The pros guide to diversification Fidelity Investments

Post on: 5 Апрель, 2015 No Comment

Your e-mail has been sent.

There are two moments when checking on the value of your investments and portfolio may be almost irresistible: when the market is roaring ahead—and when it’s tanking. But that’s just when emotions have a nasty way of clouding the minds of even the most seasoned investors.

It is better to take the time to set a long-term mix of stocks, bonds, and other investments according to your goals, time horizon, and risk tolerance. Then make a regular checkup a normal part of a disciplined investment process. At the very least, you should check your investment mix, known as your asset allocation, once a year or if your financial circumstances change significantly—for instance, if you lose your job or get a big bonus.

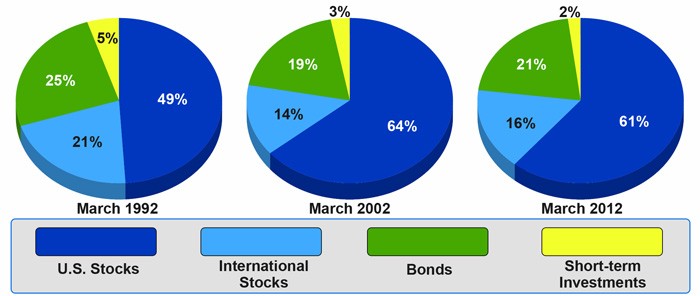

We believe that setting and—just as important—maintaining your strategic asset allocation are among the most important ingredients in your long-term investment success. No matter what your age or goals, we believe this means being diversified both among and within different types of stocks, bonds, and other investments.

Why diversify

The goal of diversification is not to boost performance—it won’t ensure gains or guarantee against losses. But once you choose to target a level of risk based on your goals, time horizon, and tolerance for volatility, diversification may provide the potential to improve returns for that level of risk.

At the heart of diversification lies the concept of correlation. Simply put, correlation is a measure of how often the returns of two investments move together, up or down. Correlation is a number from –1 to +1 that is computed using historical returns. A correlation of +1 between two stocks, for example, means that in the past when the return on one stock was up 5%, then the return on the other stock was up 5%. A correlation of –1 tells you that, historically, they moved in opposite directions.

When you put assets that have low correlations together in a portfolio, you may be able to get more return while taking on the same level of risk, or the same returns with less risk.

To build a diversified portfolio, you should look for assets whose returns haven’t historically moved in the same direction, and, ideally, assets whose returns move in the opposite direction. This way, even if a portion of your portfolio is declining, the rest of your portfolio, hopefully, is growing. Thus, you can potentially offset the impact of poor market performance on your overall portfolio.

Another important aspect of building a well-diversified portfolio is that you try to stay diversified within each type of investment.

Within your individual stock holdings, beware of overconcentration in a single stock. For example, you may not want one stock to make up more than 5% of your stock portfolio. Fidelity also believes it’s smart to diversify across stocks by market capitalization (small, mid-, and large caps), sectors, and geography. Again, not all caps, sectors, and regions prosper at the same time, so you may be able to reduce portfolio risk by spreading your assets. You may want to consider a mix of styles, too, such as growth and value.

Similarly, when it comes to your bond investments, consider varying maturities, styles, and duration, which measures sensitivity to interest-rate changes.

Diversification has proven its long-term value

During the 2008–2009 bear market, correlations went up, and many different types of investments lost value at the same time. While it may have felt as though diversification failed during the downturn, it didn’t. The major asset classes were more highly correlated, but diversification still helped contain portfolio losses.

Consider the performance of three hypothetical portfolios: a diversified portfolio of 70% stocks, 25% bonds, and 5% short-term investments; a 100% stock portfolio; and an all-cash portfolio.

Diversification helped limit losses and capture gains during the 2008 financial crisis

Source: Strategic Advisers, Inc. Hypothetical value of assets held in untaxed accounts of $100,000 in an all cash portfolio; a diversified growth portfolio of 49% U.S. stocks, 21% international stocks, 25% bonds, and 5% short-term investments; and all stock-portfolio of 70% U.S. stocks and 30% international stocks. This chart’s hypothetical illustration uses historical monthly performance from January 2008 through February 2014 from Morningstar/Ibbotson Associates; stocks are represented by the S&P 500 and MSCI EAFE Indexes, bonds are represented by the Barclays U.S. Intermediate Government Treasury Bond Index, and short-term investments are represented by U.S. 30-day T-bills. Chart is for illustrative purposes only and is not indicative of any investment. Past performance is no guarantee of future results.

By the end of February 2009, both the all-stock and the diversified portfolios would have declined. The all-stock portfolio would have lost nearly half of its initial value (–49.7%); however, the diversified portfolio would have lost a bit more than a third (35%). Yes, the diversified portfolio would have declined, but diversification would have helped reduce losses compared with the all-stock portfolio. The all-cash portfolio (1.6%) would have outperformed the all-stock and diversified portfolios over this 14-month period.