new managers and strategies that provide the edge our clients demand in this difficult environment. Earlier in the year, several managers approached me with complex arbitrage strategies with ETFs.

One stated that the new triple leveraged funds from Direxion will work amazingly well with his rocket science type tactics. After the initial surprise of learning that these products even existed wore off, I decided to look a little deeper into these ultra leveraged ETFs.

Click here to learn how to utilize Bollinger Bands with a quantified, structured approach to increase your trading edges and secure greater gains with Trading with Bollinger Bands® A Quantified Guide.

If cutting edge fund managers were looking at them, perhaps opportunities exist within these esoteric products for the average trader. Lets take a closer look at these aggressive leveraged animals and see how they can be used to boost your portfolio returns.

Are you new to exchange-traded funds (ETFs)? Be sure to read our ETF primer, ETF Basics: What You Need to Know About Exchange-Traded Funds .

Direxion is the primary firm that offers the tripled leverage ETF products. They have been operating for 11 years and first introduced the so called triple leverage index fund in 2006. However, just in May of this year, they rolled out an entire suite of these products across a wide range of underlying indexes. I stated so called due to the fact that these ETFs are leveraged within 50 basis points of the 300X leverage, therefore the common name is a bit of a misnomer.

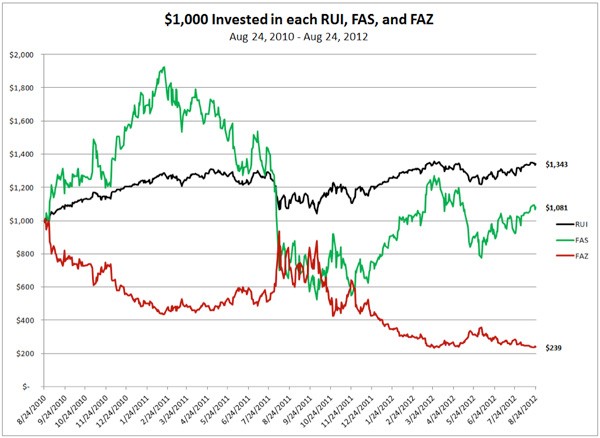

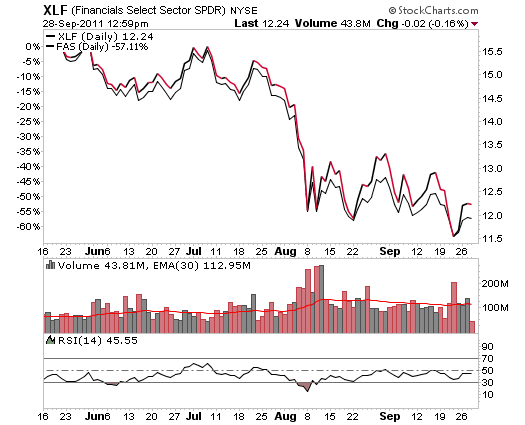

However, its a good marketing tool for the products, and they are the highest levered ETFs available to investors. What this means is for every point the underlying instrument/index moves, these products move 2.5 to 3.5 times that amount. For example, if the S&P 500 moves one point up, the ETF moves 2.5 to 3.5% points. As you can imagine this leads to wild gains and losses for traders speculating with these tools. They are becoming very popular among traders with the most traded ones approaching 10 million per day.

www.direxionfunds.com/products.html .

Why would a trader use these types of products? As you can imagine, the returns have been shocking in both directions this year. One of the bullish domestic index funds is down over 80% this year and, as you can expect, the bearish domestic names are up over 100%. The simplest reason traders would add these products to their portfolio of tools are to magnify gains when speculating in the market. Less capital goes further, more bangs for your buck, so to speak. However, its critical to ALWAYS keep in mind that this kind of leverage, or any leverage for that matter, is a two edged sword. You can lose just as fast as you can win when trading these volatile products. Several of the other reasons tripled leveraged ETFs make sense include:

As I mentioned, at the start of this article, there are many sophisticated strategies that can be utilized with these tools. Tripled leveraged ETFs can enhance your portfolio but they can easily destroy it, if used in the wrong way. Every trader should look closely at these offerings but do so with caution!

David Goodboy is Vice President of Business Development for a New York City based multi-strategy fund. Read his blog at marketsurfer.com .